Fuel products in Corsica: the Autorité imposes a fine of €187.5 million on TotalEnergies Marketing France, two companies in the Rubis group and EG Retail for an anticompetitive agreement

Background

On 15 December 2021, the Autorité de la concurrence launched an investigation into practices in the road fuel distribution sector in Corsica. After receiving a complaint from Ferrandi in September 2022, it then combined its own investigation and the complaint into a single case.

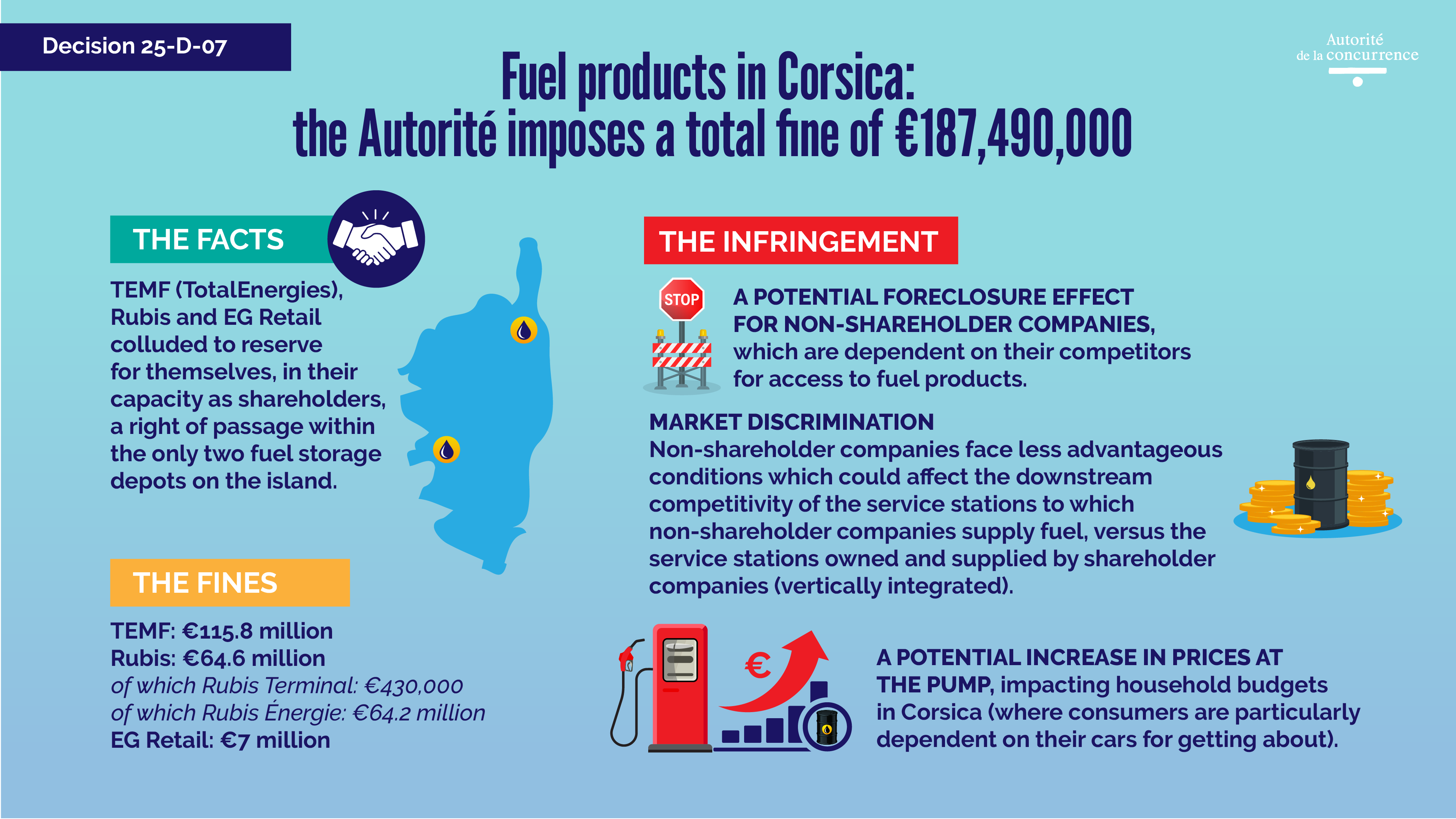

In its decision, the Autorité sanctions several companies, which are shareholders of Dépôts Pétroliers de la Corse (hereinafter “DPLC”) and active in the supply, storage and distribution of road fuels in Corsica, for implementing an anticompetitive agreement consisting of a written agreement to reserve a right of passage within Corsican fuel depots for their sole benefit.

