Wood fuel pellets: the Autorité issues its opinion to the Economic Affairs Committee of the French National Assembly

Background

The Autorité de la concurrence was asked by the Economic Affairs Committee of the French National Assembly (Assemblée nationale) for an opinion on the competitive situation in the domestic wood fuel pellet sector.

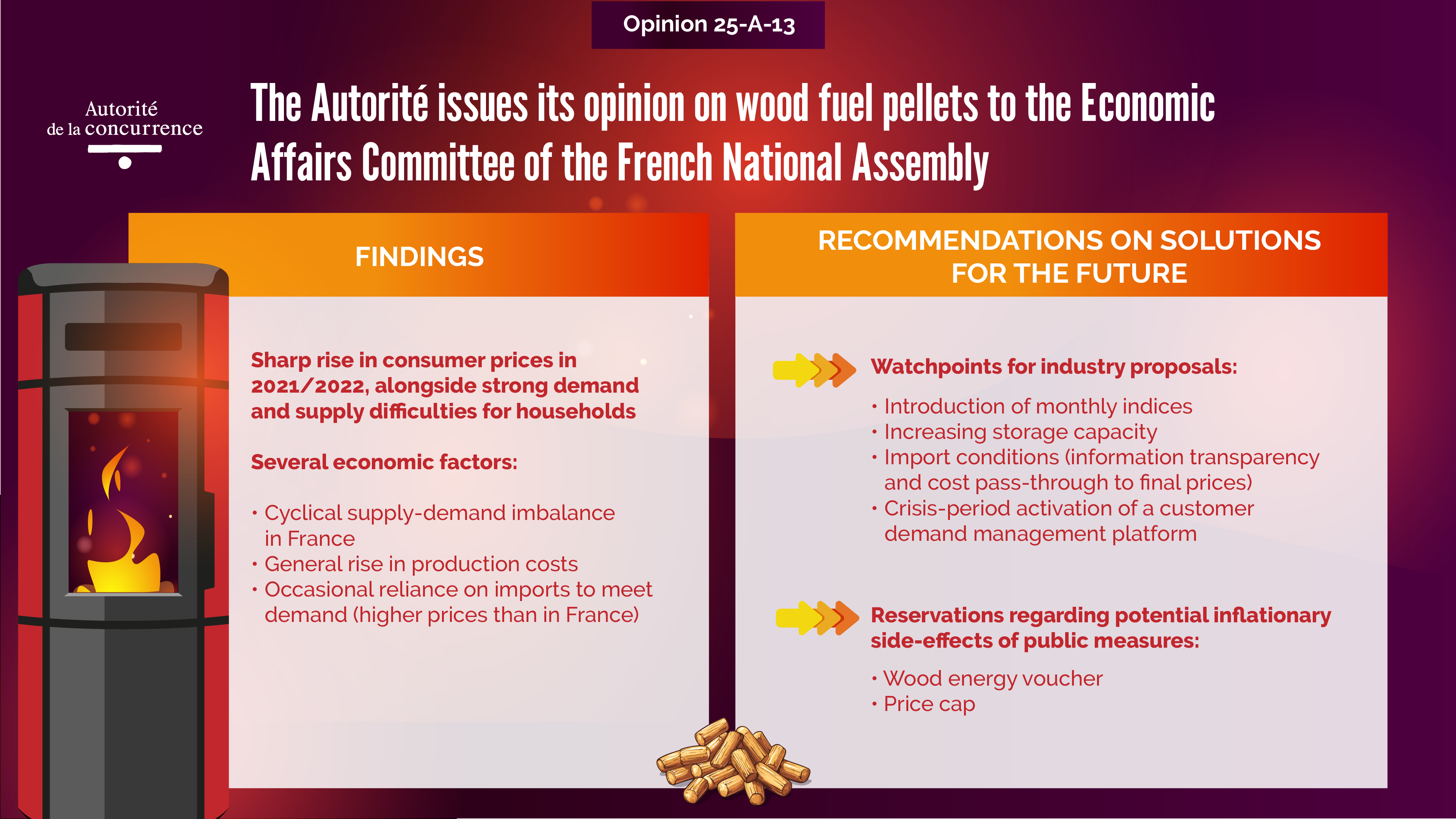

The request was made in the following context: wood pellets, used primarily by private individuals with stoves or boilers to heat their homes, have until recently seen stable and particularly attractive prices compared with other energy sources. However, prices rose sharply over the 2021/2022 period, and supply came under pressure, to the detriment of consumers. This situation can be attributed to a combination of economic factors.

To support the industry and protect consumers, the Autorité has examined, from a competition law perspective, the solutions proposed by industry players to limit the occurrence and effects of such situations in the future. The Autorité is therefore making recommendations on several measures, notably the introduction of monthly price, volume and stock indices, the strengthening of supply flexibility, and temporary measures intended to limit the effects of similar situations on consumers.

Lastly, the Autorité reminds operators of the possibility to request informal guidance, under the notice published on 27 May 2024, to assess the compliance with competition rules of certain initiatives with a sustainability objective.

