The Autorité analyses the causes of the high cost of living in Martinique and makes 9 recommendations

Background

On 29 January 2025, the French government requested an opinion from the Autorité de la concurrence on the margins of wholesale importers and distributors within Martinique’s food distribution chain. The request was made in the context of the island’s high cost of living: according to INSEE data, prices in Martinique were 13.8% higher than in mainland France in 2022 (Fisher index), rising to a 40% difference for food products.

In response to protests by the local population, in October 2024, the French State, the territorial collectivity of Martinique (CTM) and various stakeholders in Martinique signed an agreement to combat the high cost of living on the island (Protocole d’objectifs et de moyens de lutte contre la vie chère, the “Protocol”). Among its measures, the Protocol provided for the French government to request an opinion from the Autorité de la concurrence, with the aim of increasing transparency around the prices and margins of wholesale importers and distributors.

In its opinion, the Autorité begins by noting that consumer price disparities between mainland France and Martinique remain high and appear to be widening. It also notes that, while existing tools to combat the high cost of living – the Price, Margin and Revenue Observatories (OPMR), the various versions of the price-quality shield (BQP, BQP+) and the adoption of the Protocol – remain useful, they are insufficient. In particular, it highlights the lack of resources available to OPMRs to fulfil their mandates. The Autorité has therefore issued a set of recommendations to address these issues (recommendations 1 and 2).

Secondly, as noted in its previous opinions (09-A-45 of 8 September 2009 on import and distribution mechanisms for consumer goods in the French overseas territories and 19-A-12 of 4 July 2019 on the functioning of competition in the French overseas territories), the Autorité reiterates that the persistent significant price differences between Martinique and mainland France are the result of multiple, ongoing structural and other factors. Lastly, the Autorité analyses the margins of wholesale importers and integrated distributors operating on the island.

Persistent structural factors behind the high cost of living in Martinique

The specific characteristics of Martinique’s economy, including the small size of the market, an unbalanced trade situation with heavy reliance on mainland France for supplies, the impact of local taxes (VAT and dock dues) and high forwarding costs, largely explain the island’s high consumer prices. The Autorité makes a series of observations and issues several recommendations in this regard (recommendations 3 to 6).

Analysis of margins in the food distribution chain

Based on the data collected and analysed, the Autorité considers that the margins achieved by wholesale importers and integrated distributors operating in Martinique are broadly comparable to those observed in mainland France.

Concerning wholesale importers, the cornerstone of supply in Martinique, the Autorité observes that several exclusive import agreements may persist despite the Lurel Law, which has prohibited such agreements since 2012. It therefore recommends strengthening the oversight of the Directorate General for Competition Policy, Consumer Affairs and Fraud Control (DGCCRF) in this area and increasing its resources (recommendation 7). Furthermore, the Autorité recommends that, as wholesale importers’ margins appear higher than those of distributors, wholesale importers should be more closely involved in measures to combat the high cost of living (recommendation 8).

Concerning the margins of integrated operators, the Autorité regrets the lack of available information, in particular on how their accounting results are restated, and highlights the difficulty of isolating performance across the entire value chain.

Accordingly, the margins of distributors and wholesale importers should be interpreted with caution, in particular in view of intra-group invoicing, which allows the total margins associated with the import and distribution of products in Martinique to be allocated among the different entities within a group.

To reduce this opacity, the Autorité recommends establishing a permanent and binding framework for collecting such data, so that public authorities can monitor, on an ongoing basis, the evolution and structure of the prices and margins of wholesale importers and distribution groups in Martinique, in particular their internal allocation (recommendation 9).

Widening consumer price disparities between Martinique and mainland France, which are not fully addressed by the existing tools to combat the high cost of living

Widening consumer price disparities with mainland France

According to INSEE data, the average consumer price differential between Martinique and mainland France was 13.8% in 2022. This significant disparity has continued to widen (+4 percentage points between 2010 and 2022) and is primarily attributable to the difference in the price of food products, which represent a major component of household expenditure (with an average price difference of 40.2%). Such disparities, which are similar to those observed in all French overseas territories, largely result from the costs associated with importing goods. While they affect all categories of consumer products, certain items – such as fruit and vegetables – are comparatively less impacted.

Recommendation 2

To monitor price developments effectively, the Autorité, as stated in its 2019 opinion, recommends that INSEE spatial surveys be conducted with sufficient frequency, to enable temporal comparisons and analyses of changes in the differences between regulated and unregulated prices.

