Acquisition of OCS and Orange Studio by Canal Plus Group: the Autorité makes the transaction subject to commitments

Background

On 11 July 2023, Canal Plus Group notified the Autorité de la concurrence of its plan to acquire exclusive control of OCS and Orange Studio.

During its investigation, the Autorité held many discussions with Canal Plus Group. It also conducted extensive market consultation, sending out questionnaires to dozens of operators in the sector and holding a number of hearings. In addition, it held discussions with the French Regulatory Authority for Audiovisual and Digital Communication (Autorité de régulation de la communication audiovisuelle et numérique – ARCOM) and the French Directorate General for Media and Cultural Industries.

After examining the transaction, the Autorité has cleared the acquisition subject to conditions. To address the risks of harm to competition identified, Canal Plus Group has entered into commitments, in particular to preserve the diversity of the French cinema offering.

The parties to the acquisition

Canal Plus Group is a pay and free-to-air TV group operating in France and internationally in the production of pay and free-to-air channels, the distribution of pay-per-view and subscription video-on-demand, the aggregation and distribution of pay TV and subscription video-on-demand services, and the production, acquisition and distribution of films and TV series. Canal Plus Group operates in mainland France, and in the French overseas territories via its subsidiary C+I that distributes pay TV channel packages.

Prior to the proposed transaction, OCS was jointly controlled by Orange SA and Canal Plus Group. OCS produces pay TV channels and operates a subscription video-on-demand and catch-up TV service. OCS also produces original content through two labels (OCS Signature and OCS Originals). OCS is distributed in mainland France, either by OCS itself or through third-party distributors. In the French overseas territories, OCS is only distributed through distributors.

Prior to the proposed transaction, Orange Studio was wholly owned by Orange SA. Its main activities include the co-production, acquisition, distribution and sale of cinematographic works and TV series.

In particular, the Autorité identified a risk to the diversity of French cinema

As part of an investigation involving the parties and operators in the film, TV and video-on-demand sectors, the Autorité reviewed its decision-making practice in the markets concerned. It concluded that segmentation according to broadcasting mode (linear and non-linear) was no longer relevant, either in the upstream markets for the acquisition of broadcasting rights or in the intermediate markets for the production and marketing of pay TV channels.

