2025: a year of action for the Autorité de la concurrence

Background

In 2025, the Autorité de la concurrence issued 9 antitrust decisions and imposed €379 million in fines. The key decisions of the year included Decision 25-D-02 sanctioning Apple for abusing its dominant position in the sector for mobile application advertising on iOS terminals (€150 million), Decision 25-D-03 sanctioning no-poach agreements (€29.5 million), Decision 25-D-06 sanctioning Doctolib for abusing its dominant position in the sectors for online appointment booking and remote consultations (€4.7 million), and Decision 25-D-07 sanctioning an anticompetitive agreement in the road fuel distribution sector in Corsica (€187.4 million).

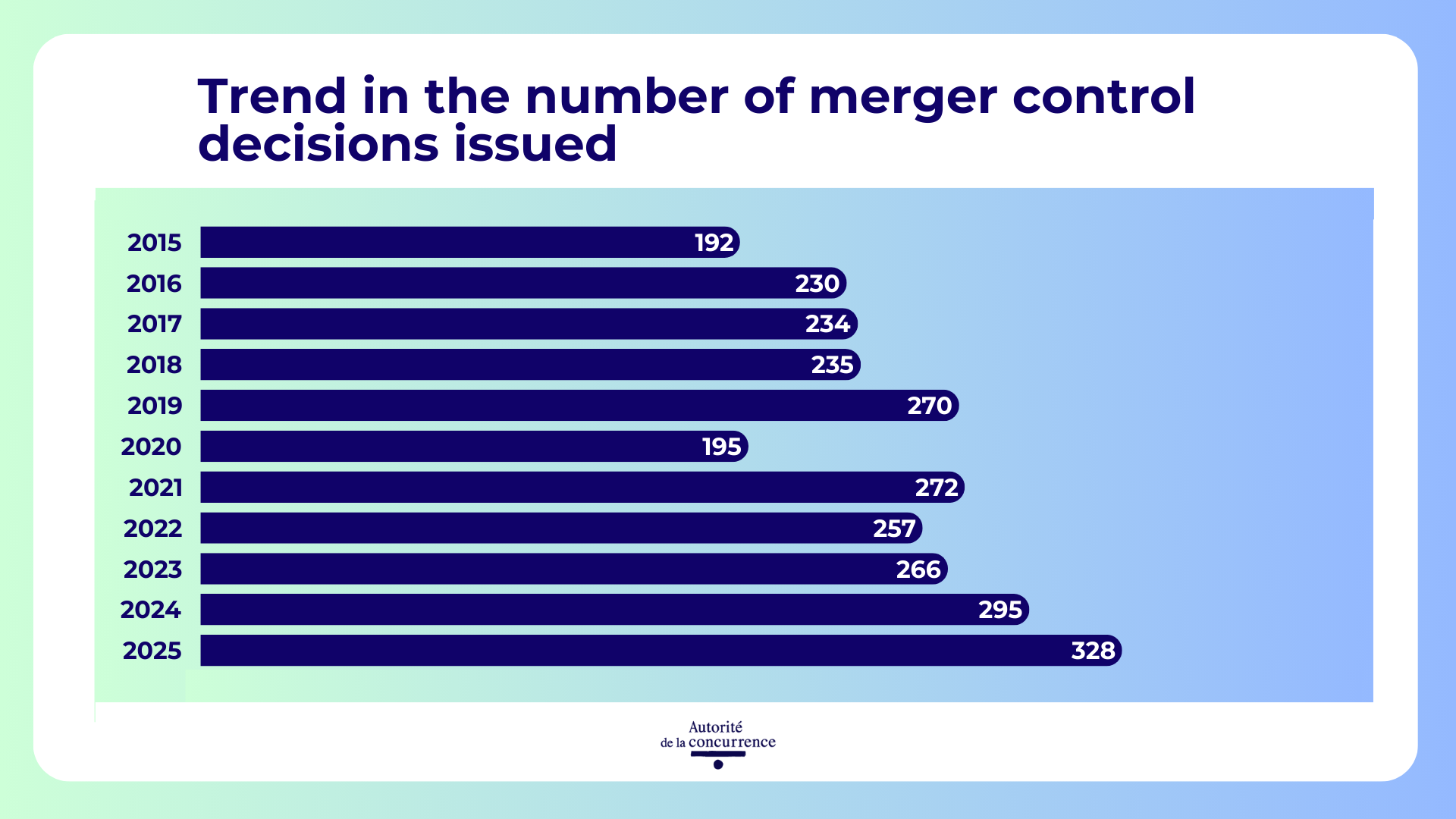

In merger control, the Autorité issued a record number of decisions (328 transactions), up 11% on the previous record in 2024 and representing a total transaction value of more than €31 billion. 2025 was once again marked by the transformation of the food retail sector, with the Autorité clearing a number of transactions (involving more than 600 stores in total), including: the acquisition of Casino stores by Auchan (25-DCC-65), the acquisition of Auchan stores by Lidl (25-DCC-214), the acquisition of Cora and Match stores by Carrefour (25-DCC-56), and the acquisition of Bio&Co stores by Marcel&Fils (25-DCC-222). No transactions were prohibited and no in-depth Phase 2 examinations were opened.

