29 May 2013: Distribution of commodity chemicals cartel

The Autorité de la concurrence fines a cartel, between the four major distributors of commodity chemicals operating in France, a total amount of €79 million

Today, the Autorité de la concurrence issued a decision whereby it fines a cartel between Brenntag, Caldic Est, Univar and Solvadis, a total amount of €79 million. The anticompetitive agreement between these distributors of commodity chemicals restricted competition by allocating customers among the parties and coordinating prices. The practices at issue were observed in the Bourgogne and Rhône-Alpes regions, and in the North and the West of France. The Autorité considered that these practices were part of a global and single strategy. The undertakings concerned total more than 80% of the commodity chemicals distribution market in France. Very many undertakings on the downstream side of the market (industrial companies, SMEs) have been harmed by these practices, and the majority of French industrial areas have been affected, with the exception of the Ile-de-France and South-West regions.

Solvadis, which had applied for leniency, was granted immunity from penalty; it would otherwise have been liable to a fine of €13 million. It was the first to report the existence of the cartel to the Autorité de la concurrence.

The case originated from a leniency application

The Autorité de la concurrence (at the time the Conseil de la concurrence) was informed of the existence of this cartel by Solvadis, which applied to benefit from the leniency procedure. The Brenntag and Univar groups then successively applied for leniency.

Under certain conditions, the leniency procedure allows an undertaking, which informs the Autorité de la concurrence of a cartel in which it took part, to benefit from a full or partial immunity from fines, in particular on the basis of the rank of arrival of its leniency application, the ‘added value’ of the information given as well as its full cooperation with the Autorité to establish the existence of the infringement (more about the leniency procedure - in French).

Since the procedure was introduced into French law in 2001, the Autorité has received 61 leniency applications and issued 7 rulings1.

The commodity chemicals distribution sector

The sector concerned in the decision issued by the Autorité is the distribution of chemical products, and, more specifically the distribution of commodity chemicals.

Commodity chemicals, produced by the major chemical groups (Exxon, Shell, BP, Solvay, Rhodia, BASF, etc.) are basic raw materials produced in particular from inorganic chemistry and petrochemistry such as solvents, alcohols, acids, ethers, bleach, soda…

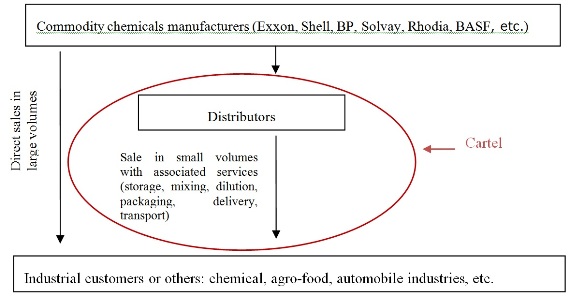

They are used in a large number of sectors: the chemical, agro-food and automobile industries, hospital and private laundries, water treatment, armaments, the concrete industry, the disinfection and cleaning industry, paint manufacturing, the mechanical and aeronautical industries, the textile industry, etc. Commodity chemicals are either sold directly by the producers when large volumes are requested, or marketed by intermediaries, such as distributors, for smaller volumes. The practices at issue were implemented by the distributors, as illustrated in the diagram below.

A specific regulatory and economic context

Commodity chemicals are products that can be dangerous (sometimes inflammable, toxic or explosive). For this reason, they are subject to strict regulation, under the so-called “Seveso” Directive. This Directive is aimed at guaranteeing the safety of products, populations and the environment by laying down rules for their quality and their storage and transport conditions. This Directive accordingly requires suppliers and distributors to invest in the facilities housing these products.

This context combined with vigorous price competition impacted distributors’ profits. They therefore decided to establish a joint strategy aiming to pacify the market by putting an end to the “price war” which had been initiated by Brenntag, and to restore their margins.

A participant to the cartel summarised the situation as follows (paragraphs 74 to 88 of the Decision):

“Brenntag had just taken over the Orchidis company and started charging very low prices for commodity chemicals in the hope of weakening local businesses and thus opening the way to possible takeovers in the Rhône-Alpes area. In particular, in order to withstand competitive pressure, the Favre and Vaissière businesses merged into 1995. All the local companies were forced to take part in this price war, even though this strategy weakened the various businesses. Brenntag also experienced a sharp downturn in profits in the region. In my opinion, Mr. Z…, who knew the various company directors of the local sites, and in order to bring Brenntag’s profits back up, took the initiative of gathering together all the region’s representatives with a view to forming an agreement on inorganic chemicals and on the charging of technical costs. Discussions very soon brought up solvents and an agreement on pricing and the allocation of volumes was established (…). We progressively increased prices in order to recover the margins”.

Price coordination and customer allocation

The cartel arrangements were put in place between 1998 and mid-2005 in the four geographic areas where the storage sites of the commodity chemical distributors concerned were generating the lowest profits: Bourgogne, Rhône-Alpes, West and North.