Useful but insufficient tools to combat the high cost of living

For several years, public authorities have implemented a range of tools to combat the high cost of living, such as OPMRs, the price-quality shield (BQP, BQP+) and, most recently, the Protocol, with the aim of containing price levels in Martinique.

The Protocol, signed on 16 October 2024 by the French State, the CTM, local elected representatives, distributors, wholesalers, professional associations, the Grand Port Maritime de la Martinique and the main shipping carrier (CMA CGM), has been in effect since 2 January 2025. Over a 36-month period, it provides for the implementation of a series of measures structured around three main objectives:

- reducing the prices of more than 6,000 reference food products in Martinique;

- promoting a general reduction in food prices across all categories in Martinique;

- rebuilding Martinique’s economic model.

An initial assessment by the DGCCRF confirmed a reduction in the average price of the 6,000 products covered by the Protocol between January and October 2025.

However, the Autorité notes that the Protocol may have the effect of increasing the prices of products not covered by the measure. Furthermore, the tools to combat the high cost of living appear to affect smaller food retailers more than larger outlets such as hypermarkets, given the more limited product ranges offered by smaller stores. It is therefore essential to closely monitor the practical consequences of the tools on smaller retailers, in order to ensure that their long-term economic viability is not jeopardised.

As noted in its 2019 opinion, the Autorité observes that insufficient resources are allocated to the OPMR, whose mandate is “to analyse the level and structure of prices, margins and revenues, and to provide public authorities with regular information on changes”.

Recommendation 1

The Autorité observes a mismatch between the mandate assigned to OPMRs and the resources allocated. In line with Opinion 19-A-12, the Autorité therefore recommends that the Martinique OPMR be provided with the financial and human resources necessary for its proper functioning, so that it can effectively fulfil its mandate and provide timely, useful guidance to public authorities.

The specific characteristics of Martinique’s economy, which largely explain the high level of consumer prices

In its previous opinions of 2009 and 2019, the Autorité noted that price disparities between mainland France and the French overseas territories partly reflect their geographic and economic characteristics, notably the small size of their markets, the high cost of land, their dependence on mainland France for supplies and income disparities. In addition, Martinique continues to suffer from a high trade deficit.

The predominance of imported products

The Autorité observes that most products consumed in Martinique continue to be imported by sea from mainland France. For small island economies such as Martinique, regional integration – i.e. the development of regular trade flows with neighbouring countries – could be a key lever to overcome the constraints of a small local market, diversify imports and reduce logistics costs. Establishing industrial or agricultural partnerships would facilitate access to regional markets with several million inhabitants and could attract investments that would otherwise be unattainable if pursued in isolation.

In practical terms, such an approach could involve redirecting trade towards geographically close partners; reviewing technical and labelling standards, where such standards operate as non-tariff barriers to imports, while guaranteeing protection for Martinique consumers; and, where appropriate, concluding free trade agreements that support the development of strategic local industrial and agricultural sectors. The Autorité stresses that public authorities are responsible for determining the scope and pace of implementation of such instruments.

In this respect, the Autorité considers that the signature in February 2025 by the CTM of the agreement to join the Caribbean Community and Common Market (CARICOM) constitutes an initial step towards Martinique’s regional integration within the Caribbean area.

Moreover, since the vast majority of imports and exports are transported by sea, the Autorité considers that the proposed creation of an “Antilles hub”, promoted jointly by the ports of Martinique and Guadeloupe on the one hand and the shipping company CMA CGM on the other, could create new markets and diversify sources of supply in the Caribbean area. However, such a project must not harm free competition in the maritime sector.

Recommendation 3

In line with Opinion 19-A-12, the Autorité supports the continued strengthening of Martinique’s regional integration within the Caribbean area. Such integration constitutes a key lever for overcoming the limited size of the local market, diversifying imports, developing exports and reducing logistics costs.

Recommendation 4

The Autorité takes a favourable view of the proposed creation of an “Antilles hub”, which will create new markets and diversify sources of supply within the Caribbean area. However, it stresses the need to ensure that any such project preserves free competition among all shipping operators in the area and does not result in the foreclosure of CMA CGM’s current or potential competitors.

