The Autorité de la concurrence issues its opinion of 31 July 2025 on the assessment and outlook of the 2015 reform of the conditions of establishment and regulated rates for certain legal professions

Background

On the 10th anniversary of French law 2015-990 of 6 August 2015 for Growth, Activity and Equal Economic Opportunities (hereinafter the “Law for Growth and Activity”), the Autorité started inquiries ex officio on 10 October 2024 in order to assess the reforms of freedom of establishment and rates, which have profoundly changed the legal framework applicable to the regulated legal professions.

In the opinion, the Autorité has made both a quantitative and qualitative analysis of both aspects of the reform.

The reforms introduced by the Law for Growth and Activity have produced mixed results, with an overall positive impact on freedom of establishment but a more mixed impact on the regulation of rates. In some respects, the legislator’s objectives cannot be considered to have been achieved.

With regard to freedom of establishment, the objectives set by the reform to increase the service offering and to encourage women and young graduates to enter the profession, while preserving the geographic coverage and economic viability of the offices set up prior to the reform, have on the whole been achieved. The Autorité notes, however, that offices set up by notaries and commissioners of justice in the context of freedom of establishment become profitable after between three and five years in business, meaning some offices set up during the most recent waves of establishment are still experiencing economic difficulties.

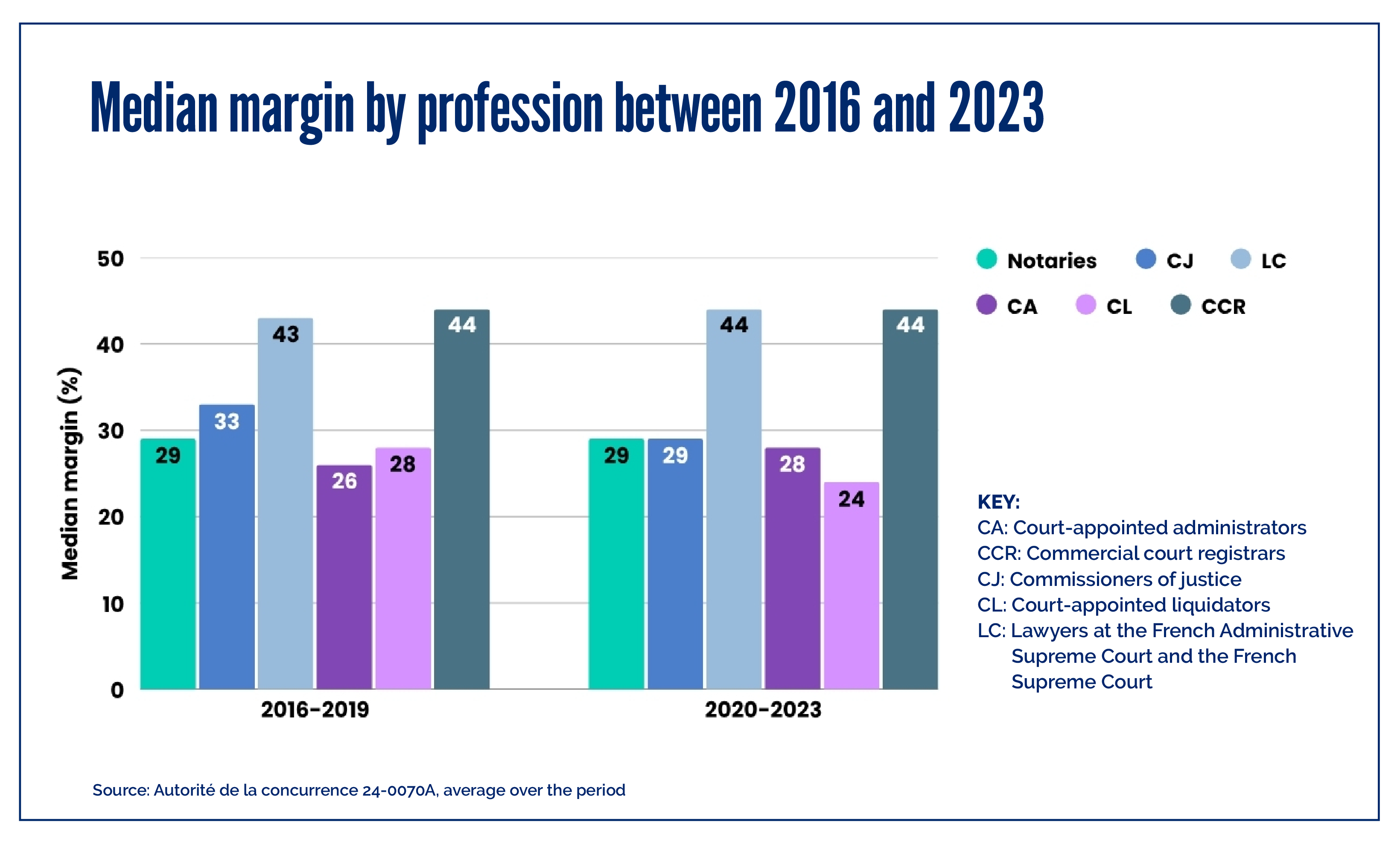

As concerns the regulation of rates, the picture is more nuanced. There are still uncertainties about the method for revising rates, and the rate reductions introduced do not appear to be sufficient to bring rates into line with costs, as envisaged by the Law for Growth and Activity. In response to the findings, the Autorité makes a number of recommendations aimed at improving the current system, and also suggests that ways of enabling each profession to achieve the profitability target of 20% set by the French Commercial Code (Code de commerce) should be explored, starting from much higher levels for certain professions.

Context of the ex officio inquires launched by the Autorité

