Merger control

As the market competition watchdog since 2009, the Autorité de la concurrence reviews all proposed mergers and acquisitions above a certain size, in order to prevent the creation of excessively strong market positions or monopolies. It therefore ensures, at an early stage, that such transactions do not reduce competition and, where a risk to competition is identified, makes its clearance conditional on the implementation of appropriate remedies. If the companies concerned do not offer any commitments, the Autorité may impose injunctions or, where no solution is possible, prohibit the proposed transaction.

A quick guide to merger control (in French)

What is a merger?

A merger can take several forms. It may involve the merger of two previously independent companies, the creation of a joint venture or the acquisition of control of one company by another.

What transactions have to be reviewed by the Autorité?

Notification to the French authority

Only transactions above a certain size that meet the following three conditions (unless the transaction concerns an overseas territory or the retail sector) are subject to mandatory review by the Autorité:

- the total global pre-tax turnover of all the companies or groups of legal persons or individuals that are party to the merger is greater than €150 million;

- the total pre-tax turnover generated in France by at least two of the companies or groups of legal persons or individuals concerned is greater than €50 million;

- the transaction does not fall within the jurisdiction of the European Union.

Notification to the European Commission

Where a transaction affects the territory of several Member States and the turnover of the companies concerned is very large (in particular where the combined global turnover of all parties to the transaction exceeds €5 billion and at least two of the companies each generate more than €250 million in turnover within the European Union), the European Commission has jurisdiction. However, the Commission may decide to refer the examination of the transaction to the Autorité if the Commission considers the Autorité to be better placed to assess the case, for example where the effects of the transaction are primarily felt within France.

Specific thresholds for transactions affecting the retail sector and the French overseas territories

For the retail sector and the French overseas territories (which are characterised by high levels of concentration), specific lower thresholds apply, enabling the Autorité to examine transactions that would otherwise escape its control.

-

What happens in the event of failure to notify?

Any company that meets the criteria for notifying a transaction but fails to do so risks a fine for failure to notify, which may reach up to 5% of the company’s turnover generated in France.

How long does a review take?

When reviewing a merger, the Autorité conducts a forward-looking analysis of the impact of the transaction on competition in the various markets affected (the market share of the new entity, effects on competition in the sector, impacts on suppliers and customers, effects on prices and quality, etc.). The length of the review varies depending on the complexity of the case, ranging from a few days to several months.

Time limits

If a transaction does not raise any competition concerns, the Autorité clears the transaction following a short review known as Phase 1 (maximum 25 working days). In practice, the timeframe is often shorter for simplified cases, i.e. transactions that do not appear to pose competition issues, in particular where the companies hold small positions in the markets concerned.

If doubts remain as to the potential risks to competition after the first review and no commitments have been accepted by the Autorité, a Phase 2 in-depth review is opened, lasting an additional 65 working days.

A rapid review in the majority of cases

The remaining cases are generally handled in less than five weeks (Phase 1/simple review). Only in a very small number of cases (complex transactions or identified risks of serious harm to competition) does the Autorité conduct a more in-depth review (Phase 2/in-depth examination).

Possible review even below the thresholds: the application of the Towercast ruling

What different outcomes are possible?

