Today, the Autorité de la concurrence issues a decision by which it fines two anticompetitive agreements in the delivery service industry for a total amount of 672.3 million euros:

The principal agreement in question has been subject to a penalty of 670.9 million euros. It concerns 20 companies as well as the professional trade associations TLF (transport and logistics trade association) and involved, during the period between 2004 and 2010, repeated collusions between competitors regarding annual price increases.

A smaller-scale agreement involving 15 of the same companies as well as TLF was also fined an amount of 1.4 million euros.

It concerned defining a common method for passing on the costs of a “diesel surcharge”.

> French version

|

THE KEY POINTS

Today, the Autorité de la concurrence issues a decision concerning a case which has been brought to its attention through the leniency procedure. The Autorité principally fines 20 delivery service companies for coordinating on annual price increases that they charged their respective clients. This information sharing process, which occurred between September 2004 and September 2010, mainly took place during meetings held within the framework of a professional trade association body (TLF) which has also been fined.

Round table discussions were regularly organised upstream and downstream of the price increase campaigns, enabling the companies to harmonise their pricing demands and secure their business negotiations. The discussions were kept secret with no official minutes being taken.

These discussions were completed, with regard to some companies, by bilateral or multilateral exchanges.

The following companies were involved in the agreement: Alloin, BMVirolle, Chronopost, Exapaq (now known as DPD France), Ciblex, Dachser France, DHL Express France, FedEx Express France, Gefco, Geodis, GLS France, Heppner, Lambert et Valette, XP France, Norbert Dentressangle Distribution, Normatrans, Schenker-Joyau (now known as Schenker France), TNT Express France, Transports Henri Ducros, Ziegler France.

The professional trade association sanctioned is TLF. The documents in the case file show that TLF, instead of playing its role of vigilance in terms of compliance with competition rules, actively participated in organising unlawful discussions whilst also protecting their confidentiality.

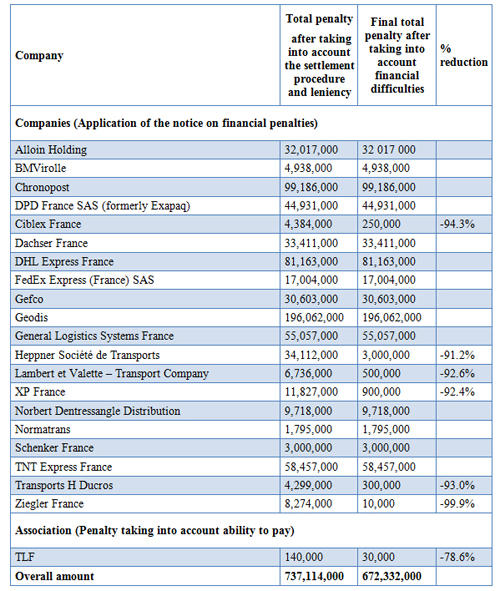

When calculating the penalties, the Autorité took into account the duration of the practices, their seriousness and the harm caused to the economy in particular to SMEs, which due to their insufficient negotiating power, were the first victims of the agreement. It nevertheless adapted its penalties to the specifics of the case, in particular by reducing, for six companies (Ciblex, Heppner, Lambert et Valette, XP France, Transport Henri Ducros and Ziegler) the amount of the penalties by more than 90% in order to take into account their current financial difficulties (see summary table at the end of the press release). Moreover, the Autorité, when calculating the penalties, took into account the leniency applications and the fact that the charges were not challenged (settlement procedure).

Moreover, this decision sanctions 15 of the same companies as well as TLF, for having reached anti-competitive agreements, between May 2004 and January 2006, on the principle and the method used to pass on the costs (at the bottom of invoices) of the increase in the price of diesel to their clients.

|

A case revealed thanks to the leniency programme

These agreements were brought to the knowledge of the Autorité by the Deutsche Bahn Group (for the conduct of its subsidiary Schenker-Joyau now known as Schenker France) at the end of 2008 and during 2010 and by Alloin (Kuehne+Nagel Group) in 2010 respectively. These companies in turn applied for leniency.

For the record, the leniency procedure enables companies participating or which have participated in an anticompetitive agreement, to reveal its existence to the Autorité and obtain, under certain conditions, the benefit of a complete or partial exemption from financial penalties, based in particular on their order in approaching the Autorité, the added value of the documents provided and their cooperation with the investigation.

> Find out more about the leniency programme by reading sheet 1 as well as the 60 secondes pour comprendre (60 seconds to understand) sheet.

PARCEL DELIVERY: a key business for the french industry

Delivery service companies transport parcels (of less than 3 tonnes) mainly by road. They are different from the road haulage industry which transports goods by batch and by full lorry. They pick up parcels from the shipper, consolidate and sort them on dedicated platforms, route them and, lastly, deliver them to the recipient. The manufacturing industry is the main market for delivery service companies. Wholesaling, distance selling and e-commerce sites are also clients for these companies. In fact, the majority of e-commerce operators increasingly make use of delivery companies’ services, as shown by the online sales of goods and services, which have increased, in terms of value, more than five times between 2005 and 2012.