French law 2015-990 of 6 August 2015 for Growth, Activity and Equal Economic Opportunities (hereinafter the “Law for Growth and Activity”) introduced far-reaching changes to the legal framework applicable to the activities of the regulated legal professions.

The aim of the reform was to liberalise the conditions of establishment for these professions and to achieve more cost-oriented regulated rates, while guaranteeing a reasonable level of remuneration for the professionals.

On the 10th anniversary of the Law for Growth and Activity, the Autorité decided on 10 October 2024 to start ex officio inquiries with a view to making an assessment of the reforms.

The opinion also provided an opportunity for dialogue with the academic world at a workshop entitled “Opening and regulation of the regulated legal professions”, held in February 2025.

The role of the Autorité in the reforms of freedom of establishment and rates

The Autorité was given a key role in the reform of freedom of establishment. In accordance with Article 52 of the Law for Growth and Activity, it identifies the areas where the establishment of new offices of notaries and commissioners of justice (former court bailiffs and judicial auctioneers) would be beneficial, in order to enhance the proximity and offering of services. Every two years, the Autorité publishes a map for the establishment of offices of notaries and commissioners of justice[1], which is then adopted by a joint decree of the Ministers of Justice and the Economy. The map also includes recommendations on the pace of establishment, in order to gradually increase the number of professionals in the areas in question[2]. With regard to lawyers at the French Administrative Supreme Court (Conseil d’État) and the French Supreme Court (Cour de cassation), the Autorité identifies – in accordance with Article 57 of the Law for Growth and Activity – the number of new offices necessary to ensure a satisfactory service offering.

NOTARIES

| Opinion by the Autorité | Recommendations on the pace of establishment (over a two year period) | Approval of the proposed map |

|---|---|---|

| Opinion 16-A-13 of 9 June 2016 uin 2016 | + 1,650 notaries | Decree of 16 September 2016 (map 2016-2018) |

| Opinion 18-A-08 of 31 July 2018 | + 700 notaries | Decree of 3 December 2018 (map 2018-2020) |

| Opinion 21-A-04 of 28 April 2021 | + 250 notaries | Decree of 11 August 2021 (map 2021-2023) |

| Opinion 23-A-10 of 7 July 2023 | + 600 notaries | Decree of 27 February 2024 (map 2023-2025) |

