Meal vouchers: the Autorité de la concurrence issues an opinion to the government

Meal vouchers: the Autorité de la concurrence issues an opinion to the government, in which it recommends, as a priority, making computerised vouchers compulsory, seeking a structural solution to redress the balance of power in the market and introducing regulations adapted to the sector.

It considers that, if the pricing cap can constitute an answer to the market failures, in this case it does not constitute the most appropriate response.

Background

The French Minister of Economy, Finance and Industrial and Digital Sovereignty referred to the Autorité de la concurrence for an opinion on the appropriateness of a regulatory framework for the value of the commissions collected from merchants approved by the French National Meal Vouchers Commission (Commission Nationale des Titres-Restaurant, CNTR) by meal voucher issuers and on the question of the widespread computerisation of meal vouchers.

In its opinion to the government, the Autorité invites the government to consider:

- introducing adapted regulation for the meal voucher market through the implementation of issuer accreditation and comprehensive advertising of accredited businesses.

- searching for a structural solution to rebalance the power relationship in the market by ending the monopoly exerted by each issuer on its vouchers vis-à-vis merchants so that they can gain genuine negotiating power.

While the question of introducing a price cap may legitimately be raised, insofar as it may be a response to the failings of certain two-sided markets, in this case it is not the most appropriate response in that it would not correct the malfunctions observed in the meal voucher market and would have uncertain effects.

In addition, the Autorité recommends other measures, such as the compulsory computerisation of meal vouchers with more transparent and clearer pricing, in particular through an obligation to display the equivalent of an overall effective rate.

Background and the complaint to the Government

The French Minister of Economy, Finance and Industrial and Digital Sovereignty referred to the Autorité de la concurrence (hereinafter "the Autorité") on the basis of Article L. 462-1 of the French Commercial Code (Code de commerce) on the appropriateness of a regulatory framework for the value of the commissions collected from merchants approved by the French National Meal Vouchers Commission (Commission Nationale des Titres-Restaurant, CNTR) by meal voucher issuers.

Meal vouchers are special payment instruments with a total face value of almost 8.5 billion euros in 2022. Implemented in the late 1960s, they are today used by more than 5 million employees to pay for meals and food services at some 234 000 merchants approved by the CNTR to receive meal vouchers for these meals and services.

This mechanism which is not subjected to social security and employer contributions and income tax- is subsidised to the tune of 1.5 billion euros per year by the public authorities.

Given the significant imbalance between the relatively low commissions paid by companies purchasing meal vouchers for their employees on the one hand, and the relatively high commissions paid by approved merchants on the other, the government is considering capping the latter. The government is also studying the scenario of the commonplace computerisation of meal vouchers.