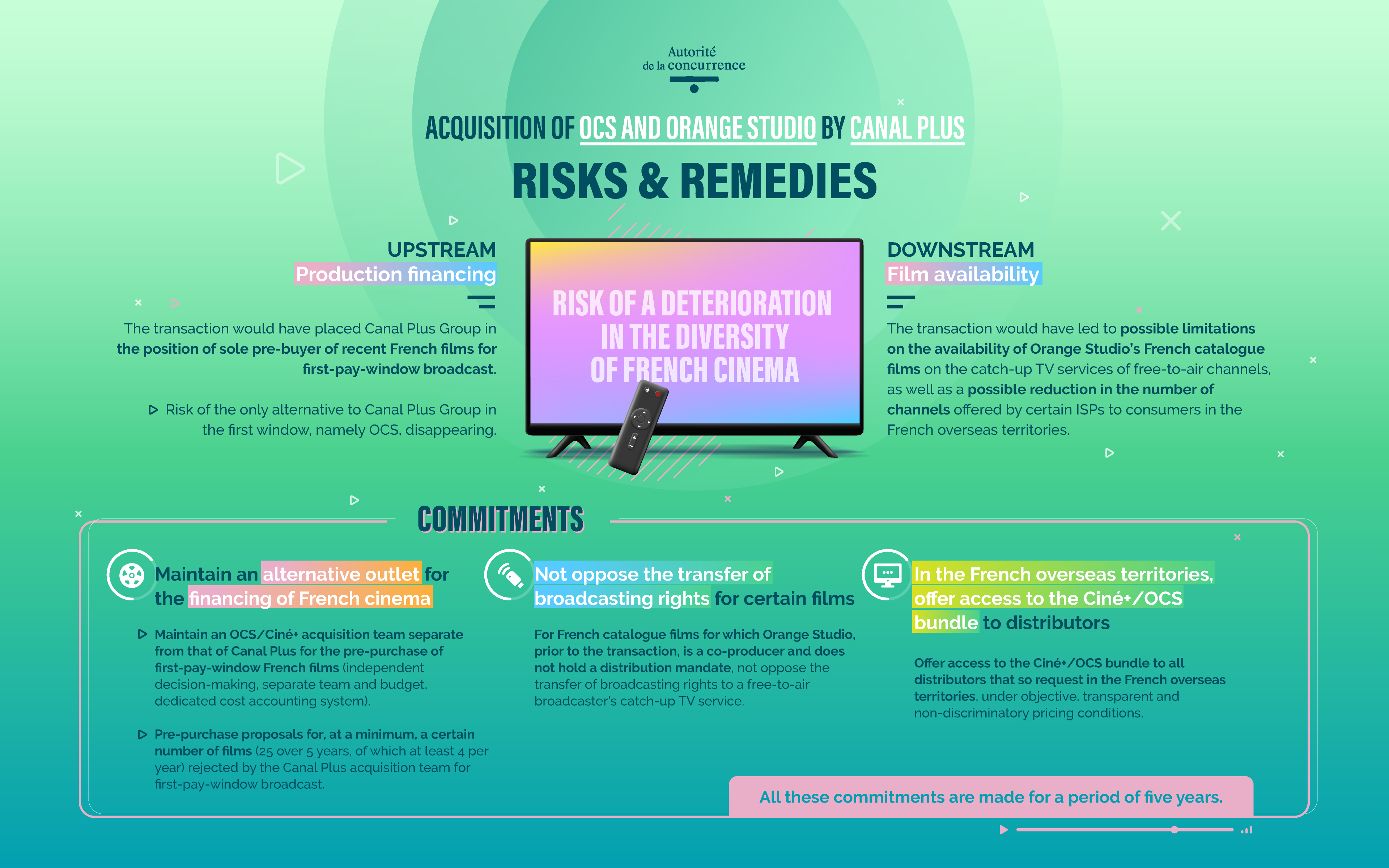

The Autorité found that the transaction could have had a significant impact on the diversity of French cinema by creating a monopsony (single buyer) situation in certain markets.

-

The transaction would have placed Canal Plus Group in the position of sole pre-buyer of recent French films for first-pay-window broadcast

First-window broadcasters are key players in the financing of film projects. To date, Canal Plus Group and OCS are the only two first-pay-window outlets available to French film producers seeking pre-financing for their projects.

As a result of the transaction, the only alternative to Canal Plus Group in the first window, namely OCS, would disappear. While the amounts invested by OCS are considerably lower than those of Canal Plus Group, the fact remains that OCS has a policy for investment in French cinema that is distinct from that of Canal Plus Group. The Autorité’s investigation also showed that subscription video-on-demand platforms are not sufficient real and potential alternatives to the new entity, particularly with regard to the challenges of diversity in French film production.

The disappearance of the alternative financing outlet would have entailed the risk, as was widely emphasised by the operators interviewed, of a deterioration in the diversity of French cinema, by making the new entity the sole investor in first-window pay TV. In its analysis of the extent of these effects, the Autorité also took into account the recent significant reduction in OCS’s investment in French cinema.

-

The Autorité also identified two other anticompetitive risks

In addition, the Autorité found that the transaction would have led to possible limitations on the availability of Orange Studio’s French catalogue films on the catch-up TV services of free-to-air channels, as well as a possible reduction in the number of channels offered by certain ISPs to consumers in the French overseas territories, as these operators do not have sufficient alternatives for the OCS channels.

The proposed commitments

Canal Plus Group has entered into behavioural remedies to address the risks of harm to competition identified by the Autorité.

Commitments to maintain an alternative outlet for the financing of French cinema

To preserve the diversity of French cinema, in particular, Canal Plus Group has committed to maintain an OCS/Ciné+ acquisition team dedicated to pre-purchasing first-pay-window French films from French producers, separate from that of Canal+. To guarantee the effective separation and viability of the OCS/Ciné+ team, Canal Plus Group has committed to:

- guarantee the strict and effective independence of the Ciné+/OS team in relation to the Canal+ team in decisions concerning the pre-purchase of first-pay-window French films from French producers and the related negotiations with these producers;

- provide the Ciné+/OCS team with its own staff and budget to pre-purchase first-pay-window French films from French producers. The annual budget of the Ciné+/OCS team will correspond to the amount guaranteed by OCS as part of its interprofessional agreement with cinema trade associations of 9 February 2022. Investments must reflect the diversity of French film production, particularly in terms of production budgets and the diversity of talent, filmmakers and types of films financed;

- maintain a cost accounting system that clearly separates the costs and revenues of the OCS/Ciné+ team from those of Canal+.

To further guarantee the diversity of French cinema, Canal Plus Group has also committed to make, on behalf of the Ciné+/OCS team, pre-purchase proposals for a minimum of 25 French film projects over five years, including at least four French film projects per year (of which one per year with a budget of less than €4 million) for films rejected by the Canal+ acquisition team for first-pay-window broadcast.

The other proposed commitments

In addition, to address the other anticompetitive risks identified, Canal Plus Group has committed, for French catalogue films for which Orange Studio, prior to the transaction, is a co-producer and does not hold a distribution mandate, not to oppose the transfer of broadcasting rights to a free-to-air broadcaster’s catch-up TV service. In addition, Canal Plus Group has committed to offer access to the Ciné+/OCS bundle to all distributors that so request in the French overseas territories, under objective, transparent and non-discriminatory pricing conditions.

All these commitments are made for a period of five years, and may be re-examined.

In light of the commitments made by Canal Plus Group, the Autorité has cleared the transaction following the phase 1 examination.

Decision 24-DCC-04 of 12 January 2024

Contact(s)