COMMISSIONERS OF JUSTICE (former judicial auctioneers and court bailiffs)

| Opinion by the Autorité | Recommendations on the pace of establishment (over a two year period) | Approval of the proposed map |

|---|---|---|

| Opinions 16-A-25 and 16-A-26 of 20 December 2016 | + 202 court bailiffs + 42 judicial auctioneers | Decrees of 28 December 2017 (maps 2018-2020) |

| Opinions 19-A-16 and 19-A-17 of 2 December 2019 | + 100 court bailiffs + 3 judicial auctioneers | Proposals not approved (in 2020, the French government requested new proposals to take into account the impact of the Covid-19 crisis) |

| Deliberations 2021/01 and 2021/02 of 28 April 2021 | + 50 court bailiffs No judicial auctioneers | Decrees of 20 July 2021 (maps 2021-2023) |

| Opinion 23-A-09 of 7 July 2023 | + 33 commissioners of justice | Decree of 26 December 2023 (map 2023-2025) |

LAWYERS AT THE FRENCH ADMINISTRATIVE SUPREME COURT AND THE FRENCH SUPREME COURT

| Opinion by the Autorité | Recommendations on the pace of establishment (over a two year period) | Publication in the Official Journal |

|---|---|---|

| Opinion 16-A-18 of 10 October 2016 | + 4 offices | 1 November 2016 |

| Opinion 18-A-11 of 25 October 2018 | + 4 offices | 1 November 2018 |

| Opinion 21-A-02 of 23 March 2021 | + 2 offices | 9 April 2021 |

| Opinion 23-A-03 of 7 April 2023 | + 2 offices | 22 April 2023 |

| Opinion 25-A-06 of 16 April 2025 | + 1 office | 20 April 2025 |

Unlike the reform of freedom of establishment, the role given to the Autorité in the regulation of rates is more limited. In accordance with Article L. 444-7 of the French Commercial Code (Code de commerce), the method for revising rates must be submitted to the Autorité for its opinion. On the other hand, consulting the Autorité on the calculation of rates is only optional.

Assessment and outlook

The reforms introduced by the Law for Growth and Activity have produced contrasting results, with a positive overall impact on freedom of establishment, but a more mitigated impact on the regulation of rates.

Freedom of establishment

Assessment

The objectives set by the reform to increase the service offering and to encourage women and young graduates to enter the profession, while preserving the geographic coverage and economic viability of existing offices, have been achieved.

The adoption of the Law for Growth and Activity has led to an increase in the number of offices and private practitioners in all professions (with the exception of former court bailiffs), with a particularly pronounced rise among notaries.

The number of female private practitioners also increased between 2014 and 2024 in all professions, with an increase of over 50% among notaries and former judicial auctioneers.

| Period studied | Profession | % change in offices | % change in private practitioners |

|---|---|---|---|

| 2016 – 2023 | Notary | + 52% | + 42% |

| 2016 – 2023 | Court bailiff | + 5% | - 5% |

| 2016 – 2023 | Judicial auctioneer | + 13% | + 7% |

| 2016 – 2023 | Lawyer at the French Administrative Supreme Court and the French Supreme Court | + 18% | + 14% |

| Period studied | Profession | % change in the proportion of female private practitioners |

|---|---|---|

| 2014 – 2023 | Notary | + 56% |

| 2014 – 2023 | Court bailiff | + 54% |

| 2014 – 2023 | Judicial auctioneer | + 43% |

| 2014 – 2023 | Lawyer at the French Administrative Supreme Court and the French Supreme Court | + 28% |

The Autorité also found the average age of professionals has become slightly younger, due to the ban on practicing after the age of 70 introduced by the Law for Growth and Activity for notaries and commissioners of justice, and the arrival of new, younger professionals.

Lastly, the objective of safeguarding the geographic coverage and ensuring the economic viability of existing offices has been achieved.