Local taxes (VAT and dock dues)

In line with its commitments under the Protocol, the French State has implemented a VAT exemption for 69 product categories, representing 6,000 reference food products. However, the Autorité notes that, in accordance with the principle of budgetary neutrality underpinning the State’s commitments, all other products remain subject to the standard VAT rate (8.5%).

Similarly, under the Protocol, the CTM committed to abolishing dock dues (internal and external) for 54 categories of food products. The CTM has estimated the cost of this commitment at around €6 million per year. However, in accordance with the principle of compensation through equalisation set out in the Protocol, the Martinique Assembly adopted resolutions to increase dock dues on other products, with the revenue generated by these increases far exceeding the cost of the CTM’s commitment under the Protocol.

The Autorité notes that dock dues constitute an important factor in efforts to combat the high cost of living in Martinique. They have a significant impact on price levels in the French overseas territories and, according to the French Court of Auditors (Cour des comptes), their contribution to the high cost of living exceeds their direct mechanical effect on the food product prices. However, dock dues represent the main source of tax revenue for local municipalities and the CTM, and their abolition would raise questions about the financing of local and regional public authorities and the CTM’s capacity to meet the specific needs of Martinique.

Recommendation 5

In the absence of a more ambitious reform of taxation in the French overseas territories, which would require identifying new revenue sources for local and regional public authorities and implementing alternative measures to support local production, the Autorité recommends that the rates of dock dues applied to goods entering Martinique, as well as the identity of the operators subject to the tax, be made simpler, more predictable and more transparent.

The Autorité also recommends that the rates of dock dues applicable to imported products be reviewed and abolished where no locally produced equivalent exists.

