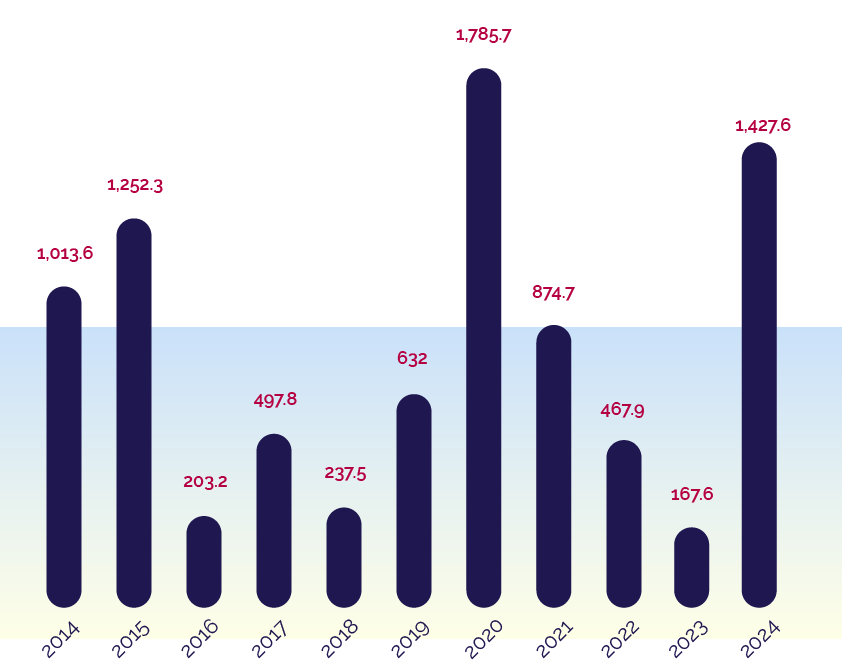

2024, a historic year for the Autorité de la concurrence: €1.4 billion in fines imposed and a record 295 mergers examined

Background

In 2024, the Autorité de la concurrence issued 11 antitrust decisions and imposed more than €1.4 billion in fines. The key decisions of the year included Decision 24-D-03 sanctioning Google for non-compliance with its commitments on press related rights (€250 million) and several decisions sanctioning anticompetitive agreements, such as Decision 24-D-06 regarding the pre-cast concrete products sector (€76.6 million), Decision 24-D-09 regarding several manufacturers in the low-voltage electrical equipment sector (€470 million), Decision 24-D-11 regarding ten manufacturers and two distributors of household appliances (€611 million) and Decision 24-D-10 sanctioning anticompetitive agreements between the airlines Air Antilles and Air Caraïbes.

In merger control, the Autorité once again examined a record number of transactions (295), representing a 10% increase on the previous record set in 2021. This high level of activity reflected, in particular, the transformation of the food retail sector, as illustrated by the decisions on the sale of Casino stores (24-DCC-02, 24-DCC-255 and 24-DCC-288). The Autorité examined innovative markets, such as parking payment solutions, non-search-related online advertising and commuting. Lastly, the year was marked by the clearance of several key transactions in various sectors, such as toy retailing (takeover of assets belonging to Ludendo by JouéClub), audiovisual (acquisition of OCS by Canal Plus and of the media unit of the Altice group by CMA CGM), animal nutrition (acquisition of Axéréal by the Avril group), online gambling (acquisition of Kindred by La Française des Jeux) and aeronautics (acquisition of Cobham Aerospace by Thalès).

The Autorité fully exercised its advisory role during year, issuing eight opinions, including two major sector-specific inquiries: one on charging infrastructure for electric vehicles and the other on generative artificial intelligence.

Continuing its commitment to sustainability, the Autorité issued its first ever notice on the provision of informal guidance to companies wanting to verify the compatibility of their sustainability projects with competition rules.

An exceptional year for fines

For the fourth time in its history, the Autorité de la concurrence topped the symbolic threshold of €1 billion in cumulative fines in a single year. With a total of €1.4 billion, 2024 is the second-highest year in terms of fines imposed, demonstrating the determined and resolute commitment of the Autorité to fighting anticompetitive practices[1].