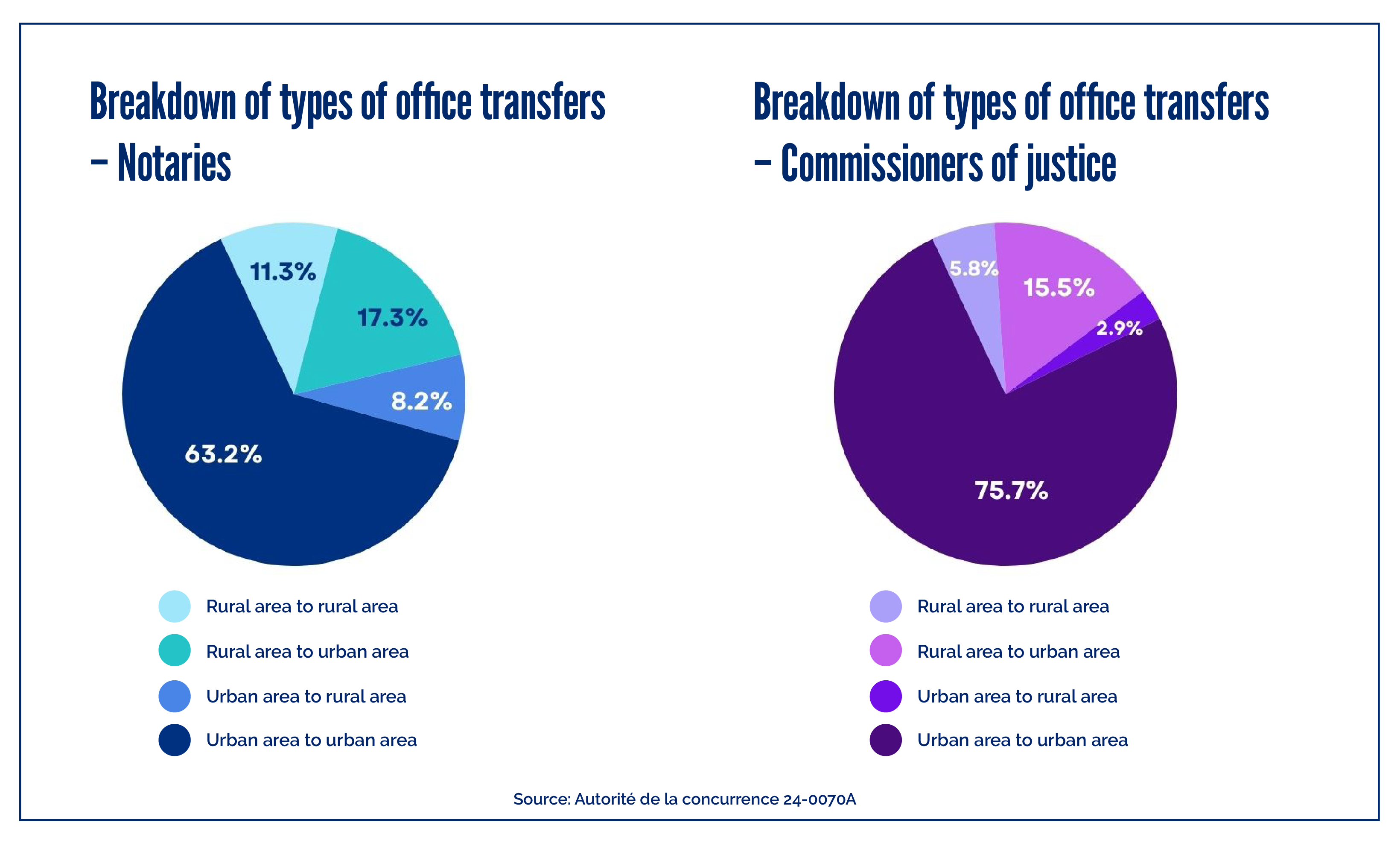

In particular, the Autorité did not observe any mass exodus from rural areas towards urban areas. It notes that a zone of establishment constitutes a relevant market within the meaning of competition law, i.e. a geographic market within which services are substitutable and offices compete with each other. In addition, the Autorité found that offices – in particular newly-established offices – prioritise urban areas and close proximity to populations rather than rural areas, owing to economic considerations. Lastly, the waves of establishment are going hand-in-hand with the increasing digitisation of documents, avoiding the need for users and professionals to make repeated journeys. In addition, the phenomenon of office transfers (relocation within the same zone of establishment) to the detriment of rural areas remains marginal and cannot be equated with a general problem of exodus.