The sector is characterised by the presence of major national or international groups, such as Geodis (SNCF Group), Chronopost/Exapaq - now known as DPD France - (La Poste Group), Dachser, FedEx and DHL in addition to a multitude of small regional or local companies.

At the time of the events, the turnover in France of the standard (delivery between 24 and 72 hours) and express (delivery within 24 hours) courier industry amounted to 8.5 billion euros. Although turnover has been growing steadily, the delivery service industry has for several years been marked by very low and, in some cases, even negative profitability. These problems were particularly linked to the existence of structural overcapacity in the industry since the end of the 1990s (see sheet 1).

These low margins led to a large wave of bankruptcies and restructuring, in particular during 2008, which saw 11% of the companies in this field cease trading. These financial difficulties partly explain the continuing decline in the number of salaried employment in the delivery service industry, falling from 55,000 in 2004 to 40,000 in 2011.

THE DELIVERY SERVICE COMPANIES REACHED AN AGREEMENT CONCERNING THE ANNUAL PRICE

NCREASES WHICH THEY INTENTED TO CHARGE THEIR CLIENTS

A considerable amount of evidence was obtained concerning this case provided both directly by the two leniency applicants (statements, hearings) and also contained in the documents obtained during dawn raids conducted in September 2010 (minutes of TLF meetings, internal memoranda of several companies, emails exchanged between competitors, etc.).

All this evidence establishes that, during the course of seven annual price increase campaigns held between September 2004 and September 2010, the delivery service and express delivery service companies shared, within a multi-party context, in particular during TLF meetings, sensitive business information relating to their annual pricing increases. This process of sharing information was often backed up by communications between two or more of the companies involved.

By way of example, during the 2006-2007 trade negotiations, the majority of the companies that had initially envisaged a price increase of approximately 5%, after sharing information, increased their demands to a higher level – around 7%.

- Roundtable discussions during the trade council’s meetings

Discussions generally took place before the start of annual negotiations, and then during them in order to monitor progress and carry out ex post assessments. They took the form of roundtable discussions during which each company spoke to its competitors about its own price increase plans or the way negotiations with clients were going. As these discussions were secret, the anticompetitive content was included on the agenda under the heading “economic situation” to avoid attracting attention and the minutes were deliberately succinct.

In this respect, an exchange of emails in September 2009 between one of the companies concerned and TLF, the trade association, obtained during dawn raids, illustrates the deliberately secretive nature of the practices:

“I am surprised not to see the 2010 price increase on the agenda. We had agreed in June to tackle this subject (…)” (emphasis added).

And the TLF Manager replied: “As you know, I must be careful concerning the titles of the agenda items. This is to prevent TLF and the member companies of the organisation in attendance from facing the risks of inspections and financial penalties on the part of the conseil de la concurrences [sic](Autorité) hence my cautious approach. This aspect is dealt with in point 1 called “economic situation”..etc.

when speaking the participants raise the issues they want to” (emphasis added). (§ 331 of the decision).

The price increases announcements were followed by circulars sent to clients, with a strong convergence between the announced prices and those sent. For the members of the anticompetitive agreement, these exchanges provided them with genuine security as they enabled them to obtain a precise insight into the business strategies of their competitors instead of being isolated in their discussions with clients. The pricing circulars sent to the parcel delivery service companies’ clients bear testimony to the strict respect of the announced increases in prices (see tables 14 p. 60; 15 p. 67; 16 p.74; 17 p.81; 18 p.87 and 19 p.93). As a result of failing to respect the announcement which it had made, one company, Mory, was threatened with exclusion from TLF, as borne out by this email sent by the Chairman of Graveleau to his Mory counterpart:

“I am sending this email in order to inform you of the great displeasure of all the members of the Conseil de Métier Messagerie Express TLF (TLF Express Parcel Delivery Trade Committee ), concerning your 2005 price increase circular letter of 15 November.

It doesn’t correspond in any way to what had been discussed together during our meeting, and is seemingly in total contrast to the attitude you have always shown, and which we have all ardently defended. We are all wondering whether it is worth continuing our collaboration in the Parcel Delivery Service Committee of TLF” (emphasis added). § 364 of the decision

- Bilateral discussions between companies consolidated the agreement

These discussions were completed by a series of bilateral or multilateral collusive exchanges of information between certain members of the agreement, as shown by the seizure of a large number of documents in the companies concerned during the dawn raids. Here are a few examples:

- An email was seized in which a Dachser Sales Director says to several of his company’s managers “I’ve just been getting some information from our fellow parcel delivery service companies”. §499

- Documents show that, during the summer of 2007, Schenker-Joyau not only provided Dachser with information on its own pricing policy but also the details it had concerning another competitor, namely Calberson (Geodis). Paragraph 435