Analysis of forwarding costs

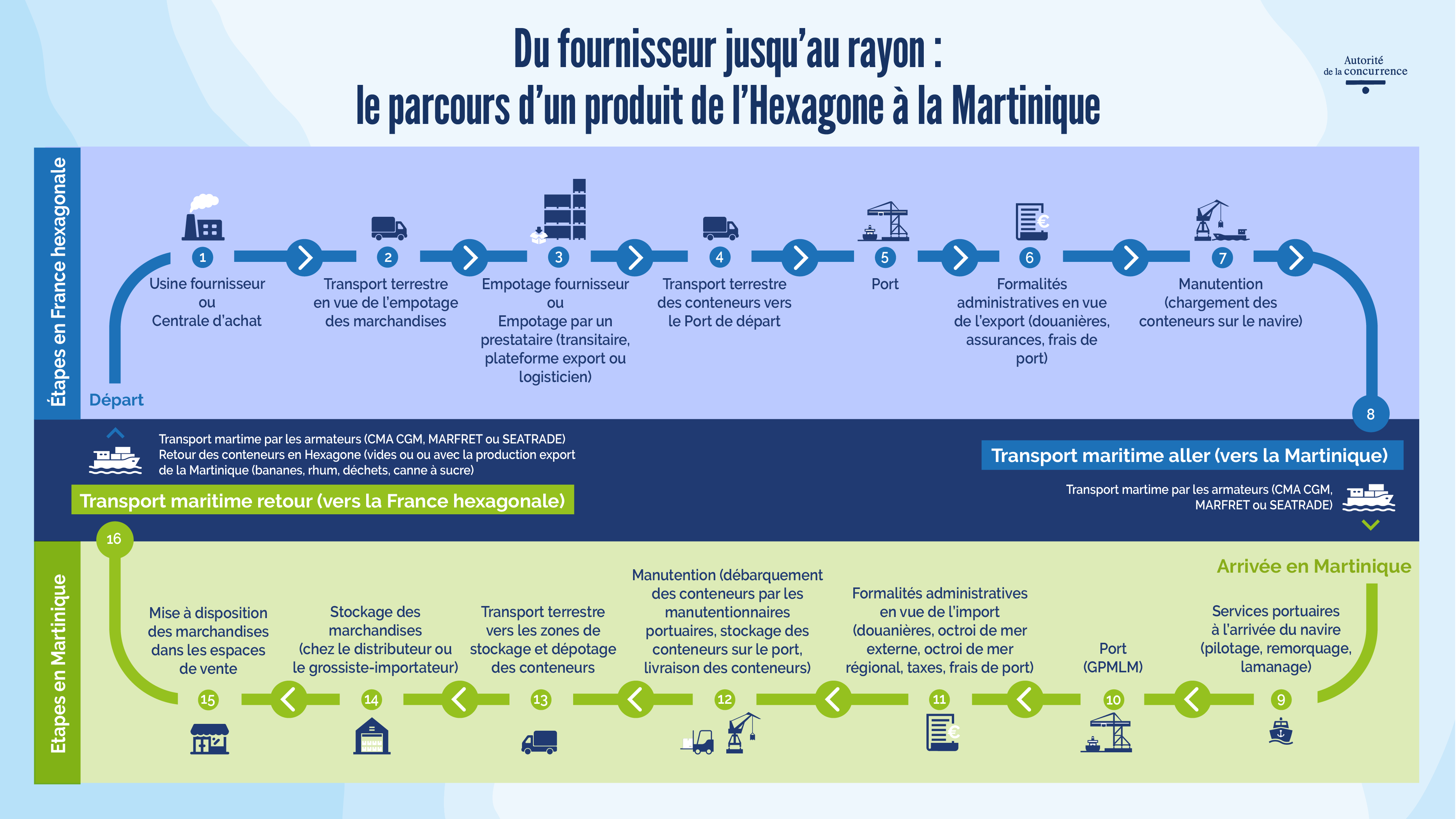

Given its insularity and distance from mainland France, the supply of goods to Martinique involves multiple stages and a range of operators.

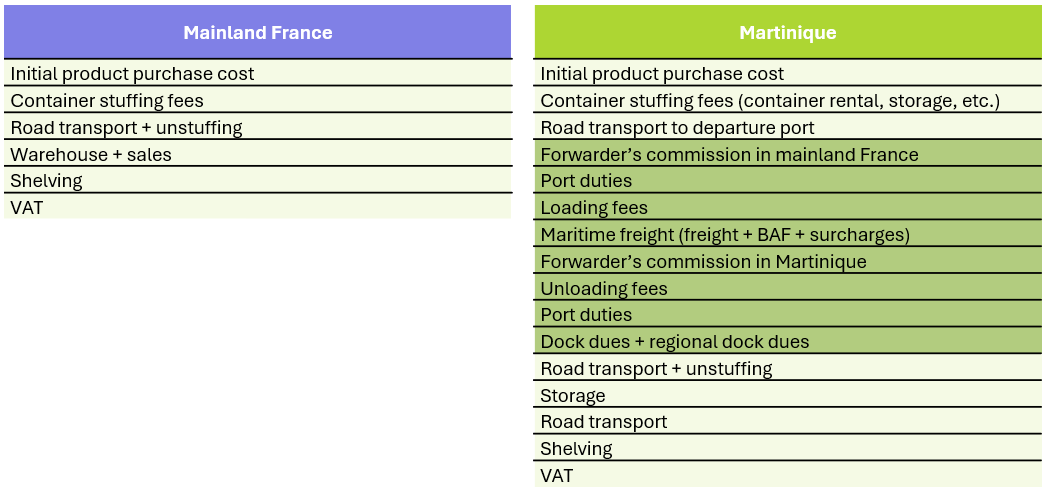

The multiple stages generate forwarding costs that do not exist for the supply of stores in mainland France. All distributors and wholesale importers interviewed reported several additional cost items linked to the distance from mainland France, primarily transport, logistics and storage costs, as well as tax-related costs.

Comparison of the main cost items in the price structure in mainland France and Martinique

Since the analysis conducted by Autorité in 2019 covering all the French overseas territories, the share of forwarding costs in the cost of goods imported by distributors in Martinique has increased by around 19%, from 28% to 33.3%. Logistics and port activities are the largest cost items (12.8%), followed by shipping (10.9%) and dock dues (9.6%).

However, the data available to the Autorité does not extend beyond the 2024 financial year and, as such, does not reflect – or only marginally reflects – changes in dock dues following the signing of the Protocol. Nonetheless, according to the data collected by the Autorité, forwarding costs in Martinique represent, on average, an additional 49.9% on the cost of goods for distributors compared with mainland France, and an additional 29% for wholesale importers.

The Autorité agrees with operators that a large proportion of forwarding costs (excluding taxes) are flat-rate, i.e. determined on a per-volume or per-container basis, regardless of the value of the goods transported. This invoicing method particularly penalises food products, which generally have a low value-to-volume ratio.

Recommendation 6

As allocating forwarding costs to prices on a flat-rate basis penalises products with a low value-to-volume ratio in particular, the Autorité considers that importers should prioritise allocating the costs based on the value of the imported goods rather than their volume.