With regard to the economic viability of offices set up before the reform, the analyses conducted by the Autorité show they are in good financial health and have not been significantly impacted. On the other hand, newly-established offices have more financial challenges than offices with similar seniority set up before 2017, and take longer to reach an economic viability threshold. The Autorité notes that offices set up in the context of freedom of establishment generally become profitable after between three and five years in business, which explains why some offices set up during the most recent waves of establishment are still experiencing economic difficulties.

Outlook

In its opinion, the Autorité suggests a number of areas for improvement, in particular with regard to the method used to calculate quantitative recommendations (for example, the correlation coefficient for demand or the grouping of commissioners of justice within a single profession).

The Autorité also makes a number of recommendations to the French government aimed at enhancing the effectiveness of the system, such as extending freedom of establishment to Alsace-Moselle, reducing the frequency of opinions on freedom of establishment, increasing transparency around the allocation of the compulsory voluntary contribution (CVO), and bringing the scope of the legal monopoly of notaries into line with EU law, as well as the conditions of access to the profession of lawyer at the French Administrative Supreme Court and the French Supreme Court. Lastly, the Autorité suggests the duration and scope of the term of the members of its Board appointed for their expertise in freedom of establishment should be reviewed.

Rates

Assessment

The aim of the reform was to establish new principles for setting and revising rates, to bring rates into line with actual production costs by eliminating unjustified rents, to encourage the granting of discounts, and to reduce surcharges in the French overseas territories, while making rates more transparent.

With regard to the setting of rates, in accordance with Articles L. 444-1 and R. 444-1 et seq. of the French Commercial Code, the French government conducts a review every two years in order to take into account, for each profession, relevant costs (Article R. 444-6) and reasonable remuneration (Article R. 444-7).

While the reductions vary from profession to profession and from year to year (see table below), an assessment of the reductions shows inconstancies in their implementation.

| 2016 | 2018 | 2022 | 2022 | 2024 | Change in rates between 2016 and 2024 | |

|---|---|---|---|---|---|---|

| Commercial court registrars | - 5.0% | - 5.0% | - 5.0% | 0% | - 5.0% | - 18.5% |

| Notaries | - 1.4% | 0% | - 1.9% | 0% | % | - 3.3% |

| Former court bailiffs | - 2.5% | 0 % | - 0.8% | 0 % | 1.0% | - 2.3% |

| Former judicial auctioneers | 0% | 0% | - 0.8% | 0% | 0% | - 0.8% |

| Court-appointed administrators | - 5.0% | 0% | - 1.0% | 0% | - 3.0% | - 8.8% |

| Court-appointed liquidators | - 5.0% | 0% | - 1.0% | 0% | 0% | - 6.0% |

For a given profession and year, the criteria set out in Article R. 444-7 of the French Commercial Code do not always provide a coherent explanation for how the average margin (taux de résultat) objective by profession, which has an impact on the change in rates, upwards or downwards, is set. Similarly, the rate reductions have not necessarily lead to a decrease in the professionals’ margins and therefore to a closer correlation between rates and costs, which was the legislator’s initial objective.

In addition, discounts – intended as a way for professionals to stand out from each other – are still rarely used.

Conversely, the reduction in surcharges in the French overseas territories has almost entirely achieved its objectives.

Savings by consumers on real estate transactions between 2016 and 2023

Among the gains made by consumers as a result of the various rate reductions implemented since 2016, the Autorité calculated the savings made on the payment of notary fees on real estate transactions. Using data on property values available online, the Autorité estimated the fees actually paid by consumers on real estate transactions and compared them with the fees that would have been paid without the rate reductions. The savings made by consumers on real estate transactions total an estimated €612 million between 2016 and 2023, or an average of €76 million a year.

