Oil pipeline: The Autorité takes note of the sole control acquisition project’s withdrawal of Trapil by Pisto

The Autorité de la Concurrence takes note of Pisto’s announcement to withdraw from the transaction under which this company specialised in petroleum product storage intended to acquire sole control of Trapil, the leading company for refined product (petrol, diesel, heating oil, jet fuel) pipeline transport in France.

This transaction entailed high risks to competition for both the refined petroleum product transport and storage markets, which had been identified by the Autorité following the in-depth examination procedure.

Parties

Trapil was created at the initiative of the French Government and various oil companies, by the Law of 2 August 1949 relating to construction of a pipeline between the Lower Seine and the Paris region, and the creation of an oil pipeline transport company. This company is subject to State control by a representative of the Minister of the Economy on its Board of Directors, and by the Directorate General for Energy and Climate under the Ministry for Ecological and Inclusive Transition.

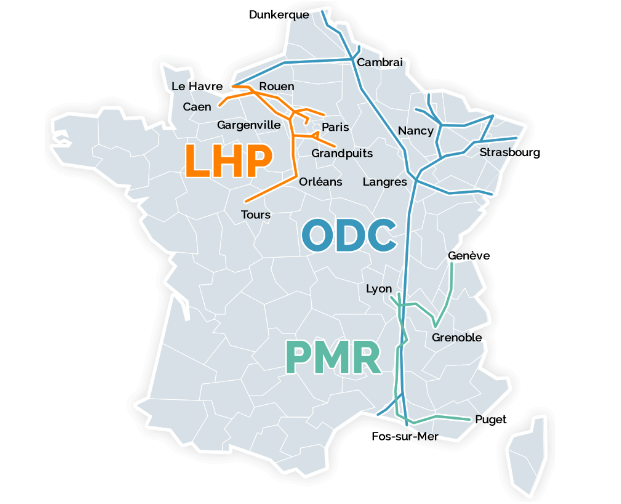

Trapil owns and operates the public-interest pipeline that links Le Havre and Paris, commonly referred to as the “LHP” (“Le Havre-Paris”). It also manages the common defence pipeline (“ODC”) that links Le Havre, Dunkirk, Fos-sur-Mer and the East of France, and the Mediterranean/Rhone Pipeline (“PMR”). The LHP, ODC and PMR are among the largest multi-product pipelines in France (see map below).

(source: Trapil website)

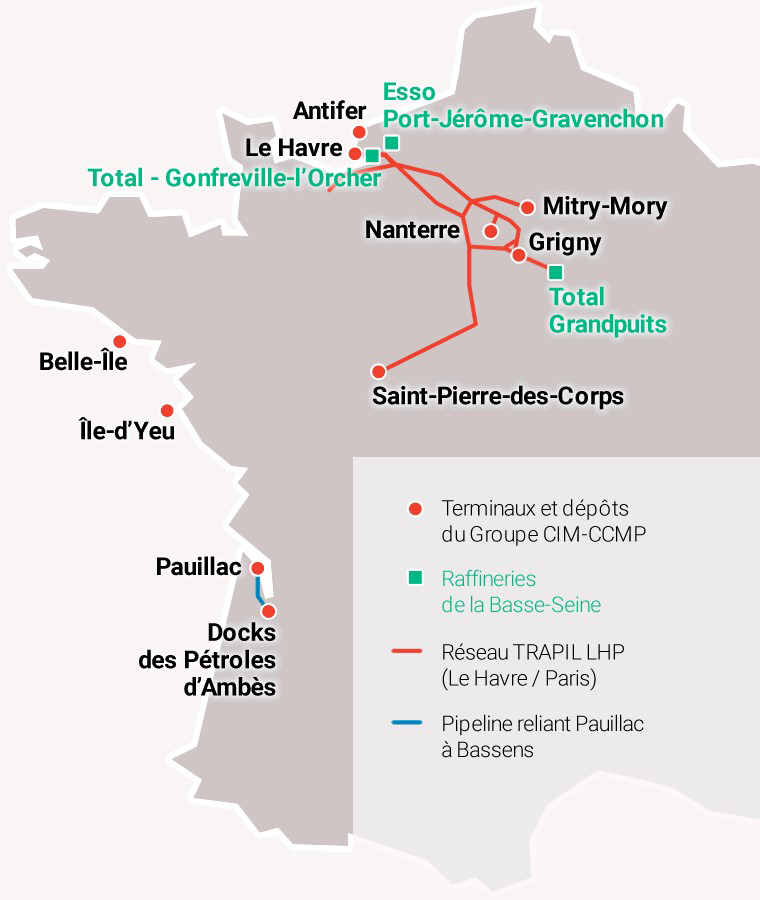

With CIM-CCMP, Pisto offers petroleum product storage services, especially via various storage depots linked to the LHP, and, in particular, operates the refined product receiving, storage and distribution facilities in the ports of Le Havre and Le Havre-Antifer (see map below).

In-depth examination of the transaction

The Autorité de la concurrence was notified of this transaction on 5 November 2019. Given the serious risk to competition in the refined product pipeline transport and storage markets, the Autorité decided to launch an in-depth examination of the transaction scheduled for December 2019. During this period, known as Phase 2, the Investigation Services produced a report to which Pisto was able to respond. Following this, a hearing was held before the Board of the Autorité during which the Investigation Services, the Directorate General for Competition Policy, Consumer Affairs and Fraud Control (DGCCRF) as representative of the Minister of the Economy, the Directorate General for Energy and Climate (DGEC), witnesses and representatives of Pisto were heard.

Isabelle de Silva, President of the Autorité, summarised the expected consequences of the transaction on the affected markets as follows:

“Pipelines are a means of mass transportation to ensure the continuity and security of petroleum product supply in France. The notified transaction related to the LHP, the largest French pipeline, which has all the characteristics of essential infrastructure: it cannot be duplicated and is indispensable for its clients. Acquisition of control of the LHP by a single operator would have been unprecedented. The Autorité therefore conducted an in-depth examination of this transaction and especially investigated the regulatory framework governing the LHP. It observed that, although this infrastructure is subject to State control exercised by the Directorate General for Energy and Climate, this only related to maintaining the security of petroleum product supply in France and not to upholding competition rules. This legal and regulatory framework alone could therefore not exclude risks of harm to competition caused by the transaction.”

In the absence of sector-specific regulation, the transaction could therefore have resulted in giving the new entity a market power that was durably non-contestable by a competitor. In particular, because of the durable and non-contestable nature of the market power due to the ownership of essential infrastructure and the related competition risks, the legislator has decided to closely regulate the action of operators in most of the network’s sectors by imposing numerous obligations with the aim of protecting competition (accounting separation, non-discrimination obligation, cost-oriented pricing, etc.) and control by a specialised regulator.

Contact(s)