The domestic wood fuel pellet sector

The wood fuel pellet sector is relatively new and growing in France. Wood pellets are a renewable and comparatively inexpensive energy source, and they enjoy strong popularity among French consumers. This trend has been reinforced by public policies supporting this heat source. In 2022, French consumption reached 2.5 million tonnes, compared with domestic production of 2.05 million tonnes. Although wood pellets are a local energy source, imports and exports can serve as adjustment variables in periods of high or low demand.

The sector is also characterised by a highly fragmented supply, among both producers and distributors.

A tense situation over the 2021/2022 period, explained by several economic factors

The Autorité believes that several economic factors explain the situation experienced by the industry in recent years, in particular over the 2021/2022 period.

Firstly, there was a cyclical imbalance between supply and demand in France, with very high and early demand, due in particular to the increased installation of pellet-fired heating appliances, a shift in household consumption towards this energy source, and certain households bringing forward their purchases.

Secondly, the general rise in production costs and the importation (to reduce the imbalance between domestic supply and demand) of wood pellets from neighbouring countries, where prices were higher than in France, significantly contributed to this exceptional situation.

As such, the result of the interplay between supply and demand, even if temporarily unfavourable to consumers, does not raise concerns under competition rules.

The recommendations made by the Autorité on the proposals from industry players to limit the occurrence and effects of such phenomena in the future

-

Monthly indices

The French wood research centre (Centre d’études de l’économie du bois - CEEB) currently publishes quarterly price reports, but would like to go further by establishing monthly price, volume and stock indices.

The Autorité stresses, however, that such transparency must be implemented with caution, given the potential competition risks.

Recommendations

- Use aggregated data collected retrospectively, with a sufficient delay to prevent companies from knowing and monitoring their competitors’ commercial policies in real time;

- Ensure the indices are made public;

- Explain the purpose of monthly indices and remind companies of the need to set their prices according to their own strategy, taking into account their own cost structure;

- Refrain from encouraging that contract prices be indexed to the price indices or from indicating any joint action to operators in response to the published information.

-

Strengthening supply flexibility

Increase storage capacity

One proposal is to increase storage capacity, which would help to smooth out supply availability and partially decouple supply levels from fluctuations in production.

The Autorité notes that increasing storage capacity may also increase the risk of speculative behaviour. However, given the characteristics of supply (production and distribution fragmented among many small players), demand (uncertain and subject to weather conditions) and the product itself (bulky, costly to store and difficult to preserve in optimal condition), that risk seems limited.

Occasional reliance on imports

Another suggested solution is the occasional use of imports to respond to imbalances between supply and demand. However, importing can be more expensive than sourcing pellets produced in France.

Recommendations

- When importing, operators should remain vigilant regarding the information provided to consumers. Misleading information, if provided by a dominant operator or as part of a coordinated strategy among competitors, may fall under competition law where such information constitutes a parameter of competition;

- Operators should refrain from jointly determining how to pass on any extra import-related costs in their prices;

- If operators pool certain import operations or resources (either occasionally or on a more permanent basis), they must ensure they do so in compliance with competition rules; in particular, if they are competitors, they should refrain from aligning prices or sharing anticompetitive information.

Activation of a customer demand management platform

Industry players are considering a customer demand management platform, inspired by a solution introduced in Austria, where interested consumers can enter a single request (for a given quantity of pellets) and receive a response from participating distributors. According to stakeholders, prices would neither be set nor shared on the platform, which would be activated only in the event of a “crisis”. The platform is currently being finalised and will be tested in the coming months.

Recommendations

- Set clear criteria for activating the platform;

- Ensure the design and operation of the platform do not allow for the exchange of sensitive information between operators, in particular pricing information;

- Provide a system for accessing consumer requests that preserves competition among distributors.

The recommendations made by the Autorité on proposals from public authorities

- The wood energy voucher

The wood energy voucher was introduced in December 2022, but the Autorité notes the vouchers were not widely used. Should such a scheme be considered again, its design should limit distortion of competition as far as possible.

Recommendations

The use of wood energy vouchers must be temporary, to limit any windfall effects, especially for suppliers: by financially assisting a large share of demand to pay their energy bills (in circumstances where demand is relatively insensitive to price), the public authorities may create an incentive for suppliers to raise prices.

- Price cap

Under the French Commercial Code (Code de commerce), the French government may introduce a price cap during periods of crisis. However, the Autorité considers that such a mechanism, which is unusual in a market economy, may incentivise suppliers to align their prices with the cap, to the detriment of consumers, and should be regarded as a temporary measure to address an exceptional situation.

Recommendations

Any exceptional use of such a mechanism in the pellet sector should be kept to a minimum and tightly controlled.

Since 2020, the Autorité has been committed to an “open door” policy. Players wanting to develop virtuous projects, but for which the analysis in terms of competition rules is particularly complex, can ask the Autorité for guidance in order to better self-assess the compatibility of their projects with competition rules.

In order to better support undertakings in their efforts, the Autorité published a notice on 27 May 2024, following a large public consultation. The notice is based on the chapter of the new European Commission horizontal guidelines dedicated to sustainability agreements, while taking a broader scope that covers all competition-related matters, with the exception of mergers.

For more information, see the dedicated page on the Autorité de la concurrence website.

Opinion 25-A-13 of 20 November 2025

Contact(s)