| Year | Fees actually paid (after rate reduction) | Fees that would have been paid without the rate reduction (before 2016) | Savings on fees |

|---|---|---|---|

| 2016 | €2,525m | €2,556m | €31m |

| 2017 | €2,971m | €3,012m | €41m |

| 2018 | €3,049m | €3,090m | €42m |

| 2019 | €3,494m | €3,541m | €48m |

| 2020 | €3,208m | €3,304m | €96m |

| 2021 | €3,732m | €3,855m | €123m |

| 2022 | €4,054m | €4,188m | €133m |

| 2023 | €3,000m | €3,099m | €99m |

| Total | €26,033m | €26,645m | €612m |

Outlook

In its opinion, the Autorité also makes proposals to the French government with a view to achieving the objectives of the Law for Growth and Activity in terms of the regulation of rates. With no change to the current method, the Autorité suggests the regulatory framework should be clarified, in particular by specifying how relevant costs (Article R. 444-6) and reasonable remuneration (Article R. 444-7) are taken into account in the determination of rates. In addition, to the extent that some professions are seeing rate reductions without any decrease in their profitability, the Autorité recommends the French government should waive the 5% limit on rate reductions for each rate revision cycle, only for those professions whose regulated margin at the 3rd decile for the last available year exceeds 32%.

In addition, the Autorité recommends the French government should explore the possibility of implementing a new rate method, which would take the form of an automatic, homothetic reduction in rates according to a predefined timetable, with a view to achieving the 20% profitability target set by the French Commercial Code for each profession, starting from much higher levels for certain professions.

Moreover, the Autorité makes recommendations on the scope of the regulation of certain rates. For example, it suggests the French government should abolish fees for services where authentication by a notary is optional or extend the territorial jurisdiction of avocats à la cour, which in France are lawyers registered with a bar association in a region with an appeal court.*

Data quality

In order to conduct its quantitative assessment of the reform, the Autorité has built up a database over several years for all the legal professions in question, based on data supplied by the relevant professional associations in the context of Article A. 444-203 of the French Commercial Code.

When compiling the database, the Autorité identified a number of inconsistencies and a lack of understanding on the part of professionals regarding certain economic indicators to be provided. The Autorité therefore also makes recommendations to the French government to improve the quality and accuracy of the data contained in Annex 4-2 of Article A. 444-203.

Summary of the recommendations made by the Autorité

Data provided by professionals in the context of Article A. 444-203 of the French Commercial Code

Recommendation no. 1: to limit errors, improve the accuracy of the data mentioned in the table in Section I of Annex 4-2 of Article A. 444-203 of the French Commercial Code

The Autorité recommends the French government should:

- specify the relevant box(es) on the tax form for turnover (line K) and income (line N);

- make explicit reference to the definitions of emolument and fee set out in paragraphs 2 and 5 of Article R. 444-1 of the French Commercial Code (lines M1 and M2).

Recommendation no. 2: require the relevant professional associations to verify emoluments and fees

The Autorité recommends the French government should require the relevant professional associations to verify, prior to submission, that turnover is equal to the breakdown between fees and emoluments. Any data transmitted with a discrepancy should be justified.

Recommendation no. 3: encourage the use of median metrics

The Autorité recommends that, in addition to or as an alternative to the average metrics currently used, the French government should encourage the use of median values by professional, in particular in the analysis that feeds into rate revisions.

Recommendation no. 18: include a breakdown by category or subcategory of services into the annual data transmission

The Autorité recommends the French government should include in the annual data transmission provided for in Article A. 444-203 of the French Commercial Code, a breakdown of data at least by category or sub-category of services referred to in the various tables in Annex 4-7 of the regulatory part of the French Commercial Code.

Recommendation no. 20: amend Annex 4-2 of Article A. 444-203 of the French Commercial Code

The Autorité recommends the French government should amend Article A. 444-203 of the French Commercial Code and Annex 4-2, with a view to providing the Directorate General for Competition Policy, Consumer Affairs and Fraud Control (DGCCRF) with annual data with which to better assess the impact of discounts on the regulated rates of notaries, commissioners of justice and avocats à la cour (in France, lawyers registered with a bar association in a region with an appeal court).

Recommendation no. 24: incorporate into Article A. 444-203 and Annex 4-2 of the French Commercial Code the transmission of data on the costs incurred by offices

The Autorité recommends that data on the costs incurred by offices should be transmitted to the Autorité, such as data on personnel costs, operating costs (from intermediate expenses such as payments for services, supplies and external charges), as well as annual fixed costs (such as depreciation/amortisation, rent or set-up costs).

