29 June 2009: Fuel prices in the overseas départments (DOM)

The Autorité de la concurrence has ascertained deviations from the current regulation : it recommends strengthening the price regulations applicable to monopolies and reviewing those of retail prices in order to do away with perverse effects

After a referral on 18 February 2009 by the Secretary of State for Overseas (Secrétaire d’Etat à l’Outre-mer) regarding competition in the overseas départements, the Autorité expressed an opinion regarding the fuel sector on 24 June 2009.

In the DOM, fuels are supplied through monopoly mechanisms: purchasing, freight, refining and storage monopoly in the West Indies and Guyana, but only freight and storage on Reunion. It is for this reason that the prices are regulated. However, the public authorities also set ceilings for the retail prices of fuels so as to prevent the lack of competition at the supply level from leading to any deviation with the prices at the pump.

However, the Autorité has found that regulation of fuel prices has moved away from these initial objectives. The price regulation of the supply monopolies is insufficient: it no longer guarantees the absence of an income and the supervision system for distribution margins and retail prices has been transformed into a single price system that is easy to manipulate.

The current regulation of the fuel sector, which is based on regulating retail prices, has failed on two levels

Maximum prices that have become minimum prices

Indeed, the ceiling prices have functioned as imposed prices, thereby doing away with all encouragement for retailers to apply lower prices. The fact that each retailer is unable to adapt its retail prices to its specific economic constraints has led to periodic requests for general revaluations that have been beneficial to everyone. This system has thus created incomes in favour of the best positioned and most profitable points of sale, with part of these profits going to the oil companies owning the businesses that are under management.

The distinction between wholesale margin and retail margin, on which the regulation system is based, is also artificial since royalty systems working in both directions allow for transfers between retailers and wholesalers, thereby rendering pointless the administrative setting of both margins. Moreover, this administrative ceiling for the margins has not prevented them from drifting, as the following table shows:

|

In €/hl or ct/litre |

Guadeloupe |

Martinique |

Guyana |

Reunion |

|

2001 total distribution margin |

12.95 |

12.65 |

14.3 |

11.8 |

|

2009 total distribution margin |

18.65 |

15.20 |

19.1 |

20.9 |

|

Increase |

+44% |

+20% |

+33,5% |

+77% |

Perverse effect in terms of taxation

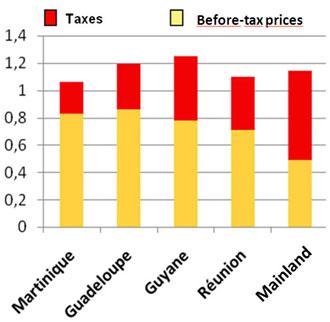

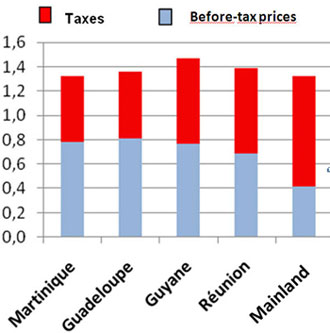

The Autorité has also noticed that the relative parity of retail prices between the DOM and mainland France over the long term (except in Guyana), despite the deviation of the before-tax prices, is only obtained through a tax moderation from the local and regional administrations (see the comparative table below). However, the missing proceeds are offset by taxation on other products, notably consumer goods to which dock dues apply (1).

Comparative table of the before-tax prices in December 2008

|

Before-tax price in €/l

|

Martinique

|

Guadeloupe

|

Guyana

|

Reunion

|

Mainland

|

|

Premium

|

0.78

|

0.81

|

0.77

|

0.75

|

[0.27-0.32]

|

|

Diesel

|

0.83

|

0.86

|

0.78

|

0.72

|

[0.30-0.35]

|

| Structure of the tax included price per litre of diesel (in euros) | Structure of the tax included price per litre of premium (in euros) |

|

|

The proposals of the Autorité de la concurrence

The Autorité proposes to strengthen the upstream regulation, in an effort to better supervise monopolies and to guarantee, in the end, procurements at the best price

For fuel purchase, it proposes to regulate the supply prices for refined products or crude products, with the reference being the market prices, independent of importers, and open up the import of fuels to operators that are not integrated oil companies.

For freight, it proposes keeping the current freight pooling system that appears to be best suited in terms of costs, security and consistency of the procurements. As this is a monopoly activity that is essential to the business activities of distributors, freight prices must necessarily be oriented towards the costs.

The consequence of these two initial measures should be that the public authorities would set the ceiling price of imports as equal to the sum of the two regulated prices: refined products + freight. This price should be the only wholesale price, periodically adjusted by the prefects according to worldwide prices. It should be publicized in order to allow users, consumer associations and all stakeholders to be informed of the price fluctuations of the products before the charging of distribution margins.

For storage, the Autorité recommends several structural measures:

- it requests a ban on the manager of an essential facility from having an activity as a downstream distributor within the same commercial structure, that would lead to storage activities being hived off into subsidiaries, or would impose very strict functional and accounting separation on them; it would also like all operators, including those that are not shareholders of the SARA, to be able to access storage installations in the West Indies at a non-discriminatory price;

- moreover, given the links between Shell and Total within the Société Réunionnaise des produits pétroliers, it requests the complete hiving off of storage activities on Reunion Island;

- finally, it recommends severing the structural links between the networks of Total and Shell retailers, which should find themselves in head-to-head competition on the distribution market.

The Autorité proposes a review of the retail price ceiling, while allowing the prefect to verify the prices in case of abnormal functioning of the market

To avoid the drift of the retail margins, it recommends suspending the publication of ceiling prices. This suspension will allow the smallest stations to adjust their prices without bringing about a general increase of the margins. Should the market operate abnormally, the prefect will be able to order the publication of a maximum price.

To ensure the fluidity of the retail market, it recommends a 5-year limit for exclusive supply contracts signed with independent retailers (service stations for which the business is not owned by the importer-wholesaler), having the contracts include the possibility of buying the fixed installations without penalty in case of a change to the firm name, and removing from the current contracts any business resale preference clauses for the benefit of the outgoing firm.

Finally, the Autorité feels that the scope of the reform makes it necessary to anticipate a 3-year experimentation period in order to observe actual changes within the market and to undertake any necessary adjustments.

The hearing during which the Board meets in order to study the competition situation in the sector of the import and distribution of consumer goods, which was the subject of this same referral, is forecasted by the end of July.

(1) Tax specific to the DOM