Analysis of the food distribution chain

Organisation of the distribution system in Martinique

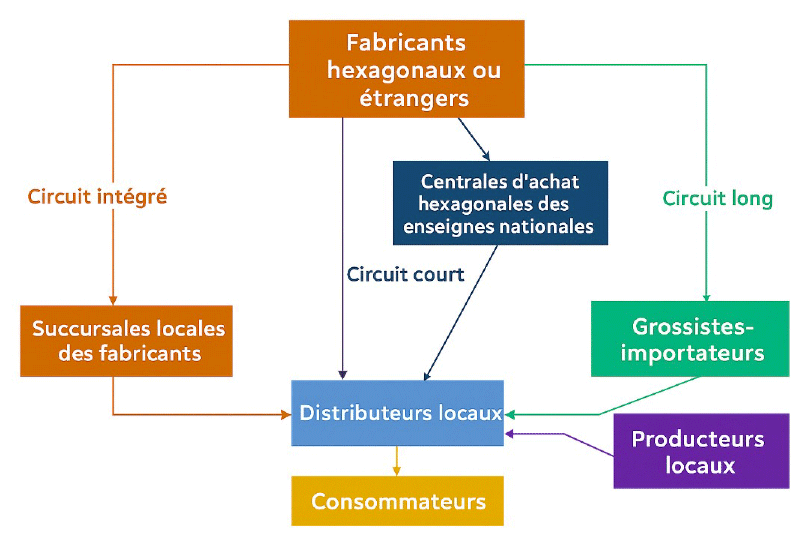

Seven groups operate in the downstream distribution market, each with very different structures:

- the GBH and Parfait groups, which have diversified into other sectors of the economy and operate four and three hypermarkets, respectively, giving them extensive retail space;

- the CréO group, which operates 16 stores in the hard discount segment;

- the SAFO group, which operates six supermarkets and is notable for its vertical integration, owning three of the island’s largest wholesale importers;

- the Sainte-Claire, Pamphile and GFHHH groups, which are smaller in terms of turnover, jobs and retail space.

The structure of the groups reflects the specific nature of the supply chain and, in particular, the essential role played by wholesale importers (short, long and fully integrated circuits).

For example, the GBH and Parfait groups operate purchasing commission structures that manage procurement from central purchasing bodies in mainland France, and have also established listing centres responsible for sourcing from wholesale importers and local producers. In addition, the GBH, SAFO and CréO groups each own one or more wholesale importers. These observations indicate, on the one hand, that the groups are not easily comparable with one another, and on the other, that the presence of intermediary structures increases distribution costs within Martinique.

Downstream margins (hypermarkets and supermarkets)

The Autorité highlights a significant disparity between the profit margins of hypermarkets and supermarkets. Hypermarkets report positive net margins (1.2%), while supermarkets report negative net margins on average (-1.4%), reflecting structurally lower profitability. However, there is considerable heterogeneity between supermarkets, with margins varying significantly from one chain to another.

The Autorité further notes that the sales margins and overall gross margins of both supermarkets and hypermarkets in Martinique are broadly comparable to the national average. By contrast, levels of value added, operating margin and net margin are lower in Martinique.

According to calculations by the delegated central bank for the French overseas territories (IEDOM), the sales margins of Martinique hypermarkets exceed the mainland French average (+1.7%), while those of Martinique supermarkets are lower than in mainland French (-3%). This trend is confirmed at the level of value added. In terms of gross operating margin, hypermarkets in Martinique report results comparable to those in mainland France, while supermarkets report significantly lower results (-2.5%).

Furthermore, these findings are confirmed in comparative terms, as Martinique hypermarkets remain more profitable than hypermarkets in other French overseas territories, whereas Martinique supermarkets continue to be considerably less profitable than supermarkets in other overseas territories.

Wholesale importer margins

The Autorité notes that intermediary entities belonging to integrated groups and operating upstream of the distribution chain demonstrate higher levels of profitability. While retail outlets report negative net margins on average (-0.79%), wholesale importers and central purchasing bodies report positive margins (1.6%) and listing centres report particularly high profitability (28.8%).