Faced with the increase in the price of diesel, the PARCEL delivery services companies decided together to pass on this increase to their CLIENTS

Between 2004 and 2006, Alloin, Chronopost, Exapaq (now known as DPD France), Dachser, DHL, Gefco, GLS France, Heppner, Lambert et Valette, XP France, Normatrans, Schenker-Joyau (now known as Schenker France), TNT Express, Henri Ducros and Ziegler simultaneously implemented a concerted practice by agreeing to pass on the variations in the price of diesel using a method common to all the parties concerned. This method involved charging the “diesel surcharge” on a monthly basis, using shared benchmarks (CNR indexes), the use of an increase schedule based on multiplying factors, and indicating the amount of this specific increase at the bottom of the invoice.

The aim of this dialogue was to present a common approach and methodology to clients in order to exclude the risk of refusal on their part and seeing contracts terminated, even though the legislative, regulatory and administrative environment prevailing at the time of the events gave the transport companies a free hand with regard to the method of passing on variations in the price of diesel in their prices. It was therefore of a nature to prevent the proper functioning of the competitive process in the industry.

Serious nationwide practices concerning a key sector of the french economy

The concerted practices related to price increases

Contacts took place between the main players in the French market. The companies concerned, many of whom are backed by major European or global groups, represent a significant part of the industry’s turnover. Therefore, as the eight main members of the agreement - Geodis, Chronopost/Exapaq (now known as DPD France), DHL, TNT, Mory, Dachser, Heppner and GLS - represented over 71% of the market at the time of the events, it was difficult for companies to escape the impact of the anticompetitive agreement.

Parcel delivery services are used by a very large number of companies at all stages of the production process. Delivery service companies transport raw materials, components and industrial parts as well as finished products intended for household consumption. Therefore, virtually the whole of the French industrial and business sectors were affected by the practices, including e-commerce, a rapidly expanding sector.

While the largest clients had a certain negotiating power enabling them to reject or renegotiate the price increase notified in the circulars, this was not the case of the smaller clients, who represented the majority of the clientele. In consequence, a large majority of small and medium-sized enterprises (SMEs) making up the backbone of the French industry suffered the most from the practices as they had the price increases applied directly to them without being able to negotiate them which thus impacted their competitiveness. Consumers might also have been affected, as transport is an important component of the cost price of goods sold online.

The diesel surcharge

With regard to the infringement relating to the collective implementation of a diesel surcharge, the practices were also of a significant nature and indeed resulted in strengthening the negotiating position of the carriers vis-à-vis their clients. However, the Autorité de la concurrence regarded the combination of the following factors as a particular circumstance to be taken into account: the concomitance of parliamentary debates and the interventions of the public authorities in favour of passing on variations in the cost of fuel to transport contracts in addition to the significant increase in the price of diesel. It consequently considered that this context had led to a situation of uncertainty for the parties in question.

The penalties imposed

When calculating the penalties, the Autorité de la concurrence took into account the seriousness of the facts, the extent of the harm caused to the economy and the situation of the companies – notably financially.

Leniency

Having applied for leniency, the Deutsche Bahn (Schenker-Joyau) and Kuehne+Nagel (Alloin) groups obtained reductions in penalties:

- Concerning the objection of an agreement concerning price increases, the Deutsche Bahn group did not, however, obtain the total immunity from penalties it could have been granted as a ‘type 1’ leniency applicant. By omitting to inform the investigation services of an anticompetitive meeting which it had attended in September 2010, it failed to satisfy one of its obligations. Consequently, the Autorité imposed a penalty of 3 million euros on it.

- Having fully cooperated, Kuehne+Nagel (Alloin) benefited from a 30% reduction as a ‘type 2’ leniency applicant, the highest percentage possible with regard to its conditional notice of leniency.

Necessary but proportionate penalties

The Autorité de la concurrence adapted the penalties imposed in order to take into account the specific situation of each company involved as well as the specifics of the case:

- With regard to the infringement relating to passing on the price of diesel at the bottom of invoices, it departed from the application of its guidelines concerning penalties in order to take into account the exceptional circumstances linked to the economic context and the intervention of the public authorities which created a certain confusion for companies in this field, and decided to apply a proportionate penalty in this very particular situation.

- It also took into account the financial difficulties experienced by several companies to pay the fine. As regards six companies (Ciblex, Heppner, Lambert et Valette, XP France, Transport Henri Ducros and Ziegler), a reduction of more than 90% in relation to the amount theoretically due was granted.

In total, after taking into account all the specifics of the case (leniency, settlement procedure, financial difficulties…), the Autorité de la concurrence imposed an overall penalty of 672 million euros.

NB. This document translated into English is for information purposes only.

Only the Decision in French is deemed authentic

> Press contact: Rebecca Hebert Tel. + 33 1 55 04 01 81 / Mel