The Autorité de la concurrence issues its opinion on the competitive situation in the property brokerage market

Background

The Autorité de la concurrence (hereinafter the "Autorité") received a request for an opinion from the French Minister of Economy, Finance and Industrial and Digital Sovereignty concerning the operation of the French property brokerage market.

In this draft opinion, which analyses the property brokerage market in mainland France, the Autorité notes that the “Hoguet Act” of 2 January 1970 governing the profession of property broker could be clarified and made more flexible in the light of developments in the sector.

The Autorité notes that, for some actors, the Hoguet Act is an obstacle to offering innovative services or lowering commission rates, which will average 5.78% incl. VAT in 2022, well above the EU average (around 4% incl. VAT). It estimates that reducing commission rates for brokers in France to the European average could generate an annual saving of nearly €3 billion for households.

To achieve this, the Autorité is making a number of recommendations to the government aimed at adapting the Hoguet Act and make it more flexible.

Framework and scope of the referral

Property brokerage is a sub-category of property intermediation, encompassing both property brokerage and property management activities. As the Autorité was only asked to issue an opinion on the operation of the French brokerage market for the sale of residential property (hereinafter referred to as "property brokerage"), the draft opinion deals only with this point and does not address other intermediation activities, such as the sale of businesses, leasing or property management.

The draft opinion also analyses the property brokerage market in mainland France.

The Autorité's findings regarding the property brokerage market

The role of a property broker is to bring together property supply and demand on the market and reduce the asymmetry of information between seller and buyer. They provide a range of services intended to complete the sale or purchase of a property.

The high financial stakes involved in the purchase of a property and the impact this purchase has on the lives of individuals make property brokerage a specific and highly regulated market.

In 1960, the French legislator introduced the principle of prior clearance for the exercise of the profession, as well as a prohibition on receiving any remuneration whatsoever prior to the actual completion of the sale. This legal and regulatory framework, laid down today in Act 70-9 of 2 January 1970 regulating the conditions governing the exercise of activities relating to certain transactions involving property and business assets, known as the Hoguet Act, was intended to professionalise the property brokerage profession, restore household confidence in it, and protect households in what is one of the most important transactions of their lives.

Fifty-three years after this system came into force, the Autorité nevertheless considers that it could be clarified and made more flexible in the light of a number of developments.

The rise of digital technology and the open data policy implemented by the government have helped to reduce the asymmetry of information between brokerage professionals and their customers, particularly concerning property values and the condition of the market. In addition, consumer law, which has undergone significant changes in favour of economic protection for consumers, and the obligatory role of the notary in authenticating the sale, ensure a high level of security during the transaction.