However, these margin levels remain below those achieved by wholesale importers that are not integrated within a distribution group, whose net margins are approximately twice as high as those of their integrated counterparts. This gap is partly attributable to the internal allocation of margins among intermediary entities within integrated groups. Lastly, a comparison of the margin levels of all wholesale importers in Martinique with those of wholesalers in mainland France, based on IEDOM data, highlights broadly comparable performance for integrated wholesalers and a marked outperformance for non-integrated operators. A parallel comparison with wholesale importers in the other French overseas territories likewise shows overall margin levels broadly consistent with those observed in Martinique.

The Autorité notes that wholesale importing – a cornerstone of the supply of branded products in Martinique – is more profitable than retail distribution, with a value-added ratio almost twice as high, notwithstanding distributors’ partial diversification through central purchasing bodies in mainland France. These operators therefore remain essential for the island. As a result, the Autorité questions their absence from the various tools introduced to combat the high cost of living in Martinique, aside from their commitment to pass on to distributors any reductions arising from the measures set out in the Protocol.

Recommendation 8

In line with Opinion 19-A-12, the Autorité recommends that wholesale importers be more extensively involved in negotiations and measures to combat the high cost of living in Martinique.

Wholesale importers are a type of intermediary specific to the French overseas territories. They primarily import national brand products from mainland France and abroad, which they subsequently sell on to distributors. To promote competition and combat the high cost of living, the Lurel Law has prohibited exclusive import agreements in the French overseas territories since 2012.

Since the law came into force, the Autorité has imposed fines totalling €2,371,800 in 10 different cases based on breaches of the ban on exclusive imports.

The Autorité observes that, in Martinique, the Lurel Law may, in certain cases, not be fully respected.

Recommendation 7

The Autorité recommends that oversight by the DGCCRF of compliance with the Lurel Law should be strengthened, particularly in cases where products are not simultaneously available through both wholesale importers and the distributors’ mainland central purchasing bodies. To this end, and in order to expedite the processing of cases, the DGCCRF’s powers should be strengthened by raising the ceilings for settlements.

Considering the group dimension

The margins of distributors and wholesale importers should be interpreted with caution, in particular in view of intra-group invoicing, which allows the total margins associated with the import and distribution of products in Martinique to be allocated among the different entities within a group.

While the analysis does not suggest that the margins achieved by integrated distribution groups are significantly higher than those in mainland France, their integration within large, diversified groups enables these operators to enhance the profitability of their distribution activities to a degree that remains difficult to quantify. It therefore appears necessary to ensure regular monitoring of changes in these operators’ pricing structures and margins in Martinique, using data that shows the allocation of margins within groups and across territories.

Recommendation 9

The Autorité recommends that information on prices and margins for distribution groups and wholesale importers in Martinique be systematically made available. To this end, it calls for the creation of a permanent framework, accompanied by sanctions for non-compliance, involving the authorities responsible for producing statistics (notably IEDOM and INSEE), so that public authorities have regular access to information on the prices and margins of wholesale importers and distribution groups in Martinique, including their internal allocation. Collecting this data would enable the competent authorities to monitor, on an ongoing basis, changes in both the level and structure of prices and margins in Martinique. It should be emphasised, however, that such measures will only be effective if the relevant services are provided with sufficient human and financial resources to carry out their work.

The Autorité analyses the causes of the high cost of living in Martinique and makes 9 recommendations

Il s'agit donc d'une forme de constat d'échec collectif qui appelle une analyse plus approfondie. S'agissant des produits alimentaires, cet écart est même de 40 %. Les constatations de l'Autorité sont de deux ordres. D'une part, nous avons analysé les spécificités de l'économie martiniquaise qui peuvent conduire à un tel écart de prix et d'autre part, nous nous sommes penchés en plus grand détail sur les spécificités de la chaîne de distribution des produits alimentaires et sur le comportement des acteurs aux différents niveaux de la chaîne.

S'agissant des spécificités de l'économie martiniquaise, elles sont évidemment bien connues. Ce sont l'étroitesse du marché sur une île de petite taille, ce sont l'éloignement de la France hexagonale et une structure du commerce extérieur de la Martinique qui, malheureusement, conduit à un déficit commercial persistant. Le caractère insulaire de l'économie martiniquaise appelle un certain nombre de réflexions sur l'insertion de la Martinique, non seulement dans le commerce avec l'Hexagone, mais également dans le commerce international.