The meal voucher market

A fast-growing market

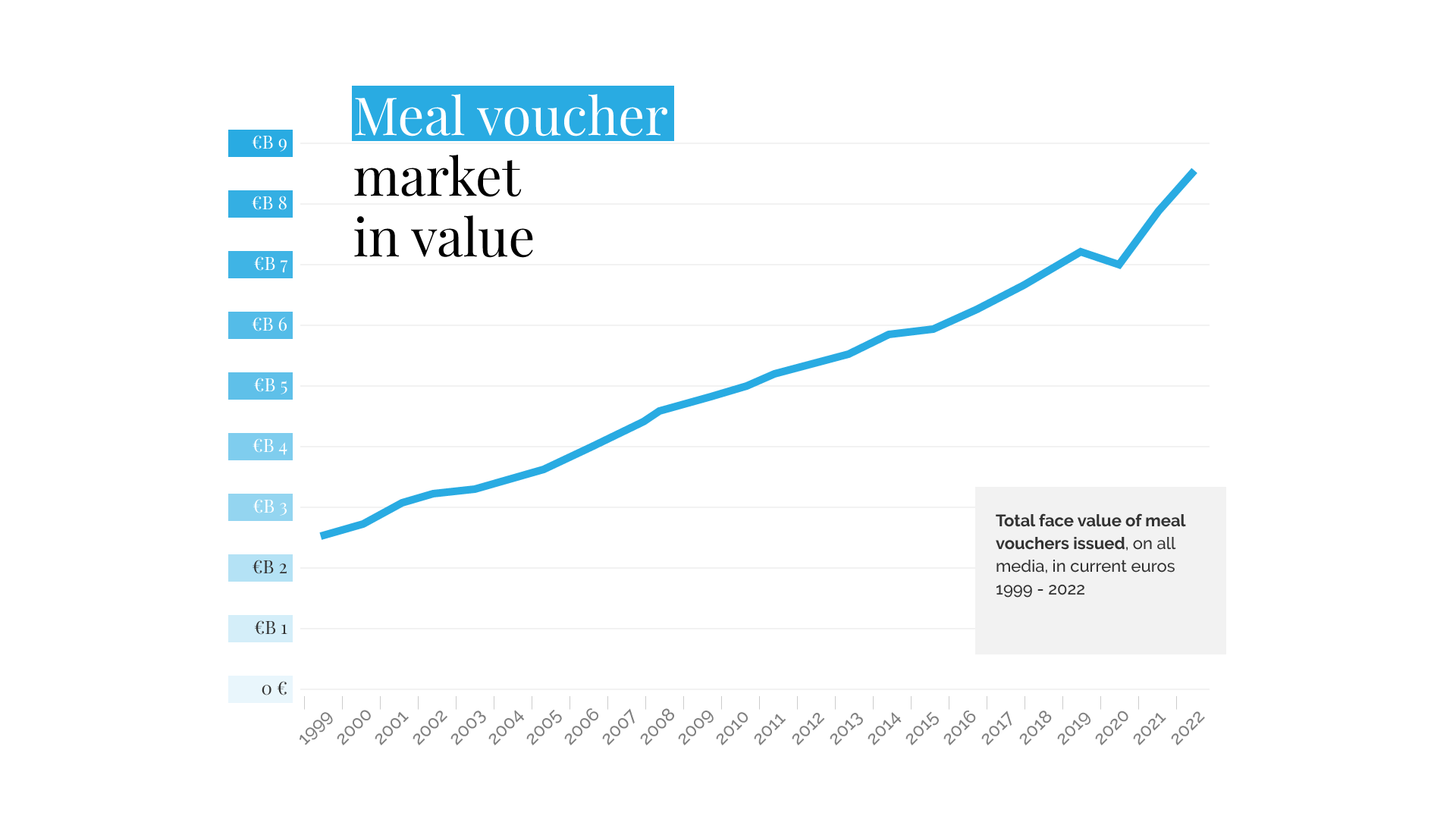

The meal voucher market has grown steadily since 1999, with the total face value issued increasing three-fold over this period.