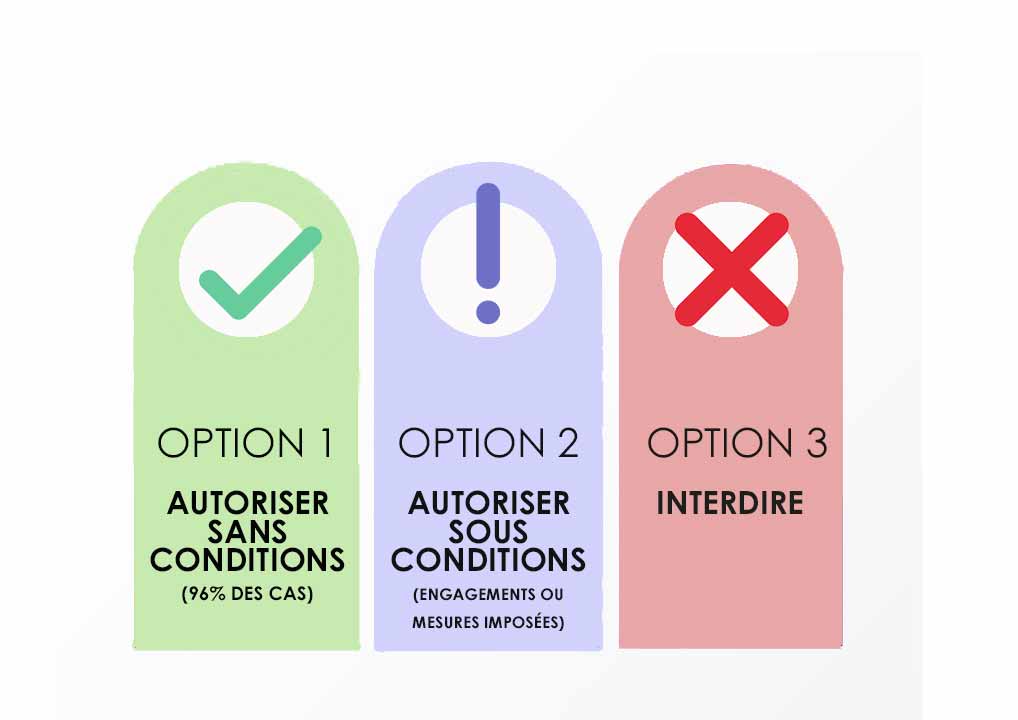

At the end of its review, the Autorité can take three decisions:

The parties to the transaction must await the final decision of the Autorité. If they begin their merger before the Autorité gives the green light (behaviour known as “gun jumping”), they risk a fine. This is what happened in 2016, when the Altice group was fined for gun jumping on two transactions (the acquisitions of SFR and of Virgin Mobile).

Remedies

Different types

When a transaction raises specific competition concerns, the companies must propose the most appropriate solutions to address the issues, enabling the Autorité to approve the planned transaction.

Commitments can take two forms:

- structural, relating to the market structure, e.g. asset divestitures (retailers, brands, companies, factories);

- behavioural, relating to the conduct of the new entity, e.g. its commercial policy.

If the companies and the Autorité cannot reach an agreement, the Autorité may impose remedies by issuing injunctions, which are applied only at the end of Phase 2.

Market consultation

When remedies appear necessary, the Autorité may consult the market via questionnaires to gather the views of interested third parties (competitors, suppliers, customers) on the proposed solutions.

Mandatory nature of remedies

Commitments made, or injunctions imposed, are binding on the company. In the event of non-compliance with the commitments or injunctions, the Autorité can record a breach and withdraw the decision clearing the transaction, impose a fine or order the parties to implement the remedies under penalty payment.

For example, in 2011 the Autorité fined Canal Plus and ordered the group to renotify the takeover of TPS.

Similarly, in 2018 the Autorité sanctioned Fnac Darty and ordered the group to divest two stores in lieu of two assets that were originally supposed to have been sold.

A look back at 10 years of merger control (in French)

Prohibition as a last resort

In certain planned transactions, where the proposed commitments are insufficient or injunctions cannot be imposed, the Autorité may have to prohibit the transaction.

This has occurred twice since 2009. The first case involved the proposed takeover of Pipeline Méditerranée-Rhône, a 760 km pipeline network supplying refined products to depots in southeastern France (2021). The second concerned the proposed joint acquisition of a Géant Casino hypermarket in the Troyes area by Soditroy and the Association des Centres Distributeurs E. Leclerc (2020).

Call-in by the French Minister of the Economy

In exceptional cases, the French Minister of the Economy may request that a case be subject to a Phase 2 review or “call in” the case, i.e. override the decision of the Autorité by adopting a decision based on public interest considerations other than upholding competition (industrial development, international competitiveness of the companies in question, job creation or protection).

To date, this provision has been used only once, in 2018, in the case of the takeover by Cofigéo of certain assets of the Agripole group (William Saurin, Panzani, Garbit).

Avenues for appeal

The parties, as well as other interested third parties, have two months to appeal a decision by the Autorité de la concurrence before the French Administrative Supreme Court (Conseil d’État).

Find out more

Print the page