During the year, the Autorité was very active in its advisory role, issuing 17 opinions. In addition to specific opinions on lawyers to the French Administrative Supreme Court (Conseil d’État) and French Supreme Court (Cour de cassation) (25-A-06) and commissioners of justice (25-A-17), the Autorité issued an opinion on the 2015 reform of the freedom of establishment and regulated rates for certain legal professions (25-A-09). At the request of the French government, parliamentary committees and other independent administrative authorities, the Autorité also examined a number of sectors, including veterinary medicines (25-A-12), local and regional public authority property insurance (25-A-04), wood fuel pellets (25-A-13), and agricultural equipment (25-A-15). Moreover, the Autorité decided at its own initiative (ex officio) to analyse emerging and structing sectors, such as consumer product and service rating systems (25-A-01) and the energy and environmental impact of artificial intelligence (report of 17 December 2025).

In its 2025-2026 roadmap published on 10 July 2025, the Autorité identified three priorities: the challenges posed by the growth of digital markets and artificial intelligence, the imperative of sustainability, and the defence of purchasing power, in particular in the French overseas territories. In a context of budgetary constraints, reflected in a reduction in its resources, the Autorité has focused, more than ever, on ensuring its efficiency, prioritising its actions and preserving its attractiveness and the motivation of its teams.

Anticompetitive practices: €379.2 million in fines imposed in 2025

The Autorité de la concurrence issued 9 antitrust decisions in 2025, of which 5 with fines. The total amount of fines imposed was €379,255,000. Since 2010, the Autorité has imposed an average of €656 million in fines per year.

- The Autorité imposed fines in two abuse of dominance cases, firstly against Apple (25-D-02) in the sector for mobile application advertising on iOS terminals (€150 million) and then against Doctolib (25-D-06) in the sectors for online appointment booking and remote consultations and for the predatory acquisition of its main competitor (€4.6 million).

- Fines were also imposed on anticompetitive agreements, including by Decision 25-D-03 sanctioning no-poach agreements (€29.5 million) and Decision 25-D-07 sanctioning an anticompetitive agreement in the road fuel distribution sector in Corsica (€187.4 million).

- Lastly, the Autorité fined the Parfait group (25-D-05) for failing to comply with the commitments made as part of a merger clearance decision (€7.6 million).

See below the 5 decisions with fines issued in 2025:

|

Decision 25-D-02 of 31 March 2025 |

€150,000,000 |

| Decision 25-D-03 of 11 June 2025 regarding no-poach practices in the engineering, technology consulting and IT services sectors |

€29,500,000 |

|

Decision 25-D-05 of 3 November 2025 |

€7,600,000 |

| Decision 25-D-06 of 6 November 2025 regarding practices implemented in the online medical appointment booking and remote medical consultation solutions sector |

€4,665,000 |

|

Decision 25-D-07 of 17 November 2025 |

€187,490,000 |

| TOTAL | €379,255,000 |

All the above decisions may be appealed before the Paris Court of Appeal.

In parallel, the Autorité continued to examine all economic sectors. Under the authority of the General Rapporteur, the Investigation Services conducted dawn raids in the cancer treatments and glass packing sectors and notified several statements of objections, notably to the Meta group in the online advertising sector.

Merger control: a new record

Continuing the rise in recent years, the number of merger control decisions issued by the Autorité de la concurrence reached a new record of 328 in 2025, up 11% on the previous record in 2024 and representing a total transaction value of more than €31 billion. 94% were decisions without commitments. Moreover, the Autorité did not prohibit any transactions or open any in-depth Phase 2 examinations during the year.

In 2025, the food retail sector accounted for almost half of the transactions examined by the Autorité. In total, the Autorité cleared the takeover of more than 600 stores. While certain transactions such as the acquisition of Auchan stores by Lidl were cleared without conditions (25-DCC-214), three transactions were cleared subject to commitments in order to ensure a sufficient level of competition and safeguard the interests of consumers.

The following transactions were cleared subject to conditions:

- the acquisition of Casino stores by Auchan (25-DCC-65);

- the acquisition of Cora and Match stores by Carrefour (25-DCC-56);

- the acquisition of Bio&Co stores by Marcel&Fils (25-DCC-222).

In 2026, the food retail sector is expected to remain a significant area of focus for the Autorité. In addition to any mergers to be examined, the Autorité will launch – in the coming days and for the first time – a competitive assessment of the AURA and CONCORDIS buying alliances, on the basis of Article L. 462-10 of the French Commercial Code (Code de commerce).