Source : Autorité de la concurrence from the CNTR website

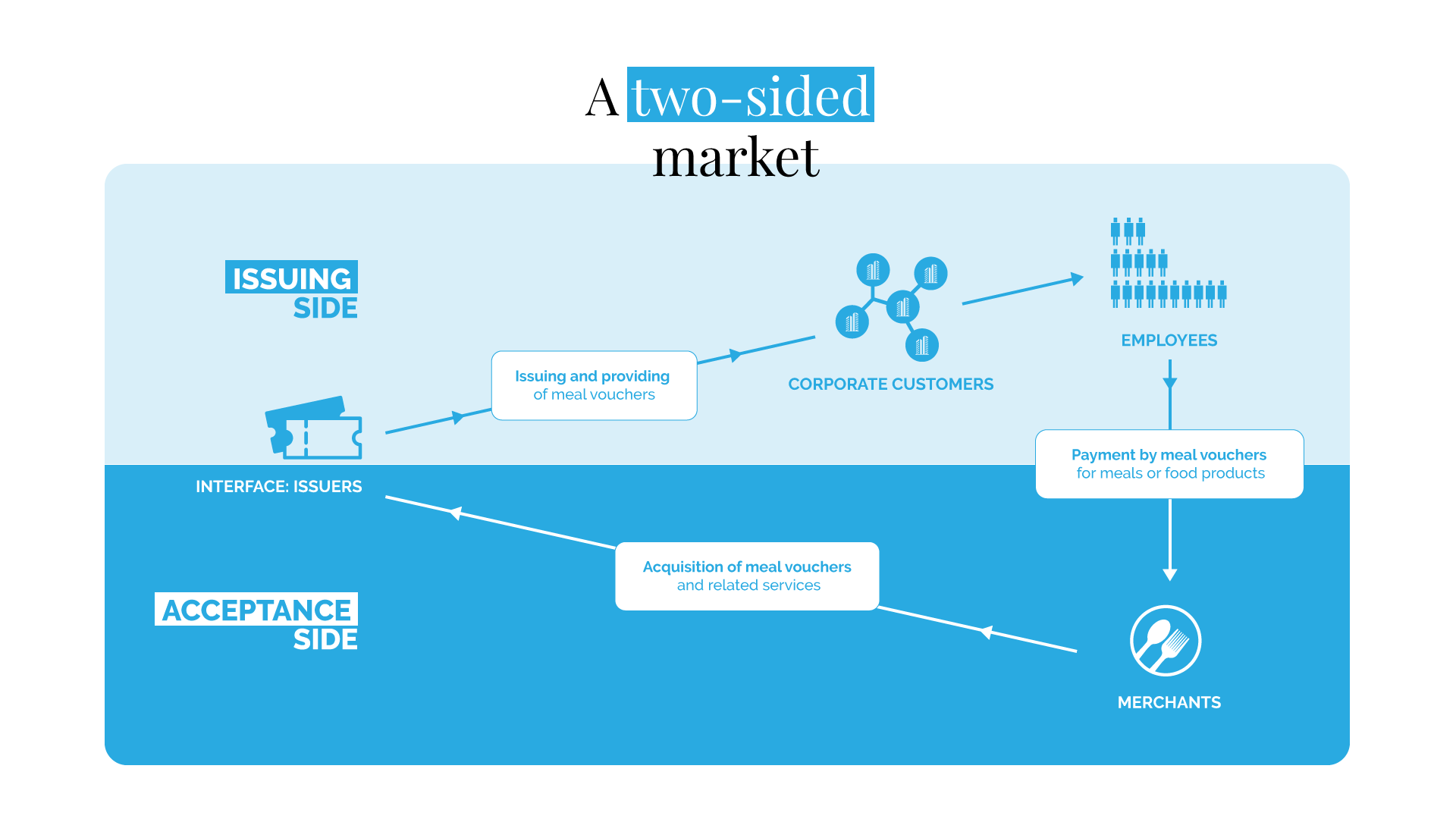

A two-sided market

This is also a "two-sided" market; on the issuing side, issuers market their vouchers to companies on behalf of their employees. On the acceptance side, each issuer acquires its meal vouchers from CNTR-approved merchants for reimbursement, and cannot acquire vouchers issued by third party issuer.

On the issuing side, companies generally use a single issuer (single-homing); on the acceptance side, authorised merchants generally accept vouchers from several issuers (multi-homing), or even all issuers, allowing them to maximise their sales.

