Sector inquiry into car repair and maintenance

The Autorité de la concurrence, after close examination of the car repair and maintenance sector, issues recommendations aiming at lowering the price of car repairs and maintenance as well as forging new dynamics in the automotive sector.

The Autorité advocates for a progressive and controlled removal of the monopoly on “visible”1 spare parts: the opening to competition could be set by law, and its schedule set by decree.

Noting in particular a significant increase in the prices of spare parts and vehicle repair & maintenance services since the late 1990s (see Background Note 1), the Autorité de la concurrence decided in July 2011 to open a sector-specific inquiry in order to examine the way competition operates within the sector.

Last spring, the Autorité de la concurrence launched a public consultation on the potential barriers it had identified through an initial analysis (see Press Release of 11 April 2012). This consultation, which was exceptional in the context of an opinion procedure, was considered necessary by the Autorité due to the issues at stake in this particular case. It was thus able to organise a reasoned and objective discussion, on the basis of the public consultation document, contributed to by around fifty contributions from all the parties involved (manufacturers, equipment manufacturers, professional bodies, consumers’ associations, etc.).

Today, the Autorité is publishing its conclusions. It is issuing various recommendations designed to optimise the way in which competition operates in this sector, for the benefit of operators and consumers, organised around five potential barriers.

1- The gradual opening up of the market of visible spare parts in a controlled manner

In France, visible parts (wings, bonnets, bumpers, windscreens, lights, mirrors, etc.) are protected by industrial design rights. Consequently, only the manufacturer has the right to distribute these parts to the various repairers. In the case of visible spare parts supply, the manufacturers therefore have a genuine, legal monopoly over more than 70% of the sale of parts, and a duopoly with the equipment manufacturers for the remaining 30%. Repairers are thus forced to obtain a large part of the supplies they need from the manufacturer’s dealer network.

The Autorité de la concurrence considers it desirable to retain this protection for the visible parts known as “OE – original equipment” (used in the assembly of the new vehicle). But it proposes to remove, gradually and in a controlled manner, the restriction on spare parts destined for repairs. This strategy (known as the “repair clause”) has already been passed into law by eleven of the countries of the European Union, and has been implemented by the United States and Germany (see Background Note 3 of the press kit).

The introduction of a repair clause would have the effect of reducing the price of visible spare parts, while allowing the sector to operate more efficiently, especially by reducing the compartmentalisation between the manufacturer channel and the independent channel. It would also enable the development of a European market – equipment manufacturers established in France could produce visible spare parts for the French market as well as for foreign markets, which have already been liberalised, especially European markets.– Furthermore, it would increase competition in the distribution of spare parts in French Départements d’outre mer, where there is currently only a single authorised spare parts distributor per make of vehicle and per département. Finally, the analyses conducted show that the introduction of a repair clause would affect neither investment in design, nor the quality, availability or safety of the parts.

The Autorité has performed an in-depth analysis of the observations sent to it regarding the issue of employment (see paragraphs 219 ff. of the Opinion). It estimates that any job losses would be very limited and could be compensated for by the creation of jobs involving the manufacture of visible parts by the equipment manufacturers, both for export and for the local market.

While the Autorité is in favour of this repair clause being set in law, it nevertheless considers it necessary to introduce a transition period so as to take account of the current difficulties in the car industry, which needs time in order to review its economic model, and to enable French equipment manufacturers to prepare for the opening up of the market.

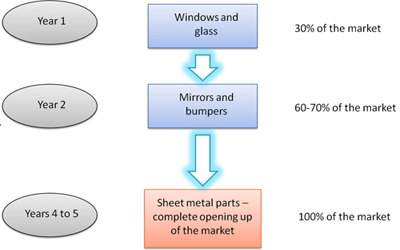

After comparing the various possible transition scenarios – depending on the age of the vehicle, the type of equipment manufacturer and type of part - (see paragraphs 235 ff. of the Opinion), the Autorité de la concurrence recommends opening up the market progressively by family of parts. The opening-up principle would be enshrined in law and the schedule provided by decree. For example, the opening up to competition could initially involve windows and lights, then mirrors and bumpers, and finally in a third phase, the sheet metal and other visible parts, leading to a complete opening up of the market in visible spare parts.