In 2024, the Autorité issued eight decisions imposing fines:

| Decision 24-D-02 of 6 February 2024 regarding practices implemented in the chocolate distribution sector | €4,068,000 |

| Decision 24-D-03 of 15 March 2024 regarding compliance with the commitments in Decision 22-D-13 of 21 June 2022 of the Autorité de la concurrence regarding practices implemented by Google in the press sector | €250,000,000 |

| Decision 24-D-06 of 21 May 2024 regarding practices implemented in the pre-cast concrete products sector | €76,645,000 |

| Decision 24-D-07 of 17 July 2024 regarding practices implemented in the sector for the sale of Côtes de Gascogne PGI wines | €500,000 |

| Decision 24-D-08 of 24 September 2024 regarding obstruction practices implemented by the Loste group | €900,000 |

| Decision 24-D-09 of 29 October 2024 regarding practices implemented in the low-voltage electrical equipment sector | €470,000,000 |

| Decision 24-D-10 of 4 December 2024 regarding practices implemented in the inter-island passenger air transport sector | €14,570,000 |

| Decision 24-D-11 of 19 December 2024 regarding practices implemented in the sector for the manufacture and distribution of household appliances | €611,000,000 |

| TOTAL | €1,427,683,000 |

In parallel, the Autorité continued its efforts to uncover anticompetitive practices. Over the last 12 months, the Investigation Services and the General Rapporteur and his teams carefully examined all economic sectors and notified several statements of objections. The Investigation Services also conducted four dawn raids[2], as well as hearings and observations as part of the verification of the commitments made by the Parfait group in Martinique in connection with a merger. During the year, the Autorité de la concurrence continued to pay particular attention to the French overseas territories, with one antitrust decision sanctioning anticompetitive agreements between the airlines Air Antilles and Air Caraïbes in the Caribbean (24-D-10) and five merger control decisions[3]. The General Rapporteur also notified statements of objections and conducted dawn raids in several overseas territories.

In total, the €1.4 billion in fines imposed by the Autorité de la concurrence contribute to the State budget, as the fines are paid directly to the public treasury. The amount of fines imposed by the Autorité can be seen in the context of its budget, which was €24.3 million in 2024. The funds collected are used to finance a range of public policies implemented by the State.

Merger control: growth and challenges in a complex economic context

The number of mergers examined by the Autorité de la concurrence has risen steadily in recent years, reaching a record 295 transactions in 2024. This figure demonstrates the resilience of the French mergers and acquisitions market, despite a more difficult economic environment. 97% of the decisions issued in 2024 were clearance decisions without commitments.

Merger control in 2024 was marked by major upheavals in the food retail sector, with the Autorité issuing several decisions on the sale of Casino stores (24-DCC-02, 24-DCC-255 and 24-DCC-288).

Other transactions cleared with conditions included:

- the acquisition of OCS and Orange Studio by Canal Plus (24-DCC-04);

- the takeover of assets belonging to Ludendo (La Grande Récré) by JouéClub (24-DCC-129);

- the acquisition of the media unit of the Altice group by CMA CGM (24-DCC-141);

- the acquisition of Kindred by La Française des Jeux (24-DCC-197).

Active advisory role

In its advisory role, the Autorité de la concurrence adopts a responsive and proactive approach, acting as a think tank to identify sectors that need to be strengthened and making recommendations to improve economic efficiency and protect consumers. The Autorité can start inquiries at its own initiative or at the request of the French government, parliament, regulatory authorities or professional organisations. The Autorité issued eight opinions in 2024, including two sector-specific inquiries. For the first time, the Autorité had the opportunity to examine the generative artificial intelligence market in Opinion 24-A-05. Prepared in record time, the opinion provides an overview of the sector and analyses the potential risks of the emergence of this innovation for the French economy.

As part of its commitment to the ecological transition, the Autorité also analysed a crucial sector that is still taking shape, namely electric vehicle charging infrastructure.

Alongside these sector-specific opinions, the Autorité issued several opinions to the French government and sector-specific regulators, sharing its expertise on strategic subjects such as regulated electricity tariffs, activated wholesale broadband telecommunications offers (“bitstream”) and personal data protection in mobile app stores.

In 2024, the Autorité started inquires ex officio or at the request of third parties into a number of issues, with conclusions already issued or to be issued in 2025, including notably:

- the product rating systems sector;

- the freedom of establishment of lawyers to the Courts and an assessment of the reforms of the conditions of establishment and rates for the regulated legal professions introduced by the 2015 Law for Growth and Activity;

- the online video creation, wood pellet and agricultural equipment sectors.

[1] Certain decisions are subject to appeal before the Paris Court of Appeal.

[2] In the following sectors: agricultural inputs, manufacture and distribution of explosives for civil uses and blasting and drilling for quarries and public works, energy cable distribution in the French overseas territories and medical biology.

[3] 24-DCC-12, 24-DCC-26, 24-DCC-149, 24-DCC-154 and 24-DCC-276.

Contact(s)