In doing so, DPLC shareholders engaged in an anticompetitive practice that was likely foreclose their non-shareholder competitors. These competitors were forced to purchase their fuel at conditions imposed by their own rivals, and also incurred higher costs due to the accumulation of markups.

This situation harmed their competitiveness and was ultimately detrimental to consumers, as it led to higher fuel prices at the pump. In this regard, the Autorité stresses in its decision that the sanctioned practices took place in a specific context. As it already noted in an opinion issued in 2020[1] , on the one hand, the fuel distribution sector in Corsica is highly concentrated, with only three operators (Total, Rubis/Vito and Esso/Ferrandi), and, on the other hand, unlike mainland France, the service station network in Corsica is not subject to competitive pressure from, in particular, food retail operators. The practices therefore impacted household budgets in Corsica, where consumers are particularly dependent on their cars for getting about.

The total amount of fines imposed is €187,490,000.

[1] Opinion 20-A-11 of 17 November 2020 on the level of market concentration in Corsica and its impact on local competition.

| Company | Amount (in €) |

| TEMF | 115,820,000 |

| Rubis | 64,670,000 |

| of which Rubis Terminal | 430,000 |

| of which Rubis Energie | 64,240,000 |

| EG RETAIL | 7,000,000 |

The fuel supply, storage and distribution sector in Corsica

There are no refineries on Corsica and only two fuel depots. These depots operate according to a storage capacity pooling system, implemented under the coordination and management of DPLC. Practically speaking, the products supplied by each operator are physically mixed together in the storage tanks.

Historically, DPLC was jointly controlled and operated by four operators (TEMF, Shell, BP and Esso), which each held a minority stake. Between 2010 and 2017, its ownership structure changed as a result of several asset disposals, with Rubis acquiring exclusive control (70% held by Rubis Terminal and 5% by Rubis Énergie).

Under the contract governing the conditions of use and operation of the DPLC depots, operators cannot rent individual spaces for storing their products; rather, they only have access to the fuel products stored in the depots within the limits of available stock. Until 1 January 2023, a clause made membership of the contract conditional upon being a DPLC shareholder. A company that was not a DPLC shareholder was therefore forced to buy its road fuel from a DPLC shareholder.

The agreement to reserve the use of Corsican fuel depots exclusively for DPLC shareholders is anticompetitive and likely to foreclose competitors to the detriment of consumers

The Autorité considers that the aforementioned clause, which stood in the contract between 2016 and 2023 and linked the status of DPLC shareholder to that of member of the contract, is anticompetitive. Article 1 of the contract stipulated that for “companies involved in the distribution of petroleum products in Corsica, holding shares in DPLC simultaneously gives the said companies the status of member of the [contract]. Similarly, the loss of shareholder status results in the loss of the status of member of the [contract]”.

Insofar as membership of the contract was conditional upon being a DPLC shareholder, non-shareholder operators found themselves in a relationship of subordination vis-à-vis DPLC shareholders for their supply of fuel products, despite these shareholders being their direct competitors.

The inclusion of the aforementioned clause therefore resulted in the fuel distribution market in Corsica being structured into two distinct categories of operators: on the one hand, DPLC shareholders, free to source their fuel products on their own terms and use the storage capacity of the depots via the contract; on the other hand, non-DPLC shareholder operators, which could only source their fuel products from their competitors (rather than directly from the depots), at conditions imposed by these competitors.

The Autorité considered that this unequal treatment, resulting from contract membership conditions that are not objective, transparent or non-discriminatory, was likely to have foreclosure effects to the detriment of operators that are not DPLC shareholders, as they face less advantageous purchasing conditions than DPLC shareholders.

The Autorité has imposed a total fine of €187,490,000

First, the Autorité considers that this anticompetitive agreement is serious, as it is likely to have foreclosure effects in the road fuel distribution market to the detriment of operators that are not DPLC shareholders. Second, the Autorité stresses that the gravity of the practices is particularly significant in this case, as they were implemented in a highly concentrated sector with only three players. Lastly, the Autorité notes that these practices are likely to harm the end consumer by leading to higher fuel prices at the pump.

For the above reasons, the Autorité has imposed fines totalling €187,490,000.

| Company | Amount (in €) |

| TEMF | 115,820,000 |

| Rubis | 64,670,000 |

| of which Rubis Terminal | 430,000 |

| of which Rubis Energie | 64,240,000 |

| EG RETAIL | 7,000,000 |

| Total | 187,490,000 |

In addition, the Autorité has ordered the sanctioned companies to publish a summary of the decision in the electronic and paper editions of the newspaper Corse Matin.

Decision 25-D-07 of 17 November 2025

Contact(s)