Computerisation not yet complete

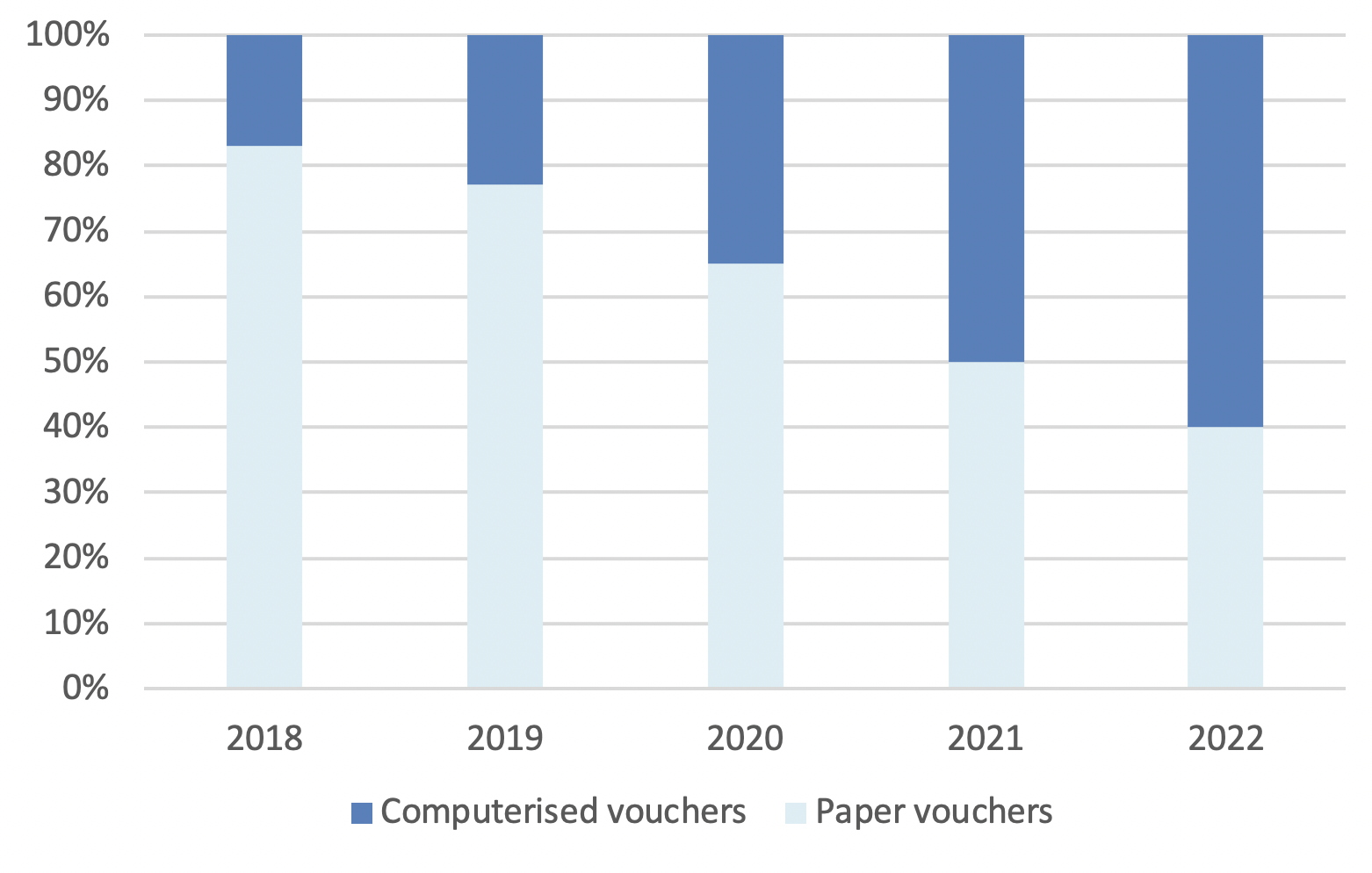

The Autorité also observed a sharp rise in computerised vouchers, which today outstrip paper-based vouchers (60% in 2022).

Percentage of computerised vouchers in the total face value issued in France between 2018 and 2022

Lastly, the meal voucher market has been marked by the recent closure of the Centrale de Règlement des Titres ("CRT"), which collected and processed paper vouchers for approximately 50 years, leading to the virtual disappearance of the deferred reimbursement rates to which the lowest commission rates were applied.

The existence of market failures

At the end of the investigation, the Autorité noted the existence of market failures, including the existence of barriers to entry, expansion and innovation, and above all the market power of the incumbent issuers, which limit the growth of new market entrants and allow commissions to rise steadily.

Barriers to entry

With regard to barriers, the Autorité noted that the structure of the meal voucher market has led to network effects and economies of scale, both of which are likely to give a competitive advantage to companies of a certain size, particularly those that enjoy a reputation and legitimacy due to their historical presence.

It also found certain obstacles to computerised vouchers and to the growth of new players, in particular the significant inertia of demand from corporate clients and the reluctance of certain amongst them to adopt computerised solutions.

Finally, the Autorité noted the existence of quasi-regulatory barriers. The meal voucher scheme is governed by the provisions of the French Labour Code (Code du travail) which set out a list of obligations for companies offering meal voucher solutions, but do not define an official approval procedure. However, it appears that the CNTR exercises this prerogative.

The market power of the four incumbent issuers

The Autorité noted a concentration of the market, which has been dominated by the four main issuers (Edenred France, Bimpli-Swile, Sodexo Pass France and Up Coop) for several decades; the combined market share of these players was over 99% as of 2022, with individual market share being between 10 and 40%.

Despite the presence of around 15 companies, market concentration, repeatedly noted by the Autorité [1], remained between 2018 and 2022, effectively limiting the penetration of new entrants over this period. The new computerised entrants such as Benefiz, Dunia, Octoplus, Open, WiiSmile and Worklife, thus have a combined market share below 1% in 2022.

Furthermore, each issuer has exclusive rights to the vouchers it issues since, in the current state of the market, it is the only party able to acquire them in order to reimburse them to merchants.

