The Autorité de la concurrence opens a public consultation until 19 September 2022 as part of its cloud sector inquiry

As part of its inquiry into the competitive functioning of the cloud sector launched last January, the Autorité is today submitting an interim document for public consultation, in order to gather comments from stakeholders (whether they are active players or carrying out a third-party activity) who are invited to comment on the definition of relevant markets and the practices implemented or likely to be implemented in the sector.

During the first semester of investigation, the Autorité conducted more than thirty informal interviews with the main economic players, particularly French ones and dialogued with institutional players (European Banking Authority, French National Cybersecurity Agency, French Data Protection Authority, General Directorate for Competition Policy, Consumer Affairs and Fraud Control, Directorate-General for Enterprise, General Directorate for Internal Security, Digital platform expertise for the public) as well as several competition authorities. It then sent out numerous questionnaires and proceeded to hear three “hyperscalers” [1].

The sector inquiry will mainly focus on the public or hybrid cloud, and more specifically on the IaaS and PaaS models.

Stakeholders are invited to answer all or part of the questions included in the summary document. All contributions, of which confidentiality will be ensured, must be submitted to the following email address: avis.cloud@autoritedelaconcurrence.fr before 19 September 2022.

What is cloud?

The cloud (or cloud computing) represents all the shared services, accessible via the internet, on demand, paid per use and, by extension, some of the underlying infrastructures (such as data centers).

- Access to servers, provision of test and development platforms, online document storage, online messaging or video streaming services are examples of cloud services.

The cloud sector is part of a constantly changing economic and regulatory context. In France, this sector should experience annual growth of 17% by 2025, with a volume of activity increasing from 16 billion euros in 2021 to 27 billion euros in 2025. Several studies [2] confirm this trend: even though adoption of cloud computing by French companies is still limited compared to the rest of Europe, it is progressing rapidly.

A plurality of players subject to multiple regulations

The cloud sector is structured around several categories of players from different businesses (for instance, IT or electronic communications sectors). It should be noted, however, that three hyperscalers concentrate most of the market in terms of volume and growth.

Moreover, if the launch of an activity in cloud computing services does not require any prior approval, the cloud sector is nevertheless governed by several regulatory frameworks which have evolved significantly over the past few years to meet security issues, protection of personal data and sovereignty [3], while certain sectors (for example, healthcare or finance) may be subject to specific regulations. Finally, on 17 May 2021, France launched its national strategy for Cloud computing [4] with the aim of guaranteeing its digital sovereignty and acquiring the cloud capacities necessary to ensure its participation in the next technological developments.

Defining relevant markets

The market definition process is based on the principle of demand-side and supply-side substitutability.

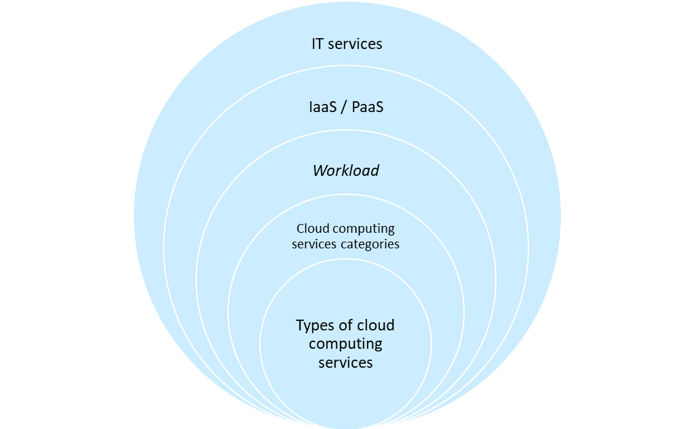

By following this methodology, the public consultation is aiming to determine whether competition constraints are expressed by cloud services types, cloud services categories, by customer needs (workload) or even by even broader categories such as IaaS and PaaS [5] or even by IT services in general.

In addition, there are specific characteristics that could justify a definition of the relevant markets according to the deployment mode of cloud services (public, private or hybrid cloud), specific offers related to the trusted cloud, sectors (in particular the financial and the healthcare sectors), calls for tenders launched by the parties or from the point of view of the completeness of the offer.

Finally, the investigation services consider the existence of related markets, such as the intermediation and data center operations markets. The players are then consulted on the geographical dimension of the markets thus considered.

The analysis conducted in the further opinion will not intend to provide a detailed market definition in the cloud sector, nor to establish the links that may exist between these markets.

Market positions and behaviours

The investigation services seek to assess whether certain players are likely to hold particular positions and competitive advantages, especially with regard to their investment capacity, their access to certain infrastructures, their ability to differentiate themselves or to offer a wide range of services. Several major players could combine several advantages and also take advantage of their well-established position on digital markets to promote their expansion (risks related to the advantages drawn from the ecosystem of certain players).

The investigation services seek to analyse certain practices implemented or likely to be implemented in the cloud sector in order to assess whether some of them could restrict the development of competition on the merits:

- Firstly, several technical practices are discussed in order to assess in particular the obstacles to customer migration and to the use of several cloud service providers.

- Secondly, a set of business practices, in particular contractual or pricing, are addressed, some of which may contribute to increase barriers to entry or expansion in certain markets or to extend a player's market power.

- Thirdly, the vertical integration of certain players in cloud markets or the existence of potential conglomerate effects could also raise competition concerns.

- Finally, the investigation services examine the risks associated with anticompetitive agreements and merger practices that may exist in the sector.

[1] Hyperscalers are generally players already well established in other digital markets, which have developed cloud services in recent years. These companies have considerable financial power and benefit from strong economies of scale and scope.

[2] These include Markess by Exaegis - Digital infrastructures and Cloud - Market data 2022, 30 March 2022; Gartner, “Gartner Forecasts Worldwide Public Cloud End-User Spending to Grow 23% in 2021”, 21 April 2022 and Eurostat, “Cloud computing - statistics on the use by enterprises”, December 2021.

[3] For example, the NIS directive (currently under review), the implementation of the GDPR or the “Schrems II” ruling issued on 16 July 2020 by the Court of Justice of the European Union.

[4] See the press kit on the National Strategy for Cloud Computing.

[5] Iaas (« Infrastructure as a service »), this term is defined by the NIST as “The capability provided to the consumer is to provision processing, storage, networks, and other fundamental computing resources where the consumer is able to deploy and run arbitrary software, which can include operating systems and applications. The consumer does not manage or control the underlying cloud infrastructure but has control over operating systems, storage, and deployed applications; and possibly limited control of select networking components (e.g., host firewalls)”

Paas (“Platform as a service”), this term is defined by the NIST as “The capability provided to the consumer is to deploy onto the cloud infrastructure consumer-created or acquired applications created using programming languages, libraries, services, and tools supported by the provider. The consumer does not manage or control the underlying cloud infrastructure including network, servers, operating systems, or storage, but has control over the deployed applications and possibly configuration settings for the application-hosting environment.”

Public consultation document

Summary of the main questions asked

Contact(s)