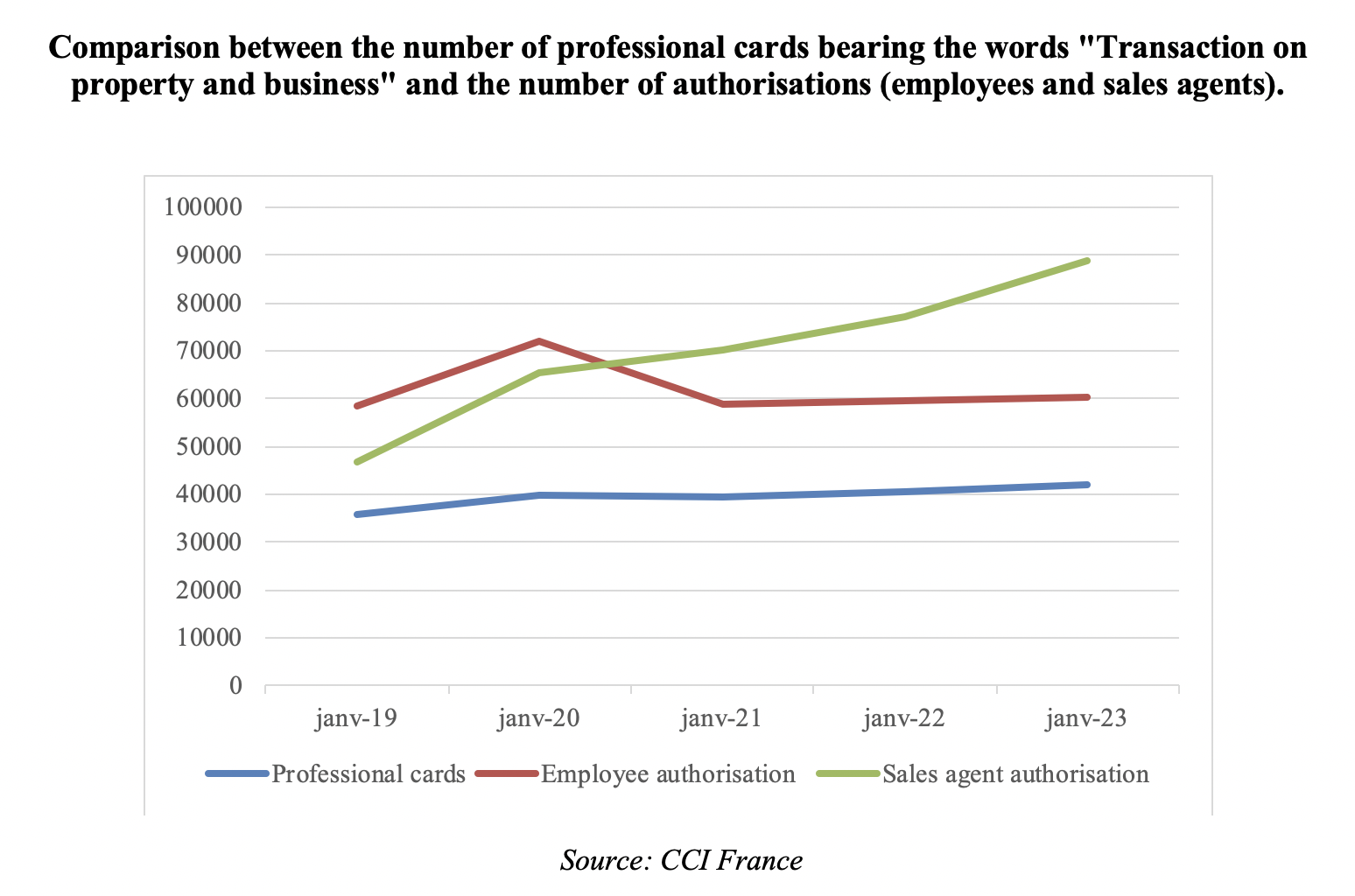

Furthermore, the special measures introduced by the Hoguet Act have not prevented the arrival of new actors on the market, with no particular increase in the number of disputes or litigation cases and no specific concerns in that regard on the part of these actors. In particular, today only one in five property brokers holds a professional card.

For some actors, however, the Hoguet Act could act as a barrier to innovative services or lower commission rates, which averaged 5.78% incl. VAT in 2022, well above the European Union average of around 4% incl. VAT.

In addition, some operators offer direct sales assistance services, known as "property coaching" services, to private individuals, which are very similar to property brokerage services but not subject to the principle of performance-based remuneration imposed by the Hoguet Act. Private customers pay for these services before the sale is actually completed, which is likely to be a competitive advantage for these players.

Recommendations made by the Autorité

In light of these findings, the Autorité recommends that the government consider a reform aimed, on the one hand, at strengthening the economic protection of consumers and, on the other, at easing the conditions under which property brokerage activities are carried out.

These recommendations are aimed at improving the quality of property brokerage services and reducing their cost, in a context of sharply rising interest rates and the challenges of energy renovation. The Autorité estimates that bringing the commission rates charged by brokerage professionals in France into line with the European Union average could generate an annual gain of nearly 3 billion euros for households.

At a time when interest rates are rising sharply and the supply of property is increasingly geared towards sustainable development (energy efficiency, the fight against greenhouse gases), stronger economic protection for consumers, combined with greater flexibility in the conditions under which professionals offer their services, would help to support purchasing power and access to housing.

For the first time, the Autorité has translated its recommendations into legal proposals for legislative and regulatory changes. They are appended to this opinion.

Recommendations

In addition to general recommendations aimed at increasing economic protection for consumers (A), the Autorité proposes two options for making the Hoguet Act more flexible (B).