Steadily rising commission levels for merchants

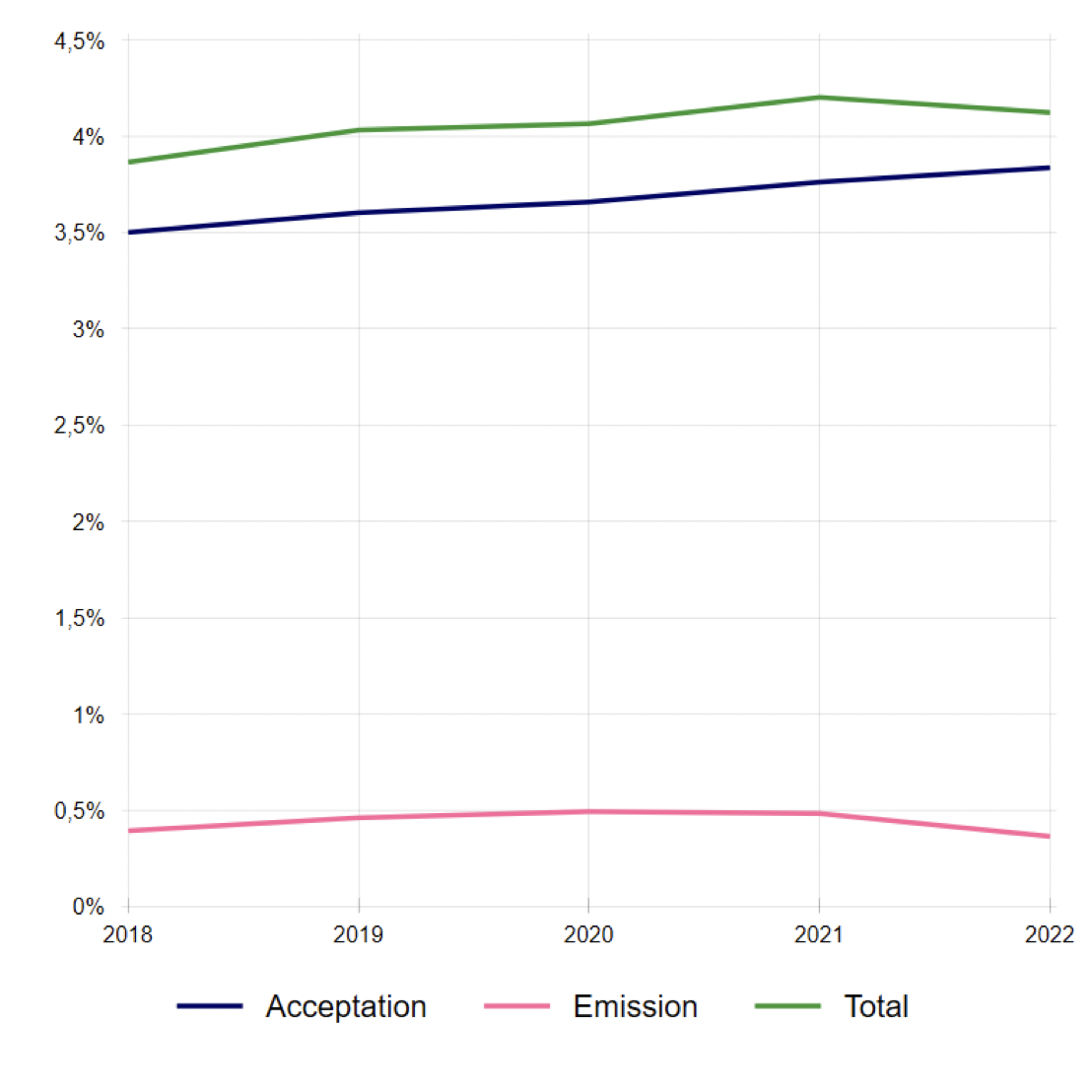

The Autorité noted that the gradual shift in commission rates from the issuing side to the acceptance side already seen between 2010 and 2016 [2] continued between 2018 and 2022 for the incumbent issuers. This shift is due in particular to the low bargaining power of merchants, who in practice can ill afford to lose sales by refusing widely distributed meal vouchers.

Average effective commission rates on the issuing side (commissions paid by corporate customers) lowered between 2018 and 2022, the average commission rate even becoming negative for certain issuers. Conversely on the acceptance side, the effective average commission rates (the commissions payed by the merchants) increased during the same period. This led to an increase in the overall commission rate (i.e. the sum of the revenues of both sides divided by the total face value issued)

Change in average commission rate for all issuers on the issuing and acceptance sides and total

Acceptance / Issuing

The recommendations of the Autorité

Price capping: a measure likely to have counter-productive effects

The Autorité considers that the introduction of the proposed price cap does not constitute the most suitable answer to the identified market failures and could cause uncertain effects.