| The progressive removal of this protection should eventually translate, for consumers, into an average price drop – in the region of 6 to 15% - in visible parts. It will also enable manufacturers and equipment manufacturers to protect themselves against the risk of being unprepared for the possible opening of the market at European level. |

2-Enabling equipment manufacturers to market their spare parts in general more freely

Independent operators’ ability to exercise competitive pressure on the authorised manufacturers’ networks, whether at the stage of distribution or retail sales, which is likely to result in price reductions, depends largely on the ease with which they can obtain a supply of spare parts directly from the equipment manufacturers. If the parts needed for a repair are not available through the independent channel, independent repairers will have to obtain them from approved distributors (RA12), who are generally also their competitors. Due to the supply conditions under which independent operators work, even if this does not translate into an inability to carry out repairs, the unavailability of parts could always result in price increases of these parts (see paragraphs 272 ff. on the availability of parts.).

| That is why it is important for OE equipment manufacturers, who are best equipped for entering the after-sales market, to be able to freely market for their own behalf the spare parts they manufacture, and that unjustified restrictive clauses should not be imposed on them in the contracts that bind them to the manufacturers. Certain contracts binding the car manufacturers to their equipment manufacturers require examination with respect to the specific exemption regulations applied to the automotive industry. Only a case-by-case analysis will make it possible to identify the clauses that restricted competition. |

Furthermore, the Autorité has noticed that, in a certain number of cases, the manufacturer has prohibited the OE parts manufacturer from displaying its own logo on the parts it sells. This requirement, although it is legitimate, may nevertheless conflict with the ban on any removal of the logo required by certain manufacturers pf their equipment manufacturers as this would be in contravention of the Intellectual Property Code3. In the case of certain parts, due to the additional costs involved, this practice dissuades the equipment manufacturer from producing and distributing such parts, or at the very least it increases the final manufacturing cost (see paragraphs 316 ff of the Opinion).

| That is why the Autorité is recommending that the legislator amend the Intellectual Property Code so that OE equipment manufacturers producing a part on behalf of a car-maker may remove the said manufacturer’s logo on these parts without being in breach of the Intellectual Property Code and thus encourage the sale of such parts directly by the equipment manufacturers. |

3-Checking and, where necessary, penalising restrictions on access to technical information from manufacturers

For independent repairers to be competitive, it is essential that they have access to the necessary technical information for vehicle maintenance and repair under the same conditions as the approved repairers. This information, which is generally held by the manufacturers, is particularly necessary to enable them to identify the parts’ references, to be informed of the electrical circuit diagrams, to estimate the time needed for the repair, to diagnose breakdowns or bring the on-board vehicle electronics systems up to standard (see paragraphs 321 ff. of the Opinion).

Rather than consulting the manufacturers’ dedicated websites (“EURO 5” sites) – whose access costs are considered to be high by the operators and whose content is not standardised, and not always exhaustive with respect to the obligations resulting from European technical regulations – most multi-make independent repairers prefer to use the multi-make solutions produced by specialist intermediaries which enable them to work on any type of vehicle, regardless of its make.

However, these intermediaries also report that they have had difficulty accessing technical information (data formats, delays in updating, exhaustiveness, pricing, continued use if the contract is cancelled, etc.). In practice, the publishers of technical information actually turn to the manufacturers despite the obstacles they have reported. The manufacturers of diagnostic tools, however, generally prefer to acquire the information independently, by producing artificial vehicle breakdowns (a practice known as “reverse engineering”). The process is lengthy and expensive, however, and does not always make it possible to obtain complete and updated information.

| Competition law is not designed to deal with sporadic access denials or difficulties, but it can tackle them on a case-by-case basis and when the obstacles are significant and result in subsequent competition barriers on the downstream market. Furthermore, the Autorité considers that the effectiveness of the existing technical rules depends on the setting up of control mechanisms and sufficient and credible penalising deterrents, which are currently non-existent. Furthermore, the Autorité is in favour of an extension of the current standardisation process, on the one hand to the specialist middle-men - diagnostic tools manufacturers and publishers of technical information – and, on the other hand, to the actual transfer procedures and the information content. |

4- Drawing up warranty contracts and warranty extension contracts that are clear and explicit

With a 53% market share in terms of value, approved repairers retain leadership in the maintenance and repair sector in comparison with independent repairers. The preponderance of manufacturers’ networks is especially high during the first years of a vehicle’s life, with an 80% market share for vehicles less than two years old and 70% for vehicles 3-4 years old.