Transactions in numerous other sectors were also examined by the Autorité, including defence (25-DCC-314), aerospace (25-DCC-243), industrial sugar (25-DCC-201), pet supplies (25-DCC-318), construction (25-DCC-164 and 25-DCC-327), clothing (25-DCC-47 and 25-DCC-247), and agrifood (25-DCC-91 and 25-DCC-138).

In the rail infrastructure sector, the acquisition of the Sateba group by Vossloh was also cleared subject to a commitment (25-DCC-220).

Upcoming modernisation of merger control

Several major modernisation initiatives are currently underway. As a first step, the Autorité is seeking a substantial increase in the notification thresholds (except in the French overseas territories), in order to ease the administrative burden on undertakings and enable the Autorité to focus on transactions that may pose competition risks. In fact, the notification thresholds have not been revised since 2009. The measure, introduced by the French government in the simplification bill, is currently being debated by the French parliament and may come into effect in 2026. In parallel, the Autorité launched a public consultation in 2025 with the aim of taking into account the case law of the Court of Justice of the European Union and proposing to the French parliament the introduction of a “call-in” power that would enable the Autorité to review below-threshold mergers that may pose a competition risk.

Lastly, the Autorité is actively participating – within the European Competition Network (ECN) and alongside the French authorities – in the revision of the European Commission Merger Guidelines, with a particular focus on how sustainability, innovation, competitiveness and resilience are taken into account. An initial draft of the revised guidelines is expected in spring 2026.

Dynamic advisory role

In its advisory role, the Autorité de la concurrence examines the competitive functioning of various sectors and makes recommendations to improve economic efficiency and protect consumers. The Autorité can start inquiries at its own initiative (ex officio) or at the request of the French government, parliament, regulatory authorities or professional organisations. In 2025, the Autorité issued 17 opinions.

Tasked with advising the French government on the regulation of regulated legal professions, the Autorité issued opinions on the freedom of establishment of lawyers to the French Administrative Supreme Court (Conseil d’État) and French Supreme Court (Cour de cassation) (25-A-06) and commissioners of justice (25-A-17). On the 10th anniversary of French law 2015-990 of 6 August 2015 for Growth, Activity and Equal Economic Opportunities, the Autorité issued an opinion on the reforms of freedom of establishment and rates, which have profoundly changed the legal framework applicable to the regulated legal professions (25-A-09). One of the recommendations made by the Autorité has already been enacted by the French government, namely the reduction in the frequency of opinions on freedom of establishment from two to five years.

Moreover, the Autorité examined a number of sectors, including veterinary medicines (25-A-12), private-hire vehicles (25-A-03), local and regional public authority property insurance (25-A-04), wood fuel pellets (25-A-13), agricultural equipment (specifically tractors) (25-A-15), the creation of a mutual reinsurance group for agricultural climate risks (25-A-10), and the new electricity capacity mechanism and universal nuclear payment (VNU) (opinion to be issued soon).

Lastly, the Autorité examined, at its own initiative (ex officio), the competition implications of consumer product and service rating systems (25-A-01) and, more recently, studied the energy and environmental impact of artificial intelligence. As required under the French law to Secure and Regulate the Digital Space (SREN), the Autorité also submitted to the French parliament and government a report on its work in the area of self-preferencing.

In 2025, the Autorité started inquires at its own initiative (ex officio) or at the request of third parties into a number of issues, with conclusions to be issued in 2026, including notably:

- the competitive regulatory framework applicable to sectors with extended producer responsibility (EPR);

- the mark-ups of wholesale importers and distributors of basic food items in Martinique;

- online video content creation sector.

Today, the Autorité is announcing two new ex officio inquiries: (i) a competitive assessment of buying alliances in the food retail sector and (ii) an opinion on conversational agents (press releases coming soon).

In conjunction with COP 30, the Autorité reiterated its commitment to supporting the transition to a more sustainable economy. As part of its efforts to support undertakings, the Autorité issued informal guidance on several projects in 2025: (i) the creation of a system for the collective financing of the additional costs and risks associated with the agro-ecological transition (25-DD-01); and (ii) the creation of a platform for collecting and sharing data on suppliers’ carbon footprints in the retail sector (25-DD-02).

The French overseas territories, a key priority for 2026

In addition to its opinion on the mark-ups of wholesale importers and distributors of basic food items in Martinique, the Autorité will issue several antitrust decisions in 2026 on the public works sector in Wallis and Futuna, the distribution of energy cables in the French overseas territories, port services at the port of Longoni in Mayotte, and the treatment, collection and transport of potentially infectious medical waste in La Réunion.

2025: a year of action for the Autorité de la concurrence (in French)

Contact(s)