L'Autorité s'est ainsi penchée sur l'organisation du transport maritime avec l'Hexagone, mais également dans la zone caraïbe et a conclu que le projet actuellement en cours de discussion d'un hub Antilles pourrait être de nature à diversifier les voies d'approvisionnement maritimes de la Martinique, à condition évidemment que ce hub Antilles bénéficie à l'ensemble des acteurs du transport maritime. Par ailleurs, l'Autorité considère que l'insertion de la Martinique dans l'économie régionale, c'est à dire dans l'économie de la zone caraïbe, pourrait être améliorée et que des voies pourraient être explorées pour améliorer les importations ou les exportations vers des territoires voisins, afin de réduire la dépendance exclusive de la Martinique au commerce avec la France hexagonale, qui est une source majeure de surcoûts pour le consommateur martiniquais.

Outre ces facteurs qui sont liés aux spécificités de l'économie martiniquaise, il y a également des spécificités de nature fiscale qui sont communes à tous les départements et régions d'octroi de mer, particulièrement l'existence de l'octroi de mer qui est évidemment justifié par le souci du financement des collectivités territoriales et un souci de protection de la production locale qui sont toutes deux légitimes mais qui a conduit à un système d'une grande complexité et surtout instable, avec de nombreuses délibérations sur la composition et les taux applicables de l'octroi de mer. Par exemple, le protocole sur la vie chère a conduit à l'exclusion d'un certain nombre de produits de première nécessité du calcul de l'octroi de mer, mais par un souci de péréquation et de l'équilibre financier a conduit à renchérir à l'octroi de mer sur d'autres produits. Et donc tout ceci d'une manière qui est difficilement prévisible par les opérateurs économiques.

Et donc, une des recommandations de l'Autorité de la concurrence, c'est la simplification et la clarification et surtout la prévisibilité dans la détermination de l'octroi de mer. S'agissant de la chaîne de distribution des produits alimentaires proprement dite, d'une part, et ce n'est pas spécifique à la Martinique, mais c'est vrai dans les autres départements d'outre mer et collectivités locales, on est face à une chaîne de distribution qui est marquée par l'existence de grossistes importateurs dont le rôle est nécessaire dans ces territoires, mais qui rajoute des étapes à la distribution des produits et qui sont parfois intégrés aux groupes de distribution alimentaire, parfois extérieurs à ces groupes, et donc qui sont facteur de marges supplémentaires puisque la chaîne de distribution est différente et plus longue dans ces territoires que dans l'Hexagone. L'activité de grossiste importateur, qui est la pierre angulaire de la distribution en Martinique, apparaît plus profitable que celle de la distribution. Or, ces acteurs sont moins intégrés aux discussions, aux négociations et éventuellement aux engagements sur la vie chère en Martinique. Il apparaît, du point de vue de l'autorité qu'il serait nécessaire de mieux les associer à ces engagements afin de refléter la spécificité de la chaîne de distribution en Martinique.

S'agissant de la Constitution des marges de ces opérateurs, l'Autorité, sur la base d'un travail très approfondi d'examen des comptes de ces acteurs, a conclu que les résultats d'exploitation, la marge des opérateurs commerciaux, c'est à dire des supermarchés et des hypermarchés, n'était pas fondamentalement différente en Martinique de la marge qui est observée dans l'Hexagone, mais que l'existence de nombreux intermédiaires en amont conduisait à des coûts plus élevés.

Quand l'Autorité s'est penchée de manière plus précise sur les fonctionnements des groupes intégrés, qui combinent un grossiste importateur et des supermarchés ou des hypermarchés, elle a trouvé que la marge de ces groupes, là encore, n'est pas forcément différente de celle que l'on observe dans l'Hexagone. En revanche, il est difficile d'analyser la nature et la valeur des prestations qui sont facturées en amont du groupe à la partie effectuant la distribution commerciale.

Et une autre recommandation de l'Autorité, c'est de se doter d'un dispositif de mesure de la formation des marges non seulement entre groupes, mais également à l'intérieur des groupes avec des obligations de déclaration de ses marges et éventuellement des sanctions en cas de non-déclaration qui permettent d'avoir une analyse plus approfondie de l'ensemble de ces prestations intragroupe et d'analyser la formation de la marge de manière plus fine que ce que l'autorité a pu faire sur la base des observations disponibles.

J'ajoute d'ailleurs que les études de l'Institut d'émission des départements d'outre mer conduisent à des conclusions qui sont globalement comparables à celles de l'Autorité.

Opinion 26-A-01 of 10 February 2026

Contact(s)