Representatives of the companies Solvadis, Brenntag, Univar and Caldic, when operating in the relevant area, would meet secretly on a regular basis in hotels or restaurants or communicate on the phone, sometimes on dedicated lines in order to avoid these calls being traced, in order to allocate customers and coordinate prices.

- Customer allocation

A distinction was made between customers who regularly issued calls for tenders from those who did not. Those who did so were allocated in “turns”: they were supplied alternatingly by the different participants to the cartel. This system was based on cover bids resulting in the offer of a distributor appointed by the members of the cartel appearing as the best offer. As for the second category of customers, less sensitive to prices and more loyal to distributors, each distributor agreed to refrain from actively poaching these customers by entering into a non-aggression pact. This led to a freeze in each distributor’s customer portfolio.

The documents or statements show for example (see paragraphs 124 to 386 of the Decision:

- “to take” the customer

- “Q +F means that Brenntag must not compete with Quarréchim and Vaissière-Favre [Univar], who share the client between themselves. Brenntag must therefore submit a cover bid”

- “to cover”

- “Caldic 2002 coverage”, “100% Caldic”

- “these are customers who were either shared or reserved. The letters “B” and “C” refer to the distributor who was to supply the client”

- Price coordination

– “The aim was to discuss the prices, fix floor prices for the sale of soda lye and allocate the customers.”

– “We reached agreements on the price level to apply depending on the packaging and the place where the product was delivered.”

– “I would discuss by telephone the sale price to charge in agreement with the competitors to retain a volume of business with these customers.”

- Monitoring arrangements

The cartel’s implementation was closely monitored in order to make sure that no participant deviated from the rules defined. Checks could be performed with customers and reminders issued on the cartel’s operating rules. Here are a few examples (see paragraphs 124 to 386 of the Decision):

– “Brenntag called Mr. Q… because RPC-Clément [Solvadis] had diverted an order from us by offering very low prices to Heineken. We wanted to know what was happening”

– “on 6/1/99, Cartonnerie de Gravelines, 85 instead of 90, -> Call U…”

Large-scale collusion among the principal distributors of commodity chemicals that impacted almost all their customers, particularly SMEs

The ample evidence and numerous statements gathered established the existence of a cartel in at least four geographic zones covering a large part of the French territory (34 départments). With the exception of Ile-de-France and the South-West regions, the vast majority of French industrial areas were affected by these practices. Major industrial groups (Thomson, Seb, Saint-Gobain, etc.) and numerous SMEs, such as laundries, as well as hospital service authorities (the Dijon University Hospital, for example) were thus the victims of the cartel, being made to pay more for their supply of raw materials.

A cartel is one of the most serious infringement to competition law, given that it steals, to the benefit of the perpetrator, the profit that the undertakings downstream in the value chain and the customers – in this case industrial customers or small or medium-sized businesses, even public authorities and buyers of commodity chemicals – are entitled to expect from normal competition. This practice was all the more serious in this case, since it affected several key parameters of competition simultaneously (price, customers).

The fines imposed

The Autorité set the amount of the fines, having regard, in particular, to the arrival rank of the leniency applications submitted by some of the companies involved and the evidence they submitted.

On this basis, it granted total immunity to Solvadis, the first undertaking to have spontaneously denounced its involvement and revealed the existence of the cartel (it would have been liable to a penalty of €13 million). GEA Group, which did not apply for leniency was, however, fined as the parent company of Solvadis at the time the offence was committed.

Brenntag and Univar, the second and third applicants for leniency, had their penalties reduced by 25% and 20% respectively under the leniency procedure.

As regards Brenntag, the Autorité also took into consideration its central role within the cartel: as the pivot of the cartel, it started it in three regions and carried out its monitoring.

Amount of penalties imposed:

| Solvadis | €0 |

| GEA Group (parent company of Solvadis at the time of the offence) | €9,405,279 |

| Brenntag, severally with DBML, its parent company at the time of the offense | €47,802,789 |

| DBML | €5,311,422 |

| Univar | €15,180,461 |

| Caldic Est | €1,335,036 |

| Total | €79,034,987 |

(1) The judgements relate to a wide variety of sectors : flour (12-D-09), laundry detergents (11-D-17), steel products trading (08-D-32), plywood production (08-D-12), removals (07-D-48), door manufacturing (06-D-09) and today, the distribution of commodity chemicals.

This press release translated into English is for information purposes only. Only the Decision 13-D-12 in French is deemed authentic.

> Full text of Decision 13-D-12 of 28 May 2013 on the practices implemented in the commodity chemicals marketing sector (in French)

> Press contact: André Piérard - Tel.: (+33) 1 55 04 02 28 - Contact by email

> See decision of the Paris court of Appeal (2nd February 2017)

> This Judgement was appealed before the Court of Cassation (Supreme court of appeal)