The manufacturer’s warranty and its extension play an important part in the tendency of car-drivers to put their vehicle in the hands of the network of the maker of the vehicle during the warranty period. 60% of car-drivers4 think they would lose the benefit of the warranty if they had their vehicle serviced outside the manufacturer’s dealership network. Independent repairers even tend to reinforce this position since 30% of them5 refuse to accept vehicles that are under warranty.

In fact, certain warranty or warranty extension contracts more or less explicitly link the benefit of the warranty to the use of the manufacturer’s dealership network for carrying out repairs and maintenance services which are, in fact, not at all covered by the warranty (see paragraphs 416 ff. of the Opinion).

| It is thus important for clauses in manufacturers’ warranty or warranty extension contracts to be as clear and explicit as possible with respect to the consumer’s option of using the services of an independent repairer without losing the benefit of the warranty. If this does not happen, such clauses could well fall within the ambit of competition law and could be subject to a case-by-case examination. |

5- Ensuring that the recommended prices for parts distributed by the manufacturers and equipment manufacturersdo not lead to a restriction in price competition between operators

Regardless of the channel, the initial suppliers (manufacturers and equipment manufacturers) circulate all the recommended retail prices and these are relayed down to each level of the industry. These prices are thus used as a reference for the pricing of parts sold first to dealers then to repairers. Exchanges of information about the prices of parts would also enable certain equipment manufacturers to know the prices recommended by certain manufacturers and even those of some competing equipment manufacturers.

In view of the hundreds of thousands of catalogue references and the fact that many of these parts are sold in small quantities, this practice may enable efficiency gains to be made as it may prevent the prices imposed by initial manufacturers from being too high and facilitate their pricing position.

Nevertheless, the circulation of recommended prices might risk changing price competition. Data collected by the Autorité de la concurrence6 thus indicates that in nearly 90% of cases the retail prices recommended by equipment manufacturers are actually passed by independent dealers on to their repairer customers. It is thus possible that the recommended prices are generally followed downstream by authorised and independent repairers, as shown in the case of the latter by certain observations or declarations collected in the context of this Opinion.

Furthermore, exchanges of information about recommended prices could lead to a risk of convergence of recommended prices between the independent channel and the manufacturer channel. In fact, if the price recommended by the equipment manufacturer is generally lower than that of the manufacturer itself, changes to the prices recommended by the equipment manufacturer are generally very similar to those recommended by the manufacturer for a similar part (the differences in the recommended prices were situated under 5% for the 2010-2011 period for 55 to 60% of the parts in the sample analysed)7 (see paragraphs 434 ff.).

| These recommended price mechanisms and exchanges of information could therefore ultimately have negative effects on the intensity of competition between the authorised channel and the independent channel in which case they would fall within the ambit of competition law. |

1Used to restore a vehicle to its original appearance

2Réparateur Agrée de niveau 1, Level 1 Authorised Repairer

3The offence of trademark removal is covered by article L. 713-2-b of the Intellectual Property Code.

4Study of drivers conducted by the French market research company GIPA 2012, part 5.13.

5Study of repairers conducted by GIPA 2011, part 4.3.

6See paragraphs 450 ff. of the Notice.

7See paragraphs 461 ff.

> For more information, please consult Opinion No 12-A-21 of 8 October 2012 on the operation of competition in the vehicle repair and maintenance sectors and the manufacture and distribution of spare parts (in French) as well as the press kit information (in French) :

Background Note 1: The French and the car

Background Note 2: Structure of the car-maintenance and repair industry

Background Note 3: Protection of visible parts and its effects

Background Note 4: Manufacture and distribution of spare parts

Background Note 5: Barriers to competition in the car-maintenance and repair industry and the solutions proposed by The Autorité de la concurrence

> Press contact: André Piérard – Tel.: (+33) 1 55 04 02 28 / email