General recommendations applicable regardless of the selected option and designed to enhance economic protection for consumers

Recommendation 1: introduce an obligation to include in the mandate an exhaustive list of the services provided by the professional, so that the client can be fully informed when negotiating fees.

Recommendation 2: standardise the rules governing the display of advertisements, regardless of whether the buyer or seller is responsible for paying the fees, to improve the clarity of information and limit the effects of fees being passed on from the seller to the buyer.

Recommendation 3: subject online property advertisement distribution platforms to the display obligations set out in the 2017 decree on consumer information by professionals involved in a property transaction.

Recommendation 4: make it compulsory to draw up a summary sheet for the technical diagnosis file, to make it easier to understand and read.

Recommendation 5: make available to the public, free of charge, the property data held by notaries on property selling prices and the commissions received by property brokers. The property values database (known as the DVF database), made available to the public free of charge, is not without its biases. The selling price of a property indicated in the database corresponds to the taxable base for transfer duties and therefore includes the amount of the fees when these are paid by the seller. This is likely to artificially increase the selling price of the property and limits the interest of this database for private individuals and professionals who use it essentially to estimate property prices. The Autorité recommends making available to the public, free of charge, the data held by the French Superior Council of Notaries (Conseil supérieur du notariat) on the characteristics of properties, their selling prices and the commissions received by brokers.

Recommendation 6: remove the ban on negotiating notaries displaying property ads in their office windows.

The two options for making the Hoguet Act more flexible

The first option is to ease the conditions under which property brokers offer their services. This option is accompanied by two recommendations: (1) the exclusion from the scope of application of the Hoguet Act of the activity of property brokerage for the sale of property and (2) the insertion of a provision in the French Consumer Code (Code de la consommation) requiring proof of a financial guarantee in the event of handling funds.

The second option focuses mainly on (1) clarifying the scope of the Hoguet Act and (2) simplifying the conditions for accessing the profession.

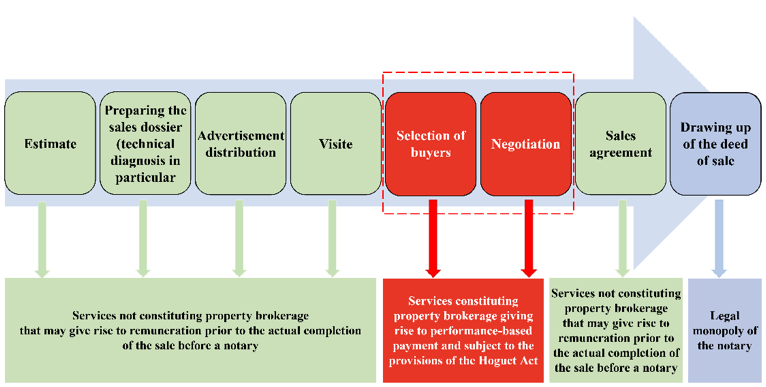

1- With regard to clarifying the scope of the Hoguet Act, the Autorité proposes, on the one hand, to precisely define the services that fall within the scope of property brokerage and, on the other hand, to specify those that do not, although this list would not be exhaustive. According to the Autorité, property brokerage involves selecting customers and negotiating the selling price. As a result, services that do not constitute property brokerage will not be subject to the principle of performance-related remuneration set out in Article 6 of the Hoguet Act.

The diagram below illustrates the practical consequences of these recommendations:

2- With regard to simplifying the conditions for accessing the profession, the Autorité recommends, on the one hand, that obtaining a professional licence should not be conditional on three years' study after the baccalaureate in an economic, legal or commercial speciality and, on the other hand, that the period of professional experience referred to in Article 14 of Decree 72-678 of July 1972 should be made more flexible and harmonised, and set at four years, regardless of the status of the professional concerned (manager, subordinate employee or person accredited by a cardholder).

In addition, liberal professions not subject to the Hoguet Act but authorised to carry out property brokerage activities (lawyers, land and agricultural experts, forestry experts, surveyors and notaries) must also be subject to the principle of performance-based remuneration.

Opinion 23-A-07 of 2 June 2023

Contact(s)