The information could be incorporated into the data transmission provided for in Article A. 444-203 of the French Commercial Code.

Freedom of establishment for lawyers at the French Administrative Supreme Court and the French Supreme Court, commissioners of justice and notaries

Recommendations on establishment

Recommendation no. 4: extend the duration and scope of the term of the qualified members of the Board of the Autorité appointed in accordance with Articles L. 462-4-1 and L. 462-4-2 of the French Commercial Code

The Autorité recommends the duration of the term of the members of its Board appointed for their expertise in freedom of establishment should be extended to five years, renewable once.

It also recommends the scope of their term should be extended to all matters on which the Autorité deliberates in its advisory capacity in respect of the legal professions referred to in Article L. 444-1 of the French Commercial Code.

Recommendation no. 5: extend freedom of establishment, as provided for in the Law for Growth and Activity, to Alsace-Moselle

The Autorité recommends the provisions on freedom of establishment should be harmonised throughout France and that Alsace-Moselle should therefore be included in the system.

Recommendation no. 6: ease the conditions of aptitude and training for notaries in Alsace-Moselle to encourage candidate notaries from the rest of France to set up there

The Autorité recommends the conditions of aptitude and training applicable to notaries and commissioners of justice should be harmonised by, on the one hand, abolishing the requirement for trainee notaries to complete at least two years’ training in an office located within the jurisdiction of the Court of Appeal of Colmar or Metz and, on the other hand, replacing the local law competitive examination with a special local law test as part of the professional examination. This recommendation is in line with the recommendation made by the General Inspection of Justice.

Recommendation no. 7: reduce the frequency of opinions to five years

The Autorité recommends the frequency of its opinions should be reduced to five years, while retaining the possibility to start inquiries ex officio or at the request of the French government in the event of a change in circumstances likely to suddenly alter the economic situation of offices.

Recommendation no. 8: continue to issue decrees of appointment within two years of the draw

If recommendation 7 is accepted, the Autorité recommends that decrees of appointment should still be issued within two years of the draw.

Recommendations to facilitate establishment and encourage competition

Recommendation no. 9: promote greater transparency in the implementation of the compulsory voluntary contribution (CVO)

The Autorité recommends the French Superior Council of Notaries (Conseil supérieur du notariat – CSN) should increase transparency in the allocation of sums from the compulsory voluntary contribution (CVO), by presenting aid for existing professionals that have already established their offices and new professionals that are in the process of establishing their offices separately.

Recommendation no. 10: introduce a regulatory framework for the allocation of sums collected under the compulsory voluntary contribution (CVO)

The Autorité recommends the French government should introduce a strict and clear regulatory framework for the compulsory voluntary contribution (CVO), setting out the specific forms of authorised aid, the fair distribution of sums between aid for existing professionals that have already established their offices and new professionals that are in the process of establishing their offices, and the obligation for the Minister of Justice to determine by decree the geographic areas eligible for aid.

Recommendation no. 11: modify the scope of the legal monopoly of notaries

The Autorité reiterates its 2015 recommendation to abolish the legal requirement for authentication of commercial leases for drink outlets, transferable rural leases, receipts and transfers of an amount equivalent to three years’ rent or farm rent not yet due on leases of less than 12 years, specifications for real estate sales and inventories, transfers of agricultural operations in the event of transfer loans, and the competition of sales of shares in companies mainly dealing in real estate.

Recommendation no. 12: modify the rules of professional conduct for notaries on subcontracting

In order to bring French regulations into line with the case law to date of the Court of Justice of the European Union, and to stimulate competition within the market for subcontracting the drafting of notarial deeds and the notarial profession as a whole, the Autorité recommends the ban on subcontracting the drafting of notarial deeds should be removed from the rules of professional conduct for notaries[3].

Recommendation no. 13: adapt the exceptional access routes to the profession of lawyer at the French Administrative Supreme Court and the French Supreme Court

The Autorité reiterates the recommendation made in Opinion 25-A-06 to make the conditions for accessing the profession more flexible for associates of lawyers at the French Administrative Supreme Court and the French Supreme Court who meet the experience requirements, by exempting them from the CAPAC qualification to become a lawyer at the French Administrative Supreme Court and the French Supreme Court, subject, for example, to passing an oral examination to test their knowledge of professional ethics and regulations, as well as cassation techniques.