Experience shows that a "cap" in fact becomes a “focal point”, meaning a price towards which the rates charged by the companies in question converge. As a result, any issuer whose acceptance commission rates were usually set below such a regulatory cap will tend to align its rates with this cap, to the detriment of the consumers concerned. Moreover, issuers could try to compensate for the loss incurred, either by circumventing regulations (increase of their margins on the acceptance side of the services for which rates would remain free), or by increasing their rates on the issuing side (compensation effect) with the ultimate risk of a fall in demand for meal vouchers.

Moreover, defining the level of this cap, as well as monitoring its effectiveness, raises complex implementation issues.

Recommendation 1: Do not introduce a price cap

If the government decides to introduce a price cap on acceptance commissions, a thorough assessment of all the elements required for its implementation will have to be carried out, notably in terms of communication on the amounts effectively invoiced, monitoring the implementation of the measure and assessing its overall impact on the acceptance and emission sides.

The introduction of appropriate regulation of the sector

Assessing that the market function shows the existence of non-regulated exclusive rights, the Autorité recommends the introduction of an accreditation for meal voucher issuing businesses, based on objective criteria, by a body that would provide guarantees of independence and impartiality.

In addition, to ensure better information concerning the identity of meal voucher issuers with regard to both corporate clients and approved merchants, the Autorité considers it necessary to introduce comprehensive advertising for companies actually issuing meal vouchers in accordance with current regulations.

Recommendation 2: Introduce appropriate regulation of the sector

The Autorité recommends that the government introduce regulation of the meal voucher market, in particular through the accreditation of the activity of meal voucher issuers and comprehensive advertising of the accredited companies.

Reduce the market power of each issuer

Based on the finding that the source of this market's main failure lies in the imbalance of power between each issuer, which holds a monopoly over the vouchers it has issued, and a fragmented demand for these vouchers on the acceptance side (234,000 approved merchants), the Autorité is in favour of introducing a structural measure to rebalance the market relationship, by separating the issuing of meal voucher from their acquisition, in order to reinject competition on the acceptance side.

In practice, this could:

be implemented by making meal vouchers fungible with each other, that is to say in suppressing the exclusivity of each issuer on the vouchers it issues, so that merchants could then remit all the meal vouchers received in payment to the intermediary of their choice, who would negotiate with each issuer the volumes remitted and the applicable commission rate. An alternative would be to enable approved merchants to pool their bargaining power, for instance via a central purchasing office.

Recommendation 3: Remove each issuer's exclusive right to accept the vouchers it issues

The Autorité recommends that the government implement measures aimed at restoring the balance of power in the meal voucher market by putting an end to the monopoly exercised by each issuer over its vouchers with regard to approved merchants, for instance by separating the issuing of meal vouchers from their acquisition.

Accelerating the computerisation of vouchers

To remedy the low market penetration of new issuers and the complexity of the pricing schedules observed for paper vouchers, the Autorité believes that accelerating the end of paper vouchers and making the computerisation of vouchers mandatory are appropriate measures on both sides of the market:

- on the issuing side, computerised vouchers would enable a substantial part of the market to be reopened to competition, as new entrants would be in a position to canvass corporate customers.

- on the acceptance side, merchants could benefit from lower processing and reimbursement costs. The single format of the computerised voucher would also simplify the work of authorised merchants.

- Computerisation would drive issuers to innovate more and lead to an elimination of the costs associated with paper vouchers for historical issuers.

Recommendation 4: Make compulsory the computerisation of meal vouchers

The Autorité recommends that the government make the computerisation of meal vouchers compulsory, with a sufficiently long lead-in period to enable sector players to anticipate and implement the widespread switchover to computerisation.

More transparent pricing

To remedy the difficulty for merchants in anticipating their rates linked to the acceptance of meal vouchers, due in particular to the complexity of the pricing schedules among certain issuers, the Autorité recommends that prices be made more transparent and easier to understand. This objective could be achieved by introducing an obligation to display the equivalent of an overall effective rate, which would include both the acceptance commission and all the ancillary costs.

Recommendation 5: Make issuer prices more transparent and easier to understand for authorised merchants

The Autorité recommends making prices more transparent and easier to understand, for example by implementing an obligation to display the equivalent of an overall effective rate.

[1] Opinion of the French Competition Commission (Commission de la concurrence) of 21 May 1980 on anticompetitive practices in the meal voucher sector; Decision 01-D-41 of 11 July 2001 regarding practices in the meal voucher and service voucher markets; Decision 19-D-25 of 17 December 2019 relating to practices implemented in the meal voucher sector.

[2] Decision 19-D-25, cited above, paragraph 177.

Opinion 23-A-16 of 12 October 2023

Contact(s)