Regulation of rates

Recommendations to review the method for regulating rates

Option 1: Improve the current method

Recommendation no. 14: clarify the wording of Article R. 444-5 of the French Commercial Code on the method for revising rates based on relevant costs and reasonable remuneration

The Autorité recommends the French government should clarify the method for determining rate revisions as set out in Article R. 444-5 of the Commercial Code, based on relevant costs and reasonable remuneration.

Recommendation no. 15: set the average margin objective at no more than 32%

The Autorité reminds the French government that, according to the method set out in Article R. 444-7 of the French Commercial Code, the average margin objective set at the time of a rate revision must not exceed 32%.

Recommendation no. 16: specify how the four criteria listed in Section II of Article R. 444-7 of the French Commercial Code must be taken into account

The Autorité recommends the French government should clarify the wording of the four criteria listed in Section II of Article R. 444-7 of the French Commercial Code for determining the average margin objective, in order to:

- with regard to the first criterion, specify how and to what extent the size of the difference between the regulated margin and the 20% reference margin influences, upwards or downwards, the determination of the average margin objective for the profession;

- with regard to the second criterion, specify how and to what extent data from the first three deciles influences, both upwards and downwards, the average margin objective for the profession, and how to determine the regulated profit of a profession, for example by applying to the relevant costs of the profession a coefficient that is representative of its regulated activity;

- delete the last two criteria mentioned in paragraphs 3 and 4 of Section II of Article R. 444-7 of the French Commercial Code.

Recommendation no. 17: introduce a new framework for rate reductions for professions whose regulated margin at the 3rd decile exceeds 32%

The Autorité recommends the French government should waive the 5% limit provided for in paragraph 1 of Section III of Article R. 444-7 of the French Commercial Code, only for those professions whose regulated margin at the 3rd decile for the last available year exceeds 32%.

Option 2: Change method

Recommendation no. 19: explore the possibility of automatically reducing rates until an average reference margin of 20% is achieved

The Autorité invites the French government to proceed in two stages:

- in the first stage, conduct an in-depth study to quantify the cause-and-effect relationships between changes in rates and the repercussions thereof on the economic indicators of the professions, such as the average margin of a profession;

- in the second stage, make the reduction in rates automatic, with a view to achieving an average margin objective of 20% for each profession. In the event of exceptional circumstances, the French government may reduce the automatic revision of rates, after mandatorily obtaining an opinion from the Autorité.

Other recommendations on the regulation of rates

Recommendation no. 21: ease the framework applicable to discounts

The Autorité recommends the French government should make the use of discounts as provided for in Articles A. 444-9, A. 444-52, A. 444-174 and A. 444-202 of the French Commercial Code more flexible, in particular with regard to the requirement for discounts to be fixed and identical, as provided for in Article L. 444-2 of the French Commercial Code.

Recommendation no. 22: abolish rates for voluntary authentic deeds

In accordance with Article L. 444-1 of the French Commercial Code, the Autorité recommends the French government should abolish the rates for deeds for which authentication is voluntary and which can be drawn up another legal professional.

Recommendation no. 23: consider changes to the territorial jurisdiction of representation

The Autorité recommends the French government should consider whether it would be appropriate to maintain the territorial jurisdiction rules applicable to postulation (which, in the French legal system, is a requirement for the parties to proceedings before a court of law to be represented by a lawyer registered with a bar association within the jurisdiction of the appeal court to which that court belongs) or, failing that, to align the rules governing representation in matters of foreclosure, division of property, auction and judicial security with those governing representation in all other matters.

[1] Former court bailiffs and judicial auctioneers.

[2] Free establishment zones, where the creation of new offices is deemed useful in order to improve the proximity or offering of services and where qualified candidates can therefore freely establish their businesses. Controlled establishment zones, for which no need has been identified and where the establishment of any new professional must be closely examined by the Ministry of Justice.

Opinion 25-A-09 of 31 July 2025

Contact(s)